TOYOTA CITY: Toyota Motor Corp. is doubling down on its investment in hydrogen fuel cell vehicles, designing lower-cost, mass-market passenger cars and SUVs and pushing the technology into buses and trucks to build economies of scale.

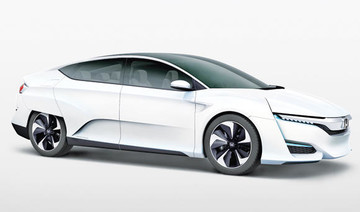

As Toyota cranks up improvements for the next generation of its Mirai hydrogen fuel cell vehicle (FCV), expected in the early 2020s, it is hoping it can prove wrong rival automakers and industry experts who have mostly dismissed such plans as commercially unviable.

The maker of the Prius, the world’s first mass-produced “eco-friendly” gasoline-hybrid car in the 1990s, says it can popularize FCVs in part by making them cheaper.

“We’re going to shift from limited production to mass production, reduce the amount of expensive materials like platinum used in FCV components, and make the system more compact and powerful,” Yoshikazu Tanaka, chief engineer of the Mirai, said in an interview with Reuters.

It is planning a phased introduction of other FCV models, including a range of SUVs, pick-up trucks, and commercial trucks beginning around 2025, a source with knowledge of the automaker’s plans said.

The automaker declined to comment on specific future product plans. But it has developed FCV prototypes of small delivery vehicles and large transport trucks based on models already on the road, as Tesla Inc. develops a battery-operated commercial semi-truck from the ground up.

“We’re going to use as many parts from existing passenger cars and other models as possible in fuel cell trucks,” said Ikuo Ota, manager of new business planning for fuel cell projects at Toyota. “Otherwise, we won’t see the benefits of mass production.”

The company is also betting on improved performance. Toyota wants to push the driving range of the next Mirai to 700-750 kilometers from around 500 kilometers, and to hit 1,000 kilometers by 2025, a separate source said.

Driven by the belief that hydrogen will become a key source of clean energy in the next 100 years, Toyota has been developing FCVs since the early 1990s.

Hydrogen is the most abundant element in the universe and stores more energy than a battery of equivalent weight.

The Mirai was the world’s first production FCV when it was launched in 2014. But its high cost, around $60,000 before government incentives, and lack of refueling infrastructure have limited its appeal. Fewer than 6,000 have been sold globally.

LMC Automotive forecasts FCVs to make up only 0.2 percent of global passenger car sales in 2027, compared with 11.7 percent for battery EVs. The International Energy Agency predicts fewer FCVs than battery-powered and plug-in hybrid electric vehicles through 2040.

Many automakers, including Nissan Motor Co. and Tesla, see battery-powered cars as a better, zero-emission solution to gasoline engines. Only a handful, including Honda Motor Co. and Hyundai Motor Co, produce FCVs.

But people familiar with Toyota’s plans said the automaker thinks demand will perk up as more countries, including China, warm to fuel cell technology. The company also sees FCVs as a hedge against a scarcity of key EV battery materials such as cobalt.

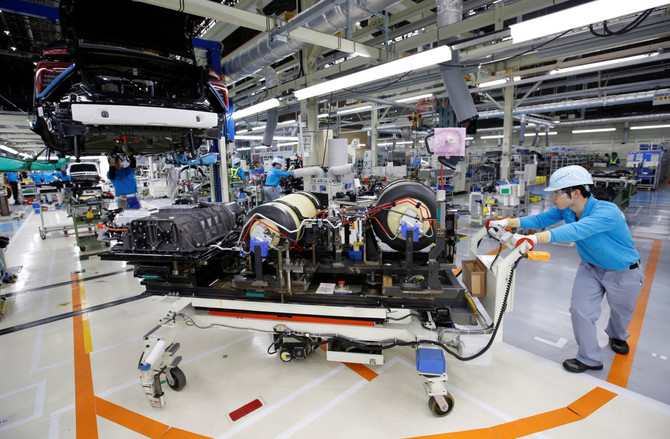

For now, Mirais are assembled by hand at a plant in Toyota City, where 13 technicians push partially constructed units into assembly bays for detailed inspections. This process yields just 6.5 cars a day, a sliver of Toyota’s average domestic daily production of about 13,400 vehicles.

