ISLAMABAD: Pakistan’s defense delegation visited Saudi Arabia to discuss existing bilateral defense ties, the Pakistani Ministry of Defense said in a statement on Monday.

“A defense delegation led by Secretary Defense Lt. General (Retd) Zamir Ul Hassan Shah visited KSA, during which the delegation met high-level officials including Chief of General Staff and Assistant Minister of Defense KSA,” the statement said.

“During the interactions issues relating to existing bilateral defense relations and areas of future cooperation were deliberated upon,” it added.

“Both sides expressed satisfaction over the present status of bilateral defense relations and expressed a keen desire to further enhance and diversify them.”

The Pakistani delegation also visited the headquarters of Islamic Military Counter Terrorism Coalition, where it was briefed about the “organizational aspects of the coalition besides the future roadmap of the organization,” the Defense Ministry said.

Pakistan is part of the Islamic Military Counter Terrorism Coalition.

Pakistan, KSA discuss enhancing defense cooperation

Pakistan, KSA discuss enhancing defense cooperation

- The Pakistani delegation was briefed about the organizational aspects of the coalition at the headquarters of Islamic Military Counter Terrorism Coalition

- Both sides expressed satisfaction over the present status of bilateral defense relations and expressed a keen desire to further enhance and diversify them

Army chief stresses economic stability as key to national sovereignty at Green Pakistan conference

- General Asim Munir says army will continue to support the government with economic development of Pakistan

- He tells the gathering the military will provide comprehensive national security, work for Pakistan’s collective good

ISLAMABAD: Pakistan’s army chief General Asim Munir emphasized the importance of economic stability for a country to achieve full sovereignty while addressing the Green Pakistan Initiative conference on Friday, adding that his institution would continue to support the government in these efforts.

The initiative was launched as a response to the severe climate change impacts that Pakistan has faced over the years, including droughts, catastrophic floods, and extreme heatwaves. The program aims not only to mitigate the effects of erratic weather patterns by improving forest cover and restoring the ecosystem but also enhance the country’s resilience against future climatic shocks.

Pakistan has witnessed a growing awareness about the nexus between environmental issues and national security, prompting various sectors, including the military, to contribute to such green efforts.

“Pakistan is a blessed land with an industrious and resilient nation which needs to come together for national development,” the military’s media wing, ISPR, quoted the army chief in a statement circulated after the conference.

“Pakistan Army will continue to provide all possible support for the economic development of Pakistan,” he continued while pointing out the efforts of his institution to provide comprehensive national security and work for the collective good of the nation.

The state-owned PTV News reported the army chief warned all those who were trying to stop the country from progressing that their efforts would be wasted.

“In today’s era, the concept of complete sovereignty is not possible without economic stability,” he added.

Senior members of Pakistan’s federal cabinet were also present at the conference.

The participants reviewed the progress made under the initiative, expressing satisfaction that the country had achieved significant milestones under the program by establishing model farms, launching water management schemes and enhancing agricultural productivity.

‘Shares on fire’: Pakistan’s key stock index nears 73,000 level after hitting another historic high

- Analysts say the bullish sentiment owes to IMF talks and optimism around Saudi investment, key policy rate cut

- The benchmark KSE100 index has surged by 8,081 points since January, gaining about 80% in US dollar terms

KARACHI: Independent financial experts in Pakistan said on Friday the country’s equity market was on fire as stocks hit another all-time high of 72,739 points amid euphoria surrounding the government’s negotiations with the International Monetary Fund for another loan along with possible Saudi investment and interest rate cut optimism.

The benchmark KSE100 index ended the weekend trading session with a gain of 771.7 points despite a relative decline in the morning. However, the market rebounded in the second half and soared to a new record high, closing at the 72,739 level.

The prevailing positive momentum began at the beginning of the year, making the KSE100 gain 8,081 points since January.

“Pakistan’s share market is on fire,” commented Muhammad Sohail, CEO of Topline Securities. “It is hovering around the 73,000 mark and still soaring.”

Sohail said Pakistani stocks were “leading the pack” with nearly an 80 percent gain in US dollar terms over the past year, maintaining their number one position.

The market on Friday saw selling pressure in the morning but recovered in the second half, mainly due to the fertilizer and banking sectors.

“Initial pressure in the morning session was mainly due to the rollover week,” said Sheheryar Butt, Portfolio Manager at Darson Securities. “Later, the fertilizer sector led the buying spree, helping with the market recovery.”

Other sectors that contributed to the highest ever close included commercial banks, cement and the power sector since they collectively reversed the previous negative close and created a more bullish trend.

“Foreign inflows, a stable rupee, speculation ahead of the central bank policy rate decision on April 29, and firm IMF new loan talks played a key role in the record close,” said Ahsan Mehanti, CEO of Arif Habib Corporation.

