PARIS: US President Donald Trump’s decision to pull the United States out of the 2015 nuclear accord with Iran and reimpose a raft of sanctions puts European businesses on the spot.

While the European Union insists it will stick by the nuclear accord to allow trade to continue with Iran, European companies are wary of being caught out by the US sanctions regime and many have already cut back their presence.

Here is an overview of how firms could be affected:

The sanctions introduced in August spooked the major automakers who were already cautious about their future in Iran and mindful of their much bigger business interests in the United States.

Germany’s Daimler, which was teaming up with two Iranian firms to assemble Mercedes-Benz trucks, said it had decided against going ahead.

Volkswagen had said last year it planned to resume business after a 17-year break but was very guarded in response to the latest US decision.

VW “conforms with all the applicable national and international laws and regulations concerning exports,” a spokesman said.

French automakers Renault and PSA, who make nearly half the cars sold in Iran, were cautious.

PSA, behind the Peugeot, Citroen and Opel brands, said in June it was preparing to suspend activities in Iran.

Renault says it intends to keep its activities in Iran but stands ready “to reduce the scale very sharply” if need be.

Aviation saw large contracts reached following the 2015 nuclear accord as Iran set about modernizing an aging fleet.

Airbus booked deals for 100 jets and was looking forward to many more.

However, the potential loss of business in Iran would not weigh overly heavily on Airbus given its total outstanding order book of some 7,168 planes at end-June.

Oil is the key issue with global implications for all concerned as Washington aims to cut off Iran’s key source of foreign income.

French energy giant Total announced in August it was pulling out of a massive natural gas project.

Italian energy giant ENI meanwhile has a contract to take two million barrels of oil per month which it will not renew after it finishes this year.

German engineering giant Siemens signed a contract in 2016 to supply gas turbines to Iranian company Mapna.

A spokesman told AFP the company “will take the appropriate measures to bring its affairs into conformity with the multilateral framework concerning Iran.”

Italy stands to lose most in these sectors, national railway operator Ferrovie dello Stato Italiano having signed a deal in 2017 to build a high-speed line linking Qom to Arak in northern Iran.

Shipmaker Fincantieri, engineering firm Maire Tecnimont and gas boiler maker Immergas all signed a string of deals with Iran which are also threatened.

Italy was Iran’s largest European trade partner in 2017, with its exports rising 12.5 percent to 1.7 billion euros.

Iran is potentially a major tourist destination but European companies were quick to pull back after the August US announcement.

British Airways and Air France halted services in September, saying the flights were not commercially viable.

German carrier Lufthansa, Austrian Airlines and Alitalia for the moment continue flights to Tehran.

French hotel chain AccorHotels, which opened an establishment in Iran in 2015, declined to comment on its plans for the future.

Spain’s Melia Hotels International chain, which signed a 2016 deal to run a five star hotel in Iran, the Gran Melia Ghoo, said in November it was still going ahead.

US Iran sanctions move hits European companies

US Iran sanctions move hits European companies

- EU insists it will stick by the nuclear accord to allow trade to continue with Iran

- Many European companies have already cut back its presence

PIF set to have $2 trillion in assets under management by 2030: report

- In March 2024, PIF’s assets under management surpassed $925 billion, up from $700 billion at the end of 2022