Strategic Analysis Inc, which has analyzed costs of FCVs including the Mirai, estimates that it costs Toyota about $11,000 to produce each of its fuel cell stacks, by far the vehicles’ most expensive part.

Toyota has been building up production capacity to change that, as it expects global FCV sales climb to 30,000 units annually after 2020 from about 3,000. Strategic Analysis estimates that would allow Toyota to reduce costs to about $8,000 per stack.

It has already begun to use parts developed for the Mirai in other models, such as the fuel cell stack, which is used in Kenworth freight trucks being tested in California, the Sora FC bus it released in Japan in March and the delivery trucks it will test with Seven-Eleven stores in Japan next year.

“It will be difficult for Toyota to lower FCV production costs if it only produces the Mirai,” the first source told Reuters on condition of anonymity as he was not authorized to speak publicly about the issue.

“By using the FCV system in larger models, it is looking to lower costs by mass-producing and using common parts across vehicle classes,” he added.

The Mirai’s high production costs are largely due to expensive materials including platinum, titanium and carbon fiber used in the fuel cell and hydrogen storage systems.

Engineers have been reducing that by improving the platinum catalyst, a key component in the 370 layered cells in the fuel cell stack, which facilitates the reaction between hydrogen and oxygen that produces electricity.

“We’ve been able to decrease the platinum loading by 10 percent to 20 percent and deliver the same performance,” said Eri Ichikawa, a fuel cell engineer at Cataler Corp, a Toyota subsidiary that specializes in catalytic converters.

Strategic Analysis says using that much less of the precious metal would save up to $300 per fuel cell stack, based on an estimate that Toyota now uses about 30 grams of platinum per unit.

“By consistently focusing on these issues, we will be able to progressively lower the cost of FCVs in the future,” Tanaka said.

Toyota cranks up investment in hydrogen fuel cell vehicles

Toyota cranks up investment in hydrogen fuel cell vehicles

- It is hoping it can prove wrong rival automakers and industry experts who have mostly dismissed such plans as commercially unviable

- The Mirai was the world’s first production hydrogen fuel cell vehicle when it was launched in 2014

Saudi Arabia and Egypt retain top spots in MENA travel preferences: Wego study

RIYADH: Saudi Arabia and Egypt remain dominant destinations among Middle East and North Africa travelers in 2024, retaining top spots in international preferences, according to a study.

Singapore-based travel booking app Wego ranked Egypt as the top destination for tourists from the region between January and April, followed by the Kingdom, with India consistently holding the third spot since 2016.

Saudi Arabia’s second spot on the wish list is a clear indication of the Kingdom’s progress as a global tourist destination, aligning with its National Tourism Strategy aiming to attract 150 million visitors by 2030.

“We are excited to see Egypt emerge as the leading destination for travelers in the MENA region during Q1 2024. According to Wego's data, Egypt stands out as a favored choice among travelers seeking unique cultural experiences and diverse attractions,” said Mamoun Hmedan, chief business officer at Wego.

He added: “Meanwhile, the United Kingdom retains its position as the preferred European destination for Middle Eastern travelers.”

Among Middle East destinations, the top three — Egypt, Saudi Arabia, and UAE —maintained their positions from 2023. Egypt and the Kingdom, in particular, have consistently held the top two spots since Wego began tracking customer trends over a decade ago.

The study utilized traveler searches and hotel booking data from its website as the foundation for its findings.

The report further revealed that the UAE ranked as the fourth favorite destination, followed by Pakistan, Kuwait, and Turkiye.

Meanwhile, China dropped one spot, reaching the 27th top destination among MENA travelers.

The UK remains the top European destination from the Middle East, holding the first spot for 10 of the last 11 years, briefly overtaken during the pandemic. Italy has notably surged from fourth to second.

Italy, a top global tourist spot, consistently ranks in the top ten European destinations for Middle East travelers.

This year marks Italy’s debut in the top three. Joint investments between Saudi Arabia and Italy in late 2023, along with direct flights by ITA Airways to Riyadh and Jeddah, signify growing ties.