The KSE100 index has gained 5.4 percent on a week-on-week (WoW) basis, with many attributing this positivity in the market to investor expectations of an interest rate cut in the upcoming monetary policy meeting on Monday.

The economic indicators also played a major role in the bullish trend of the stock market, particularly the current account number for the month of April which showed a 9-year-high surplus of $619 million.

Additionally, media reports that Prime Minister Shahbaz Sharif was going to Saudi Arabia where he would request the kingdom to expedite investment in Pakistan’s oil, gas, and mining sectors also kept the bullish sentiments alive.

“Investors expect that Pakistan’s prime minister will speed up the investment of $5 billion,” Butt said. “If he brings any good news, the market will see it positively.”

The stock market is also expecting that after keeping the policy rate high at 22 percent since June 27, 2023, the central bank will make some changes in its monetary policy statement next week. “Expectations are high this time,” he continued. “The interest rate can come down by 50 to 100 basis points.”

Pakistani stocks have largely witnessed a bullish trend after the country secured $3 billion in short-term financing in July last year to stave off sovereign debt default.

The government is now expecting the final disbursement of $1.1 billion of IMF financing after the approval of its executive board.

A new IMF program being negotiated by the authorities has also led to positive sentiment in the capital market and can lead to another round of bullish spells if and when it materializes.

Ex-PM Khan’s party stages nationwide protest against alleged rigging, vows to continue until mandate restored

- The party says the April 21 by-elections were manipulated by the authorities in favor of its political rivals

- Its leaders have promised to reclaim their ‘stolen’ mandate by protesting for democracy and rule of law

ISLAMABAD: Jailed former prime minister Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party on Friday held nationwide protests against alleged rigging and vote fraud in by-polls held on April 21 over about two dozen national and provincial assembly seats, vowing to continue until its mandate was restored.

PTI leaders believe election results were manipulated in favor of their political rivals in the recent contest after already rejecting the outcome of the February 8 national polls. The party complained of harassment and state crackdown soon after the downfall of its administration in a no-trust vote in April 2022.

Khan has now directed his party from a high-security prison in Rawalpindi, where he has spent several months after being incarcerated last August, to protest against the rigging until its mandate is restored.

“It will not end here,” Shoaib Shaheen, a PTI leader who spearheaded a protest rally in Islamabad, told Arab News. “We held our peaceful protest demonstration today despite police’s harassment and threats to arrest the workers and leadership.”

Hundreds of male and female protesters responded to the PTI’s protest call in different cities including Karachi, Lahore and Faisalabad. The demonstrators were carrying the party flags and Khan’s portraits, demanding his release from the jail. Some of them were also wearing Khan’s face masks to express solidarity with him.

The PTI has already formed a six-party opposition alliance for a nationwide movement against the alleged vote fraud. The alliance held its first protest gathering in Pishin, Balochistan, earlier this month and announced next major public gatherings in Karachi and Faisalabad.

“The nationwide protests would continue until our mandate is restored,” Shaheen said. “This is not just a protest but movement for restoration of democracy and rule of law in Pakistan.”

The party maintained it had won over 180 National Assembly seats in the February 8 polls, but its mandate was just reduced to 90 seats. It also complained of being denied its due share in the reserved seats for women and religious minorities in parliament since all of its candidates had contested as independents after the Supreme Court took away the party’s iconic symbol of a cricket bat days ahead of the national polls.

“We are being denied all our democratic, legal and even basic human rights,” Shaheen said. “All Pakistanis should join us in the movement for restoration of political and economic stability in the country.”

The PTI delegations have frequently been denied by the sitting government.

Prior to the Friday protest, the Islamabad Capital Territory police imposed Section 144 of the Criminal Procedure Code (CrPC), preventing large gatherings to ensure maintenance of public order.

“Strict action will be taken against those who violate the law,” the police said in a social media post. “Blocking of roads and disruption of normal life will not be tolerated. The law is equal for all and action will be taken against violation.”

Global logistics giant shows interest in developing Pakistan’s first green transshipment terminal

- APM Terminals sent a delegation to meet Pakistani officials and discuss the modernization of its ports

- The integrated container logistics company also develops and operates ports in countries across the world

ISLAMABAD: A delegation from a leading logistics company, A.P. Moller-Maersk (APM) Terminals, expressed interest in developing the first transshipment terminal in Pakistan while holding a meeting with Prime Minister Shehbaz Sharif on Friday.

Maersk is an integrated container logistics company operating in 130 countries. APM Terminals has been developing and operating advanced ports and container terminals for over half a century and has 60 strategically located ports and container terminals around the globe and several more in development.

The company delegation arrived in Pakistan earlier this week to discuss the possibility of developing and modernizing the South Asian nation’s ports and held separate meetings with Finance Minister Muhammad Aurangzeb and Minister for Maritime Affairs Qaiser Ahmed Sheikh.