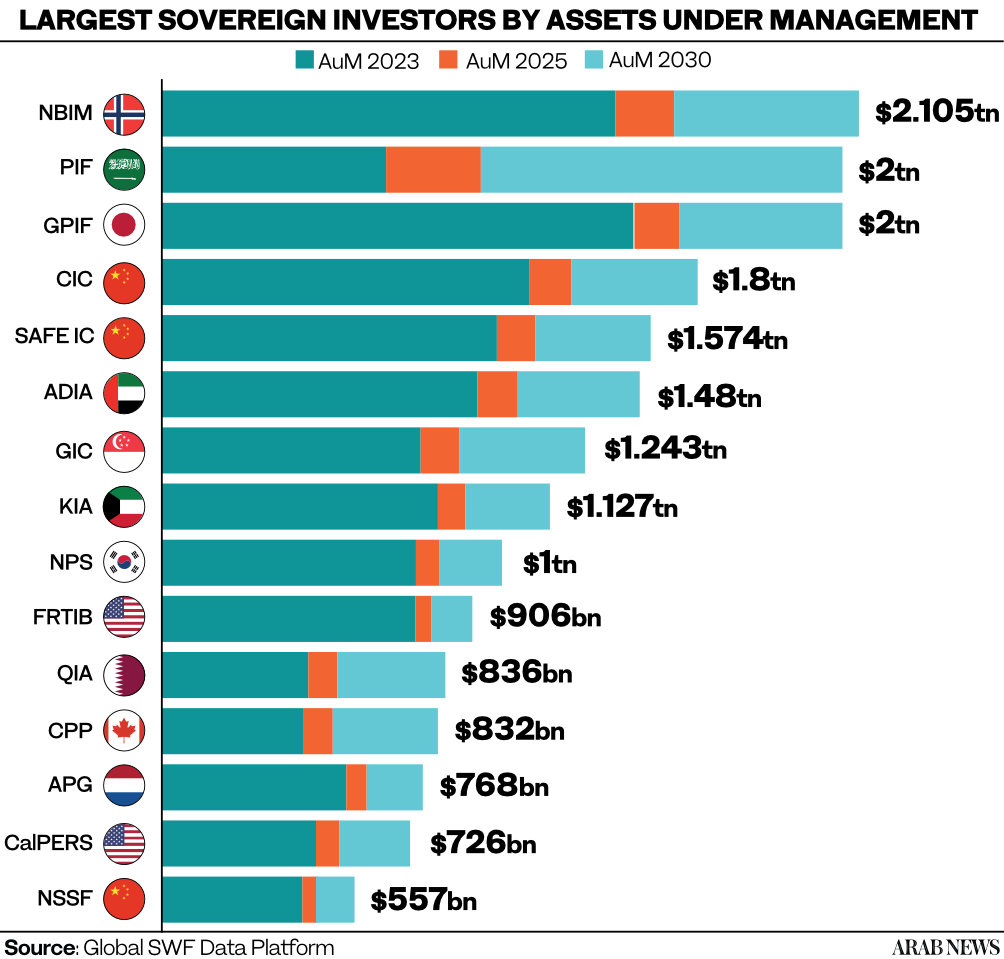

RIYADH: Saudi Arabia’s Public Investment Fund is poised to reach $2 trillion in assets under management by 2030, propelling it from 5th to 2nd place globally among sovereign wealth bodies, according to Global SWF.

The organization that monitors activity in this area stated that the PIF’s rapid ascent can be attributed to the fund’s focus on direct investments, emphasis on key sectors of the Saudi economy, dedication to sustainability through leading investments in renewables and green assets, and active participation in the digital economy.

The institute’s 2024 annual report disclosed that in 2023, PIF took the lead as the top investor among all sovereign wealth funds, allocating $31.6 billion across 49 deals – a 33 percent increase from the prior year.

This progress elevated the fund by 10 positions between global sovereign investors in new capital deployed within a mere three years.

In just eight years since its restructuring, the Saudi fund has become a dominant force both domestically and internationally, with the aim of advancing Vision 2030 and achieving the status of the world’s largest sovereign wealth fund by the end of the decade.

In March 2024, PIF’s assets under management surpassed $925 billion, up from $700 billion at the end of 2022, securing its position as the fifth largest global sovereign wealth fund, after the government transferred an additional 8 percent stake in Aramco to its portfolio.

The fund strategically delved into co-investments and forged joint ventures to bolster Saudi Arabia’s drive for economic diversification.

Noteworthy examples include partnerships with mining giant Ma’aden, tire makers Pirelli, and car manufacturer Hyundai.

This was alongside an agreement with Baosteel and Aramco for the construction of a steel mill.

The report highlighted that unlike numerous sovereign wealth funds that frequently choose co-investing as their primary strategy, both globally and in the Gulf region, PIF stands out with a strong preference for direct investments in private equity.

Specifically, it targets critical sectors of the Saudi economy, including sports and leisure, tourism, and gaming, as well as construction, and heavy industry.

Despite the clear advantages that co-investing offers – such as enhanced due diligence, favorable fee terms, and portfolio diversification – some sovereign investors may shy away due to concerns about deal visibility and relinquishing transaction control to other government funds.

According to the report, PIF stood out from other funds due to its substantial domestic investments, which significantly impacted its international investment capacity relative to other funds.

In 2023, Saudi Arabia’s sovereign wealth fund saw an 18 percent growth in its US equities portfolio, driven by rising stock values.

PIF maintained a passive approach, keeping major positions unchanged.

According to the report, its largest holding remained a 63 percent stake in Lucid Motors.

PIF initiated its investment of $1 billion in the electric vehicle rival to Tesla back in 2018, and following Lucid’s initial public offering three years later has continued to infuse capital into the company.

This included an injection of $2 billion in June 2023, and Lucid is on course to commence EV production in Saudi Arabia by 2025.