Countries farther from the Gulf region, such as Morocco, Indonesia, and the US experienced the most decline among top destinations.

This trend continued in 2024, with Malaysia, the Philippines, and the US dropping out of the global top 10, while Kuwait, Pakistan, and Jordan, which entered the top ten last year, remain preferred destinations for MENA travelers.

Closing Bell: TASI edges down to close at 12,372 points

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Monday, losing 0.61 points, to close at 12,372.50.

The total trading turnover of the benchmark index was SR7.36 billion ($1.96 billion) as 116 stocks advanced, while 110 retreated.

Similarly, the MSCI Tadawul Index decreased by 2.63 points, or 0.17 percent, to close at 1,549.13.

On the other hand, the parallel market, Nomu, increased, gaining 0.85 points, to close at 26,791. This comes as 20 stocks advanced while as many as 39 retreated.

The best-performing stock was Bupa Arabia for Cooperative Insurance Co. as its share price surged by 10 percent to SR275.

Other top performers included the Mediterranean and Gulf Insurance and Reinsurance Co. and Al-Rajhi Company for Cooperative Insurance, whose share prices soared by 9.97 percent and 9.93 percent, to stand at SR33.10 and SR148.40 respectively.

The worst performer was Arabian Internet and Communications Services Co., whose share price dropped by 4.46 percent to SR334.4.

Saudi Cable Co. as well as Gulf Insurance Group, did not perform well, as their share prices dropped by 3.55 percent and 3.01 percent to stand at SR76 and SR33.85, respectively.

On the announcements front, Bupa Arabia for Cooperative Insurance Co’s profits surged to SR359 million, during the first quarter of 2024, up 91 percent from SR189 million in the same quarter of the previous year.

According to Al-Ekhbariya, net investment income reached SR158 million in the first quarter compared to SR102 million in the same quarter of the previous year, marking a 54 percent increase.

Insurance revenues for the current quarter amounted to SR4.37 million, compared to SR3.75 million in the same quarter of the previous year, reflecting a significant increase of 16.63 percent.

This growth is primarily attributed to operational expansion and an increase in the number of insured individuals, as reported by the channel.

Al-Rajhi Company for Cooperative Insurance also announced its interim financial results for the period ending March 31 with revenues increasing to SR1.4 million from to SR865,298 during the similar quarter of the previous year.

This marked an increase of 50.6 percent attributed the increase to a growth in overall business volume, according to a Tadawul statement.

Similarly, net profit after zakat attributable to shareholders for the current quarter amounted to SR111,376, compared to SR61,282 during the similar quarter in previous year, an increase of 81.7 percent.

According to the company, the improvement stemmed from increased net insurance service results, rising to SR113,229 from SR97,616 in the previous year, a 16 percent surge due to business growth.

Pakistan ‘high priority' economic opportunity for us, Saudi top minister says in Islamabad

- 50-member Saudi delegation with representatives from 30 companies in Pakistan for investment conference

- 125 Pakistani companies negotiating with Saudi companies visiting Pakistan, petroleum minister says

ISLAMABAD: Pakistan is a “high-priority economic investment and business opportunity” for Saudi Arabia, the Kingdom’s Assistant Minister of Investment Ibrahim Al-Mubarak said on Monday, as a two-day Pak-Saudi investment conference kicked off in Islamabad with a focus on business-to-business engagements.

A 50-member delegation led by Al-Mubarak arrived in Pakistan on Sunday, comprising some 30 Saudi companies from the fields of IT, telecoms, energy, aviation, construction, mining exploration, agriculture and human resource development.

“To the Saudi government and Saudi companies, Pakistan is considered a high-priority economic investment and business opportunity,” Al-Mubarak said as he addressed the investment summit.

“We believe in the great potential of Pakistan's economy, demographics and talent as well as location and natural resources.”

Al-Mubarak said this was his second visit to Pakistan in two weeks and many influential leaders from globally renowned Saudi companies were part of his delegation.

“Today, we want to connect you [Pakistan] all to Saudi companies who desire to continue building their international presence, for Saudi Arabia's ambitions do not stop at our borders and we would like to see Pakistan as one of our leading international partners,” the Saudi official added.

