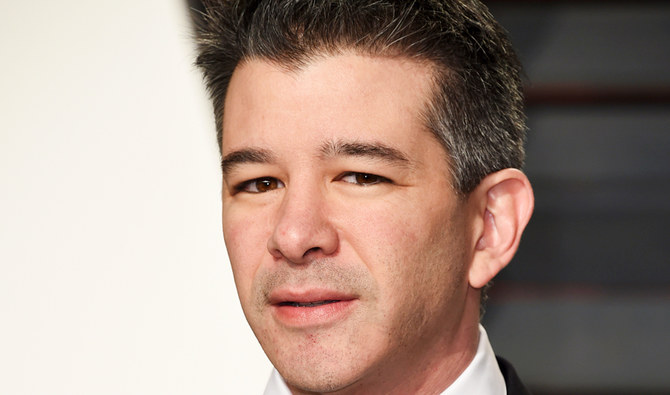

SEOUL: Chef Youm Jung-phil plans to close his restaurant in Seoul’s affluent Gangnam district this month, worn down by the rising cost of labor and rent as well as declines in the number of customers eating in. Instead Youm, who has nearly 20 years of experience in the industry, has opted to sell his avocado burgers and bagels by delivery only, renting a 16.5 square meter kitchen space from Uber co-founder Travis Kalanick’s CloudKitchens. “I am anxious every day. I can’t sleep well because this is not something I have done before,” said Youm, who was approached by CloudKitchens. “But the risks are low and I’ll have the opportunity to experiment with various menus without high cost,” he said, adding his rent will fall by roughly two-thirds.

The world’s No. 4 market for online food orders, South Korea punches far above its population size in terms of sheer numbers of restaurants and spending on food deliveries. That, plus a near 30 percent rise in the minimum wage over the past two years, is helping drive a rapid shift to shared kitchens and delivery-only businesses, industry executives and investors say — a shift which threatens the traditional restaurant industry. South Korea is the first overseas market Los Angeles-based CloudKitchens has entered under its own brand, people with knowledge of the matter said. “That Kalanick and other investors are entering Korea speaks to its attractiveness as a market for cloud kitchens.

It’s a big market and is growing faster than the U.S,” said Jimmy Kim, CEO of investment firm SparkLabs. Tucked away in a Gangnam back alley, CloudKitchens’ first South Korean outlet opened quietly in May with more than 20 separate kitchen spaces, sources said, declining to be identified as they were not authorized to speak to the media. Another 10 or more outlets are planned, six of them this year, one source added. CloudKitchens also acquired local firm Simple Kitchen this year, four sources familiar with matter said. Simple Kitchen, which counts SparkLabs as an investor, said previously it was planning 25 branches for 500 restaurants by end-2019.

CloudKitchens and Simple Kitchen did not respond to Reuters requests for comment. CloudKitchens, which also offers restaurant owners marketing support, is a unit of shared service provider City Storage Systems which scandal-hit Kalanick bought last year for $150 million after stepping down as Uber CEO. Kalanick has since acquired UK commercial kitchen firm FoodStars and is reportedly looking at investing in China.

In South Korea, a key rival is local firm WECOOK, which has four outlets and plans to lift that to 17 this year. “Investors are plowing money into South Korea which is coming to the fore in the global delivery market,” said WECOOK CEO Andy Kim, adding he expects shared kitchen firms to use lessons learnt in Korea and apply them to other Asian markets. FOOD FOR ONE While shared kitchens are growing in popularity in many countries including the US and China, the South Korean market is seen as particularly ripe for development of delivery-only restaurants.

HIGHLIGHTS

● Korea restaurant sector seeing rapid shift to shared kitchens.

● High rents, jump in mininum wage help to spur shift.

● Food delivery boom also propeled by surge in single households

About half of South Korea’s 51.8 million people are located in Seoul and its two surrounding cities, while 95 percent of adults own a smartphone. It also has 127 restaurants per 100,000 people, compared with 69 for China, 57 for Japan and 21 for the United States, according to research firm Euromonitor. Its online market for food delivery and pickup more than doubled over the past five years to $5.9 billion — bigger than Japan and Germany’s markets combined and trailing only China, the US and the UK, Euromonitor data also showed.

Euromonitor expects the South Korean market to grow to $9 billion by 2023. A huge jump in the number of single people living on their own is also propelling the boom in food delivery services — a market that pits local industry leader Woowa Brothers Corp. against rivals such as Germany’s Delivery Hero , Uber Eats and new entrant SoftBank-backed e-commerce firm Coupang. Single person households accounted for 29 percent of South Korean households in 2018, almost double 2020 levels as high living costs make marriage and children a less popular option.

“More customers living alone are shunning human interaction. They don’t want to go through the hassle of eating out,” Youm said. Delivery services have seen explosive growth. Woowa, operator of food delivery app, Baedal Minjok, said from 2016 to 2018 revenue quadrupled to 319 billion won ($270 million) while operating profit jumped 24 times to 58.6 billion won. Woowa, valued at $2.7 billion, counts Goldman Sachs, Singapore wealth fund GIC and Sequoia Capital among its backers. Delivery Hero, which in December sold its German business to Takeaway.com for $1 billion, is doubling down on Korea, now its No. 2 market after Kuwait.

It plans to increase staff to 800 from 500 last year and has doubled its marketing budget this year to 100 billion won. Following a string of investments in local firms, its South Korean revenue has more than doubled since 2016 to $107 million last year. South Korea’s Coupang is testing food delivery services in some Seoul areas. Its entry has angered Woowa, which accuses Coupang of offering exclusive contracts in return for cutting commissions, and has asked the antitrust regulator to investigate. Coupang said it is in talks with Woowa to resolve the dispute but declined to comment on its food delivery strategy.

The Korea Fair Trade Commission declined comment.