PIF’s US-listed portfolio includes $8.1 billion in gaming companies such as Activision Blizzard, Electronic Arts, and Take-Two, reflecting the Kingdom’s plan to invest $38 billion to become a hub for this sector as part of Vision 2030.

In its report, Global SWF discussed the challenges encountered by sovereign investors in recent years and the corresponding solutions they implemented in 2023 to enhance the resilience of their portfolios.

One significant challenge involved addressing the decarbonization of the global economy. This was tackled through the introduction of a new sustainable investment strategy, shedding light on “climate alpha.” This typically refers to investments or strategies that aim to address global warming and its associated risks and opportunities.

This could include investments in companies or projects that are focused on renewable energy and efficiency, sustainable agriculture, clean transportation, and other environmentally friendly initiatives.

Sovereign investors showcased their dedication to sustainability during COP28, highlighted by the UAE’s launch of a $30 billion climate-focused fund, supported by BlackRock and fellow state-backed wealth funds. The goal is to access these areas while also greening existing black assets through de-carbonization.

Meanwhile, Saudi Arabia has taken a leading role in direct investments within the EV and automotive sectors. As well as its stake in Lucid, the Kingdom launched its own EV carmaker, Ceer, in a joint venture with Taiwan’s Foxconn.

Further partnerships include collaborations with Tasaru for component localization, Hyundai for a car plant, and Pirelli for tire manufacturing.

According to Global SWF, sovereign investors directed a record $26.1 billion towards green assets in 2023, prioritizing investments in the energy transition, including renewables, battery storage, and EVs.

Gulf sovereign wealth funds contributed nearly half of this sum, leading the charge in driving the energy transition agenda.

The report also underscored another challenge encountered by sovereign funds, which is market volatility and the risks stemming from geo-economic fragmentation.

To tackle this issue, fund investors have embraced a more comprehensive total portfolio strategy. This strategy integrates alpha and beta return drivers, merging top-down and bottom-up analyses, with a significant emphasis on diversification.

By adopting this holistic approach, investors gain a thorough understanding of their investments, facilitating more informed decision-making, enhanced risk management, and the opportunity to optimize portfolio performance by focusing on the unique attributes and dynamics of each component within the portfolio.

The rise of disruptive artificial intelligence was also addressed in the report, which noted it represents a significant risk for sovereign investors as it can lead to rapid changes in industries, markets, and investment landscapes.

AI-powered technologies can impact traditional business models, alter consumer behavior, and introduce new competitive dynamics. To address this challenge, one proposed solution by sovereign investors is to integrate AI-powered portfolios into their investment strategies.

By incorporating AI technologies into portfolio management, sovereign funds can leverage advanced algorithms and data analytics to gain valuable insights.

AI-powered portfolios can analyze vast amounts of data in real-time, identifying trends, patterns, and market signals that may not be immediately apparent to human analysts. This can lead to more accurate risk assessments, better market timing, and enhanced investment decision-making.

Additionally, AI can enable sovereign investors to automate certain aspects of portfolio management, such as rebalancing, trade execution, and risk monitoring. This not only increases operational efficiency but also allows for more agile responses to changing market conditions.

According to the report, 2023 saw sovereign wealth funds adjusting their real estate investments amidst concerns of global interest rate hikes and a potential property bubble.

Despite an overall softening in the market, some segments, such as data centers and affordable housing, saw growth as fund investors aligned with emerging megatrends. Data center investments surged by 150 percent to $7.6 billion in 2023, indicating a strong focus on future-oriented assets.

This shift reflects a move from traditional investments to a more sophisticated strategy, exemplified by PIF’s forming partnerships to develop data centers.

The report flagged up that in 2023, the GCC region – led by the Abu Dhabi Investment Authority, Abu Dhabi’s Mubadala, ADQ, PIF, and the Qatar Investment Authority – saw a record surge in sovereign capital to $4.1 trillion in assets under management, with transactions totaling $82.3 billion.

Projections indicate these sovereign wealth funds could reach $7.6 trillion in assets by 2030. This growth, according to the report, is fueled by high oil prices and a maturing investment landscape, driving economic diversification with growth forecasts of 3.6 percent and 3.7 percent for GCC nations in 2024 and 2025.

In this region, two distinctive sovereign wealth fund management approaches were highlighted by Global SWF.

Abu Dhabi’s strategy involves the establishment of multiple SWFs, each with specific missions overseen by different royals. Saudi Arabia, on the other hand, centralizes its investment and strategic efforts under PIF, aligned with the government’s overarching vision.