“So, this gathering provides a wonderful opportunity for them [Saudi companies] to develop a deeper understanding of the great opportunities available for investment in Pakistan and to learn about related regulations, requirements, and incentives.”

Addressing a press conference in Islamabad, Petroleum Minister Dr Musadik Malik said 125 Pakistani companies were negotiating with the Saudi companies who were visiting Pakistan.

“First, there were government-to-government agreements during the visit of the Saudi foreign minister [last month] and now there will be business-to-business agreements,” he said.

“To facilitate the visiting Saudi companies, the Pakistani commerce ministry has affiliated one focal person with each Saudi company.”

Minister for Commerce Jam Kamal Khan said Pakistani and Saudi companies were discussing joint ventures and collaboration in diverse sectors.

“This delegation includes high officials of more than 32 Saudi companies … Saudi businessmen will invest in Pakistan in different stages,” Khan said at the press conference.

“Pakistani companies are present here, in the energy sector, in the food sector, in the construction sector, in the renewable section, in the ports and shipping section, and the IT services and general services.”

He said the visit by the Saudi delegation was “just the beginning” and now a Pakistani delegation would visit the Kingdom “to move forward towards the implementation phase.”

INVESTMENT PUSH

Pakistan and Saudi Arabia have been closely working in recent weeks to increase bilateral trade and investment deals, with Crown Prince Mohammed bin Salman last month reaffirming the Kingdom’s commitment to expedite an investment package of $5 billion.

The Saudi business delegation’s visit comes on the heels of one by Sharif to Riyadh from Apr. 27-30 to attend a special two-day meeting of the World Economic Forum.

On the sidelines of the WEF conference, the Pakistani PM met and discussed bilateral investment and economic partnerships with the crown prince and the Saudi ministers of finance, industries, investment, energy, climate, and economy and planning, the adviser of the Saudi-Pakistan Supreme Coordination Council and the presidents of the Saudi central bank and Islamic Development Bank.

This was Sharif’s second meeting with the crown prince in a month. Before that he also met him when he traveled to the Kingdom on April 6-8. The Saudi foreign minister was also in Pakistan last month, a trip during which Pakistan pitched projects worth at least $20 billion to Riyadh.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as a top source of remittances to the cash-strapped South Asian country. During the first half of the current financial year, bilateral trade between Pakistan and Saudi Arabia was recorded at $2.482 billion, with Pakistan’s exports of $262.58 million and Saudi exports of $2.219 billion.

Saudi Arabia has often come to Pakistan’s aid in the past, regularly providing it oil on deferred payments and offering direct financial support to help stabilize its economy and shore up forex reserves.

As things stand, Pakistan desperately needs to shore up its foreign reserves and is in talks with the International Monetary Fund (IMF) for a new bailout deal, for which it needs to signal that it can continue to meet requirements for foreign financing which has been a key demand in previous loan packages.

Last year Pakistan set up the Special Investment Facilitation Council, a body consisting of Pakistani civilian and military leaders and specially tasked to promote investment in Pakistan. The council is so far focusing on investments in the energy, agriculture, mining, information technology and aviation sectors and specifically targeting Gulf nations.

Saudi domestic tourism records steady growth in Q1 2024

RIYADH: Domestic tourism in Saudi Arabia witnessed steady growth during the first four months of 2024, an industry report showed.

The report, based on the data extracted from Almosafer’s consumer travel platforms, showed that 53 percent of the total bookings accounted for local tourist destinations.

The top domestic destinations were Makkah, Riyadh, Jeddah, Alkhobar, and Abha while people also showed keen interest in visiting AlUla, Tabuk, and Hail.

The sustained interest in domestic tourism showcases the success of government and private sector initiatives to boost local tourism, resulting in a 29 percent increase in total domestic booking volume across Almosafer channels.

Flights saw a 27 percent increase compared to the same period last year while hotel bookings rose by nearly double at 40 percent in the same duration.

With Saudi Arabia’s tourism sector booming, travelers are keen to make the most of their breaks as they focus on in-destination experiences.

