DUBAI: The old image of the corporate investigator — a seedy individual tailing a “suspect” along darkened alleyways, occasionally stopping to rummage through garbage bins for tell-tale correspondence — was never realistic.

These days, it is further away from the truth than ever. The investigations industry now is staffed by people with degrees in information technology who know how to use sophisticated software to get the information they need, and run by executives who are all but indistinguishable from their client bankers, lawyers and accountants.

Executives such as Yaser Dajani, the senior managing director for the Middle East and North Africa for FTI Consulting, who is in charge of forensic and litigation consulting in the region for the US-listed firm. Dajani is polished and C-suite sleek, as far removed from the traditional “gumshoe” as you could imagine.

“There has been a transformation in the corporate investigations business,” Dajani said, highlighting the move away from intelligence gathering by people to electronic techniques.

“For example, transactional due diligence work has either moved toward compliance, a box-ticking exercise, or very complex business intelligence work. That middle space is no longer relevant. We only do the latter — complex work. The investigations business in the Middle East is a tough industry, and those who don’t understand the challenges operate in a gray area — the one that we avoid,” he added.

Dajani spent a good part of his career at the Middle East unit of Kroll, the original corporate investigations business dating back to 1970s Manhattan. Almost two years ago he joined FTI to set up a forensic and litigation business for the firm.

Dajani spent a good part of his career at the Middle East unit of Kroll, the original corporate investigations business dating back to 1970s Manhattan. Almost two years ago he joined FTI to set up a forensic and litigation business for the firm.

FTI also has operations in corporate finance and restructuring, economic consulting, strategic communications and technology. “It is a multi-disciplinary platform that offers different services across a range of sectors, and they all complement each other,” he said.

“The methodology of 10 years ago is no longer valid. Then a report would have been produced based on rumors and market gossip, but it was really of very little added value. Unfortunately, many still do that, and that gets people in a lot of trouble. You have to have human intelligence still, but the role of online research has grown with the digital age. Our methods involve deep web research using state-of-the-art software,” Dajani said.

“Those firms that do this are staying ahead of the curve, for example in social media analytics and predictive sciences. Technology applies across everything we do, and that is part of the reason we have set up the forensic technology business — that business focuses on data analytics, computer forensics, cybersecurity and cyber investigations. These are very sophisticated technological platforms created by us.”

The benefits of a high-tech approach have not been lost on other players in the corporate intelligence sector, which is becoming increasingly crowded in the Middle East. Not only have the specialist firms — many with origins in Europe and North America — expanded with offices in the region (to mixed results), but the big accounting firms also have boosted their own in-house investigations capabilities.

Dajani believes his approach produces better results. “The Big Four accounting firms have set up investigations businesses in response to client demand, but we do it better because we are experts in what we do and have diverse experiences and credentials,” he said.

So why has the Middle East suddenly become a target market for the investigators? Dajani sees the demand for his services coming from several areas, but the family businesses that have traditionally been the backbone of regional economies is the most interesting.

“In many cases they have not evolved very far along the corporate governance spectrum. We can help them come in line with international standards, with proper board structures, financial oversight, codes of conduct, ethical standards and oversight mechanisms.

“Those that have been slow doing this often face internal problems — fraud, embezzlement, value destruction. It usually happens when the founding patriarch retires, and women family members are very often the victims in these cases. We have been busy advising minority shareholders in these situations. We can also advise on the restructuring operations that are sometimes needed to stave off bankruptcy if things become really serious,” he said.

Another stream for new revenue is from multinational corporations based in or seeking to do business in the region, and from international regulatory authorities on the tail of “hot money” in the Middle East, in the form of money laundering or terrorism finance.

“We aim to be organic within the region. We do not rely on work that comes from overseas, but inevitably some work comes from the UK and US, and also from India and Asia, which have seen a big influx of foreign direct investment in this region. But most work is from local economies,” he said.

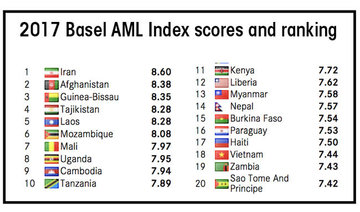

Dajani explained: “We are advising banks and regulators on these issues and helping banks respond to queries and orders from regulators and banking counter-parties. The Gulf has come under greater scrutiny in this respect in the past five years, with the emergence of groups such as Daesh and situations like Iran and Yemen,” he said.

In addition, regional regulators and the banking authorities have become more inquisitive about who is doing business in the Middle East, often in response to international pressure.

“The central bank of the UAE, for example, has been a lot more active in the past year on anti-money laundering activities,” Dajani said.

The Financial Action Task Force (FATF), the international body set up to coordinate action in response to global financial crime, is due to visit the UAE later this year to deliver a verdict on the efficiency of the country’s measures against money laundering and terrorism finance.

The other important reason for the growth in the regional investigations business is that US authorities have become more interested in the Gulf’s financial systems.

Illustration by Luis Grañena

“America is looking at banks in the Middle East more closely. In part this reflects the growth of the regional banking industry, with many having operations in the US and, therefore, subject to US banking regulations,” Dajani said.

“Most of them also conduct many of their operations in dollar denominations, which gives the US authorities the right to look at them. The extent of intrusion by US authorities into regional banks and financial institutions is very high, and this is where we often get called in.”

Saudi Arabia has become a major focus of the FTI business in the past few years. “We don’t have an office there yet, but everyone in the UAE office has a Saudi visa and we travel to the Kingdom on a regular basis. We will respond to our clients’ needs there. We have been asked to set up a Saudi office and we are looking into it,” he said.

“In the Kingdom some of the work relates to public companies facing challenges, but we also — again — help family businesses and also deal with regulators and the government. Much of the work is dispute driven. Saudi

Arabia is modernizing its corporate, legal and regulatory structures, and in addition will always remain a strategic location for foreigners and regional players wanting to invest,” he said.

As the Saudi government has recognized with its anti-corruption campaign, there is still work to be done. Last week the EU criticized the Kingdom for its practices to curb money laundering. The last visit by the FATF in 2017 found: “KSA is achieving good results in fighting terrorist financing, but needs to focus more on pursuing larger-scale money launderers and confiscating their assets.”

Dajani will not reveal the names of his clients in Saudi Arabia, or elsewhere for that matter. But FTI has worked for some of the biggest names in the region, not only in investigations, but also through its other business units.

Back in the 1980s, Jules Kroll, the founder of Dajani’s previous firm and the man who made the corporate investigations business, was featured in The New York Times, smoking a fat cigar, with Gordon Gekko braces and his feet up on a mahogany desk under the heading “Wall Street’s private eye.”

Is Dajani the modern equivalent, minus subterfuge, uprooted from New York and set down in the Dubai International Financial Center?

“I wouldn’t call myself a private eye. That is not the appropriate term in this region — and certainly the practices of the 1980s and 1990s are no longer appropriate. We have set the standards for investigations here. We are the best at what we do. We are experts with impact,” he replied.