Further, its leaders have no problems in announcing grand plans for the fund, using it in its name to buy football clubs or golf leagues, and in sharing its finances publicly given its fundraising efforts, in a rather refreshing fashion, the report said.

The institute presented updated projections in the State-Owned Investors 2030 section, factoring in the industry’s recovery in assets under management in 2023.

It anticipates that public pension funds and central banks will reach $54.9 trillion by 2025 and $71 trillion by 2030. By then, Norway’s Norges Bank Investment Management, Saudi’s PIF, and Japan’s Government Pension Investment Fund could lead the table with over $2 trillion in assets under management each.

UK’s Bioniq enters Saudi Arabia with strategic partnership

- CEO shares insights into company’s strategic objectives and expansion

CAIRO: Personalized supplements based on blood test data are set to become available in key Saudi cities as Bioniq brings its patented algorithm to the Kingdom.

Through a partnership with Al Borg Diagnostics, a provider of diagnostic health services in Saudi Arabia, Bioniq has set a strategic expansion plan into the Kingdom.

In an interview with Arab News, Vadim Fedotov, CEO and founder of Bioniq, shared insights into the company’s strategic objectives and expansion plans in Saudi Arabia and the broader Middle East and North Africa region.

“Our immediate goals in Saudi Arabia include establishing a strong presence in key cities, enhancing access to personalized health solutions, fostering strategic partnerships, and consistently delivering exceptional customer experiences,” he said.

The advantage

Looking ahead, Fedotov explained Bioniq’s long-term vision in the Saudi market, focusing on product efficacy and transparency.

“We believe it’s crucial to showcase the benefits of a quantifiable product that demonstrates how it works and its effectiveness,” he noted.

He criticized the prevailing market trends where companies fail to substantiate their claims. “Many companies in the market promise results without concrete evidence, essentially selling a dream. Bioniq, on the other hand, delivers tangible results.”

“We have already established strategic partnerships in the medical and wellness space that we have not announced yet. Moreover, we have already started integrating our solutions in some of the most prominent athletic organizations of Saudi Arabia,” he revealed, indicating an aggressive approach to embedding Bioniq’s solutions into key health and sports ecosystems.

Although specifics were not disclosed, Fedotov hinted at future collaborations that could involve governmental bodies.

The Saudi market is pivotal for Bioniq’s expansion strategy due to its significant growth potential and its position as a key player in the healthcare industry within the Gulf region.

Vadim Fedotov, CEO and founder of Bioniq

“Unfortunately, I cannot disclose details at the moment, but the plans are indeed significant,” he mentioned, suggesting potential engagements that could influence policy or regulatory frameworks within the health sector.

Regarding growth objectives for the next year, Fedotov said: “Strategic partnerships with nationwide medical institutions as well as leading athletic organizations are already in place to build brand awareness and trust.”

Fedotov stated that the company does not plan to offer exclusive products for the Saudi market and that all its products are shipped worldwide, emphasizing a unified product strategy across global markets.

Discussing the partnership with Al Borg, Fedotov further detailed how this alliance would enhance Bioniq’s operational capabilities.

“We plan to leverage our partnership with Al Borg to enhance our presence by expanding accessibility to personalized health solutions,” he explained.

“We aim to collaborate closely with Al Borg to optimize customer experience and provide seamless healthcare solutions to individuals throughout the country,” he added.

Legal standards

Fedotov highlighted Bioniq’s approach to navigating the regulatory environment in Saudi Arabia indicating it is a crucial aspect of their operations.

“We’re working closely with strategic partners in the region who have been established for decades, including nationwide partners who guide us in ensuring compliance with current and new regulations,” he explained.

“We’re fully committed to adhering to these guidelines. As our strategic partners include government entities and medical institutions, we’re confident that our offering is and will be in line with all current and future regulations,” the CEO added.

When asked about the significance of the Saudi market in Bioniq’s global strategy, Fedotov’s response underscored the strategic importance of the region.

“The Saudi market is pivotal for Bioniq’s expansion strategy due to its significant growth potential and its position as a key player in the healthcare industry within the Gulf region,” he stated.

“With its large population and substantial healthcare expenditure, Saudi Arabia presents a ripe opportunity for Bioniq to introduce its personalized health solutions and contribute to advancing healthcare standards in the region,” he explained.

He added: “Additionally, by establishing a strong presence in Saudi Arabia, we can leverage our strategic partnerships and innovative technology to further solidify our position as a leader in personalized nutrition and supplementation across the Middle East market.

Regarding the timing of Bioniq’s entry into the Saudi market, Fedotov shared that the company had already made its debut.