The addition of more flight routes, an increase in capacity, and the opening of new airports in the Kingdom has led to more affordable flight options on low-cost carriers, while Saudi travelers are willing to spend on luxury stays with 51 percent of hotel bookings on the platform being for 5-star properties and experiences, they are taking advantage of budget-friendly flight options.

Data showed an overall jump from 55 percent in 2023 to 62 percent among travelers opting to fly low-cost this year.

Internationally this year 46 percent of total bookings were done for low-cost carriers compared to 44 percent in 2023.

In terms of international destinations, Dubai, Doha, Manama, Cairo, and Istanbul remain the top favorites among Saudis. At the same time, there has been a significant shift of focus toward South Asia and the Far East with Tokyo, Singapore, and Bangkok increasingly seeing more footfall from Saudi travelers.

European capitals including Madrid and Amsterdam are also emerging as trending destinations for bookings made in the first four months of 2024.

It is worth noting that the Kingdom hosted 27.4 million international and 79.3 million domestic tourists in 2023, witnessing 65 percent and 2 percent growth compared with 2022, respectively.

The tourism sector has become important to the national economy, as spending on tourism by domestic and international tourists exceeded SR250 billion ($66.7 billion) in 2023. The sector is set to contribute 10 percent to the non-oil gross domestic product and create 1 million job opportunities by 2030. This spending represented more than 4 percent of the Kingdom’s GDP and 7 percent of the non-oil GDP, highlighting the significance of the tourism sector to the Kingdom’s economy.

According to a World Tourism Barometer report released in January 2024, Saudi Arabia topped UN Tourism’s ranking for the growth of international tourist arrivals in 2023 compared with 2019 among large destinations, achieving a 56 percent increase in international tourist arrivals.

Additionally, the report indicated that Saudi Arabia recorded a remarkable tourism recovery rate of 156 percent in international tourist arrivals in 2023 compared with 2019.

These notable achievements have positioned the Kingdom as a leader in the Middle East’s global tourism recovery. It was the only region to surpass pre-COVID-19 pandemic levels, with a 122 percent recovery rate in international tourist arrivals in 2023 compared with 2019.

Saudi private sector employment reaches 11.27m in April: official data

RIYADH: Saudi Arabia’s private sector has created more job opportunities, with the total number of employees reaching 11.27 million workers in April, official data showed.

According to the Saudi National Labor Observatory report, there was a net increase in citizen employment for April, with 18,535 individuals newly joining the private sector workforce.

Among these figures, there are over 2.35 million Saudi nationals, comprising more than 970,200 female workers and over 1.38 million male employees.

On the other hand, NLO data showed that the total number of residents employed in the private sector exceeded 8.91 million individuals, comprising over 8.55 million male workers and only 364,900 female employees.

The report provides an overview of the Saudi private sector, highlighting a dynamic workforce of over 9.9 million male workers and more than 1.3 million female workers, representing diverse nationalities and playing integral roles in sector operations.

In February, the total number of employees in the Saudi private sector reached 11.1 million, marking a 0.9 percent increase from the previous month, according to an NLO release.

The national observatory report revealed that out of the total, 2.3 million were Saudi nationals, while 8.8 million were residents of the Kingdom belonging to different nationalities.

That data reflected a positive trend in the employment industry as the private sector continues to expand its workforce, creating opportunities for Saudi citizens.

Moreover, an analysis of the Saudi national workforce revealed that while 961,690 employees were females, 1.4 million were males.

Meanwhile, among the 8.8 million non-Saudi workers, 348,892 were women, while 8.4 million were men.

In February alone, the net growth in jobs for Saudi nationals as well as residents stood at 26,694, indicating a steady increase in employment within the private sector.

Saudi Arabia’s economic diversification efforts have transformed the Kingdom into a hub for employment opportunities, propelled by bold giga-projects such as NEOM, which attract fresh talent into the construction sector.

NLO, a governmental organization, is tasked with monitoring and analyzing labor market trends and dynamics in the country. It serves as a crucial resource for policymakers, researchers, and stakeholders interested in understanding and addressing issues related to employment, workforce development, and labor market regulations.