“Our partnership with Borg AI marked our launch in the region in April of this year,” he noted.

This launch introduced Bioniq’s products, including Bioniq GO and Bioniq PRO, to the Saudi marketplace, marking a significant milestone in their regional strategy.

“We are certainly considering establishing an office in the Kingdom,” he said, hinting at a significant operational expansion.

“Currently, we have over 80 employees globally, including headquarters in London, offices in Berlin, Dubai, and New York. Saudi Arabia appears to be a very promising option for one of our future locations. Regarding key members for the region and global expansion, we will be based there, given the strategic importance of Saudi Arabia and the Middle East,” he added.

Business fundamentals

“Our primary mission in the region is to address the challenge of personalized health and wellness in Saudi Arabia’s healthcare industry,” Fedotov stated.

He highlighted that the collaboration with Al Borg is set to boast personalized health across the Kingdom, making Bioniq’s blood test panel available in 28 cities across Saudi Arabia.

“Now, consumers from Riyadh, Jeddah, Alkhobar, or any other cities across the country, can achieve optimal health levels much easier.”

The partnership allows consumers to utilize a 50-parameter blood test offered by Al Borg Diagnostics, after which they can opt for a personalized supplement formula created by Bioniq, based on their specific health data.

“We closely monitor metrics related to customer satisfaction, such as feedback scores and testimonials. We aim to deliver the most personalized supplements, so we are a super consumer-centric company,” he said.

“Of course, as a business, we also focus on revenue growth, customer retention rates, market penetration, and the number of personalized supplement formulas delivered,” the CEO added.

“In the Saudi market specifically, we pay close attention to metrics related to market penetration and customer acquisition. Given the strategic importance of this region for our expansion efforts, we track the number of customers adopting our personalized supplement solutions,” he stated.

The CEO further elaborated on how this approach leverages comprehensive blood tests and tailored supplement formulas to meet individual health needs and optimize overall well-being, marking a significant advancement in personalized health management.

Founded in 2019, Bioniq offers Bioniq PRO and Bioniq GO which are based on algorithms developed from a large and diverse biochemical database.

Bioniq PRO, as Fedotov described, offers personalized supplements derived from extensive biochemical data and combined with health questionnaires and blood tests.

In contrast, Bioniq GO provides a more generalized personalization based on health questionnaires alone. “The cost of Bioniq supplements varies depending on the package the customer chooses,” Fedotov added, with Bioniq GO priced at $75 per month and Bioniq PRO at $199 per month.

On the financial front, Fedotov shared insights into the company’s profitability. “After five and a half years, we have achieved market profitability in all our priority markets,” he revealed.

Bioniq’s inception

“The idea of Bioniq came from my sports background and a subsequent corporate career that left me burnt out at 30,” Fedotov explained.

Despite being medically healthy, he felt unwell, which led him to realize that “wellness goes beyond just the absence of illness.”

Identifying a gap in the market for personalized health solutions, he noted, “In 2018, there were no companies providing personalized solutions for people like myself.” This revelation prompted him to establish Bioniq in London in 2019.

The company has raised $15 million since its inception, and Fedotov revealed:“Given the fact that the Middle East is one of our key regions, there’s a high level of proportionate investment into the Middle East, including Saudi, to develop strategic partnerships, onboard key opinion leaders and share and demonstrate the key advantages of a personalized approach.”

He added: “Additionally, we are leveraging our investment to enhance our technology platform and data analytics capabilities, ensuring that our personalized supplement formulas are backed by the latest scientific research and insights.”

A growing market

“We see significant opportunities for growth and innovation in Saudi Arabia, which is why we are entering this market,” he stated.

Regarding the broader trends in the health tech industry, Fedotov shared his company’s forecasts and strategic plans.

“Our forecasts suggest continued growth and increasing demand for personalized health solutions in our operational markets,” he noted.

Bioniq intends to capitalize on these trends by investing in research and development to enhance its products and services further.

Additionally, the company plans to expand its strategic partnerships with healthcare providers and technology companies and continue innovating in the field of precision health.

Fedotov also emphasized the importance of consumer education in Bioniq’s strategy. “We will continue focusing on educating consumers about the benefits of personalized nutrition and wellness, empowering them to take control of their health journey,” he explained.

Islamic Development Bank’s 2024 annual meetings start in Riyadh under King Salman’s patronage

- The meetings coincide with IsDB’s golden jubilee

- The institution celebrates 50 years of promoting economic and social development in 57 member countries

RIYADH: The Islamic Development Bank’s 2024 annual meetings are being held under the patronage of King Salman bin Abdulaziz in Riyadh between Apr. 27 and 30, 2024.

The annual meetings coincide with IsDB’s golden jubilee, as the institution celebrates 50 years of promoting economic and social development in 57 member countries, under the slogan ‘Taking pride in our past, shaping our future: authenticity, solidarity, and prosperity’ that reflects the bank’s legacy and future goals, reported the Saudi Press Agency on Saturday.

Finance ministers, financial institutions’ representatives, Islamic finance experts, private sector and non-governmental organizations are participating in the meetings which are being covered by leading media outlets.

The agenda includes special knowledge sharing sessions, seminars and press conferences focusing on development, regional cooperation and Islamic finance.

Citing a news statement released by the bank, Al Ekhbariya website reported that IsDB announced its approval to allocate about $418m to finance new development projects in member countries.

In a session chaired by IsDB’s President Mohammed Sulaiman Al-Jasser, the Board of Executive Directors approved, during the 355th meeting, four projects focusing on social and economic development and sustainability.

Tajikistan received $150m to build the Rogun hydroelectric power station project, which aims to provide clean, affordable and reliable electricity from renewable sources.

Ivory Coast received €70.46 million in financing for a value chain development project for roots and tubers/cassava.

Among the annual meetings’ prominent events are the Governors’ Roundtable, the 18th IsDB Global Forum on Islamic Finance, the IsDB Group Private Sector Forum 2024, the Philanthropy Forum, and the Future Vision Symposium, reported SPA.

Discussions address pressing issues such as multidimensional poverty, South-South cooperation, and financing the Sustainable Development Goals.

Meanwhile, the CEOs of the bank’s entities will meet in a strategic session titled ‘Unlocking Economic Potential’ which reflects IsDB’s commitment to promoting economic growth.

Stellantis eyes expanding product range in Saudi Arabia, CEO says

- Dutch-based automobile manufacturer to introduce smart cars and light commercial vehicles into Saudi market

RIYADH: Dutch-based automobile manufacturing corporation Stellantis is planning to expand its product range in Saudi Arabia by introducing smart cars and light commercial vehicles into the market, an official has revealed.

In an interview with Arab News, Samir Cherfan, chief operating officer of Stellantis in the Middle East and Africa, said that the company’s Dare Forward 2030 plan aims to turn the automaker into a mobility tech company.

“Our approach in the Kingdom is multifaceted – and includes driving increased market share by expanding across brands and segments. This will be driven by introducing and expanding models including smart cars and light commercial vehicles under our Fiat, Citroen and Peugeot brands,” said Cherfan.

He added: “Moreover, Jeep is set to grow by reaching customers in new market segments while Ram will strengthen its position in the full-size pickup segment.”

Cherfan noted that Stellantis’ strategy in the Kingdom is aligned with Saudi Arabia’s Vision 2030 objectives.

He added that the company is committed to support Saudi Arabia’s economic diversification efforts and ongoing technological progress.

“By expanding our product range while improving efficiency and adopting new sustainable technologies, we aim not just for market dominance but also to support economic diversification and technological progress in Saudi Arabia,” he said.

Sustainability in focus

During the talk, the COO said that Stellantis’ move to reintroduce the Citroen brand in 2022 was to meet the rising demand for electric vehicles in the Saudi market, as the younger population in the Kingdom are giving priority to sustainability.

“In the Kingdom, Citroën offers a diverse range of vehicles that cater to young buyers – particularly in urban centers like Riyadh and Jeddah – including the growing number of women drivers,” said Cherfan.

He continued: “These younger demographics are typically looking for more sustainable, smaller, smarter models. As EVs produce zero emissions and zero noise, this in turn aligns with Vision 2030 objectives to enhance quality of life and reduce the Kingdom’s carbon footprint.”

According to Cherfan, Saudi Arabia’s economic diversification efforts aimed at reducing the Kingdom’s dependency on oil is also reshaping the automotive market in the country.

He added that Saudi Arabia’s sovereign wealth fund’s strategic investments in various sectors are also helping companies like Stellantis invest in the Kingdom.

“As the Kingdom is looking toward its post-oil economy and becoming more competitive internationally, this change is affecting the automotive market too. With the Public Investment Fund supporting the growth of the Kingdom’s economy by investing in different sectors, this opens doors for companies like Stellantis to invest and grow our business,” said Cherfan.

He added: “At Stellantis, we have a goal to increase our sales in Saudi Arabia and we believe that the Kingdom is a key to our plan to supply 90 percent of the cars and parts needed in the Middle East and Africa from within the region.”

The COO went on to say the company is planning to introduce new EV models in Saudi Arabia soon, as it eyes to grab 30 percent of this market by the end of this decade.

“When it comes to electrification, we are engaged with our Saudi Arabian partners with the objective of incorporating EV models or establishing dedicated EV brands within our product portfolios. Our aim is to have a 30 percent EV share by 2030 as set out in our Dare Forward Strategy,” he continued.

Encouraging local talents in the automotive industry

According to Cherfan, the automotive industry is an employment generator and is expected to grow at a double-digit rate till 2030 in Saudi Arabia as the Kingdom is embarking to ensure clean and autonomous mobility.

The official noted that the company currently has 12,000 employees in the Middle East and Africa region and among them only 20 are expats.

“In the Kingdom, through Stellantis and our distributor partners, we have over thousands of people working across different departments and under multiple brands, and we expect to continue to grow that number as our brands increase their market share,” said Cherfan.

He added that Stellantis aims to position itself as the most localized player in the region.

“We position ourselves as the partner in the country to maximize value creation. We have programs with universities, we have created dedicated training programs to upskill local talent. And with 1.2 billion people in our region, there is a lot of brilliant talent to be further developed,” continued Cherfan.

The company is aiming to achieve 70 percent regional production autonomy by 2030, representing a significant leap from its current level of 25 percent.

The COO said Stellantis aims to sell one million vehicles in the region by 2030, out of which 35 percent will be electric.

Strategic partnership with private and government entities

Cherfan further said that Stellantis’ strategy involves collaborating closely with local businesses, government entities and other stakeholders.

He pointed out that leveraging partnerships with local businesses is necessary to understand the market in Saudi Arabia, while collaborations with government entities is essential to navigate through regulatory frameworks.

“By working hand in hand with local companies, we can tailor our products and services to better meet the needs and expectations of Saudi consumers. Additionally, partnering with local businesses provides opportunities for technology transfer, skill development, and job creation, thereby contributing to the growth of the Saudi economy,” he noted.

Cherfan added: “By partnering with government agencies, we can ensure that our activities are in line with Saudi Arabia’s vision for economic diversification, sustainability, and innovation.”

He noted that government partnerships will also facilitate access to infrastructure and support programs, enabling the company to accelerate its growth and expansion efforts in the Kingdom.

Cherfan also underscored the vitality of collaborating with stakeholders like academic institutions, research centers and industry associations.

“Collaborating with these entities allows us to use cutting-edge research, innovation, and talent pools. By promoting partnerships with academia and research institutions, we can drive technological advancements, develop new products and solutions, and enhance our competitive edge in the Saudi market,” he concluded.

Egyptian startups secure funding to boost expansion to Saudi Arabia following a period of stagnation

Egyptian startups secure funding to boost expansion to Saudi Arabia following a period of stagnation

CAIRO: Startups in Egypt have started to gain momentum with several ventures securing funding to boost expansion efforts to the Kingdom.

Following a period of startup funding stagnation, Egyptian founders have made their way back to the regional venture capital space with a flurry of investment deals and expansion strategies already in place.

Egyptian fintech startup Waffarha has secured a seven-figure seed round from Value Makers Studio to expand its footprint.

Founded in 2012 by Tarek Magdy, the platform offers significant discounts, with daily deals ranging from 50 percent to 90 percent.

The new capital will enable Waffarha to enhance its technology, recruit talent, and expand into Saudi Arabia and additional markets.

Moreover, in 2018, Fawry for Banking Technology and Electronic Payments, one of Egypt’s largest financial institutions, acquired a share of 30 percent of the company.

The company claims to boast a network of over 1,000 merchants and over 3,000 stores that cater to more than 5 million customers, without any subscription fees.

Over the last 12 years, Waffarha claims to have emerged as a top-tier lifestyle website and mobile app.

Egyptian HRtech startup Bluworks secures $1m in pre-seed funding

Bluworks, an HR and Software-as-a-Service solutions provider based in Egypt, has raised $1 million in pre-seed funding led by Khawarizmi Ventures and included Camel Ventures, Acasia Ventures, and angel investors.

Founded in 2022 by Farah Osman, Hussein Wahdan, and Nour Ahmadein, Bluworks aims to optimize costs for businesses through data-driven decision-making.

“With so many HR softwares on the market, not one is built to manage blue-collar workers,” Wahdan said.

“Since the process of managing this type of workforce is so manual, errors frequently occur, leading to penalties and deducted salaries with no oversight from the workers, causing them to leave and ultimately contributing to high turnover rates,” he added.

“Currently, companies can spend about 7-10 days just closing their payroll accounts, but with Bluworks, this time can be cut down to one day - all while leveraging data and insights on their workforce,” he stated.

The company aims to utilize the funding to support its product development goals, expand its presence, and grow its team.

Egypt-based fintech Bokra closes $4.6m pre-seed funding round

Bokra, an emerging fintech startup from Egypt, has secured $4.6 million in pre-seed funding, led by DisrupTech Ventures and SS Capital.

Founded in 2023 by Ayman El-Sawy, Bokra offers diversified investment solutions for retail and SME investors.

The funds will support the launch of the Bokra app, expansion of its investment products, and scaling operations across the Middle East and North Africa region.

“We are dedicated to accelerating financial inclusion and elevating investment awareness across MENA,” El-Sawy said.

“In a region where financial needs and aspirations are ever-changing, Bokra is poised to become the preferred investment platform for both individuals and small and medium-sized enterprises looking to diversify their fractional ownership portfolio in a simple, trackable and informed way,” he added.

Egyptian startups win big in Saudi-Egyptian program

Ten Egyptian startups have received awards from the VMS Bridge program, aimed at enhancing connections between Egypt and Saudi Arabia’s entrepreneurial ecosystems.

Winners included Amanleek, Farhy, Sprints, Career180, and Jamaykaa, which will explore investment opportunities during a 4-day visit to the Kingdom.

Other winners, Notchnco and Neqabty, received free company licenses in Saudi Arabia, and AgriCash, ReNile, and ICareer won access to Arweqah’s training programs.

Jordan-based healthtech startup Arab Therapy secures $1m seed funding

Arab Therapy, a Jordan-based mental health platform, has raised $1 million in seed funding, led by Flat6Labs and Vision Health Pioneers, with participation from international angel investors.

Founded in 2021 by Tareq Dalbah, Omar Koudsi, and Hekmat Al-Hasi, Arab Therapy connects users with licensed mental health professionals.

The investment will facilitate the company’s market expansion and the initiation of business to business sales operations.

TVM Capital Healthcare invests $17m in Neurocare Group AG

TVM Capital Healthcare, based in the UAE, has invested $17 million into Neurocare Group AG, a Munich-headquartered healthtech specializing in personalized mental healthcare.

The investment will support Neurocare’s expansion plans in the US and Saudi Arabia and fund the development of new hardware and software innovations, enhancing their clinical solutions.

UAE-based logistics startup Shorages secures $1m for expansion

Shorages, a UAE-based logistics startup, has raised $1 million in a pre-series A funding round led by Joa Capital’s S3 Ventures Fund.

Founded in 2019 by Rayan Osseiran, the company provides fulfillment solutions in the UAE and Saudi Arabia for e-commerce platforms.

The company aims to utilize the funding to help expand its warehouse operations across the Gulf region.

UAE e-commerce startup WEE secures $12m in funding

UAE-based e-commerce startup WEE has concluded a $12 million pre-series A funding round, facilitated by SIG Investment.

Founded in 2021 by Anastasia Kim, Oleg Dashkevich, and Sergey Kolikov, WEE is an online marketplace that offers below 15-minutes delivery services.

The investment will be used to spearhead WEE’s logistics capabilities, accelerate growth, and expand its team.

Turkish fintech app Midas closes $45m funding round to boost MENA expansion

Turkish fintech app Midas closed a $45 million funding round by Portage, a global investment platform, supported by International Finance Corporation, Spark Capital and Earlybird Digital East Fund.

Founded by Egem Eraslan, the company allows users in Turkiye to invest in Turkish and US equities.

The startup is aimed at Turkiye’s retail investor market and claims to have more than 2 million users. The company claims to charge significantly lower transaction and commission fees for Turkish customers who want to invest in US or Turkish stocks.

Midas has plans to expand beyond Turkiye, and aims to target countries in the MENA region, according to a report by TechCrunch.

Midas also plans to use the new funding to roll out three new products in cryptocurrency trading, mutual funds and savings accounts.

UAE’s Maalexi signs agreement with Etihad Credit Insurance

Maalexi, a UAE-based risk management platform focused on SME agri-businesses, has entered into a strategic credit insurance agreement with Etihad Credit Insurance, the UAE’s federal export credit company.

This collaboration will enable Maalexi to utilize ECI’s extensive trade credit solutions and services, enhancing the competitiveness of regional SMEs in the food and agriculture trade sectors, both locally and internationally.

The partnership aims to reduce market entry barriers, support Maalexi’s goal of increasing SME participation in the cross-border trade of agricultural produce, and contribute to food security in the UAE.