“The prime minister expressed interest in cooperation between Pakistan and Denmark in the fields of agriculture and environment-friendly energy projects,” Radio Pakistan reported after Sharif’s meeting with the delegation led by the company CEO Keith Svendsen.

“Svendsen expressed satisfaction on the investment and business friendly policies of Pakistan,” it added. “He showed interest in the first green transshipment terminal of Pakistan in Karachi.”

The construction of the project would allow large cargo ships to utilize the Karachi port, helping the country earn greater revenue.

Previously, the country’s finance minister told the delegation Pakistan was keen to explore future projects and investments with APM, especially in the maritime sector.

“The government is fully committed to facilitate an environment conducive to business and investments,” he told them.

Svendsen and his delegation also met the maritime affairs minister on Thursday and discussed investment prospects in Pakistan’s ports and terminals sector.

“The delegation head highlighted Moller-Maersk’s prominent global position and its robust relationship with Pakistan, which reflects a market share of approximately 20 percent in containerized import-export activities,” Radio Pakistan said.

“Recognizing the immense growth potential, Keith Svendsen proposed investments to enhance integrated supply chain solutions, including the upgrading of ports and logistics infrastructure. The delegation pledged support for the advancement of maritime affairs in Pakistan and for nurturing a skilled workforce in this sector.”

On Monday, Pakistani and United Arab Emirates (UAE) officials performed the groundbreaking of a $175 million Bulk and General Cargo terminal as part of a new 25-year concession agreement signed between AD Ports Group and Karachi Port Trust (KPT) in Feb. 2024 to outsource operations of the terminal.

Under the terms of the agreement, Karachi Gateway Terminal Multipurpose Limited (KGTML), a joint venture between AD Ports Group, as a majority shareholder, and Kaheel Terminals, a UAE-based company, will develop, operate and manage the Bulk and General Cargo Terminal, berths 11 to 17 at Karachi Port’s East Wharf.

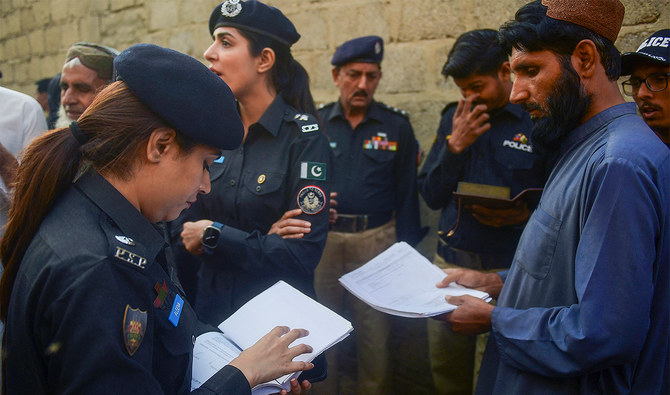

Pakistan extends Afghan refugee cards until June 30 amid deportation drive

- The drive targeting ‘illegal immigrants,’ mostly Afghan nationals, was launched last year amid security concerns

- The Pakistan government says the POR cardholders will be repatriated to Afghanistan in the third deportation phase

ISLAMABAD: The Pakistan government on Friday approved the extension of Proof of Registration (POR) cards for Afghan refugees for another two months amid an ongoing deportation drive against unregistered foreigners in the country.

POR cards are identification documents issued by Pakistani authorities to Afghan refugees. These cards serve as official recognition of the refugees’ legal status in the country, allowing them to access various services such as education, health care and banking.

The Pakistan government extends these cards on a periodic basis, often depending on the political and security situations involving both countries. The extension of these cards is typically subject to review by the Pakistani government, in consultation with international organizations like the United Nations High Commissioner for Refugees (UNHCR).

“The federal cabinet has approved the extension of the validity of Proof of Registration cards for Afghan refugees from April 1, 2024, to June 30, 2024, on the recommendation of SAFRON [the Ministry of State and Frontier Regions],” announced an official statement issued after the cabinet meeting.

“The cabinet was informed that this extension would allow POR cardholders to benefit from facilities such as schools, bank accounts and other services in Pakistan,” it added. “These POR cardholders will be sent back to their home countries in the third phase of the program for repatriating foreigners residing illegally in Pakistan.”

Pakistan initiated a deportation drive targeting “illegal immigrants,” predominantly Afghans, late last year, citing security concerns amid a spike in militant attacks.

The move stirred unease among registered Afghan refugees, many of whom pointed out they were anxious about their uncertain future.

Pakistani officials have attributed several lethal attacks on both security forces and civilians to Afghan nationals, expressing their commitment to repatriate all Afghan refugees, including many born in Pakistan to families who settled during the 1980s following the Soviet invasion.

The Afghan authorities in Kabul have objected to the deportation drive, disputing that Afghan nationals had any role in the ongoing security deficit in Pakistan.

They have also maintained that Pakistan should have consulted them over the issue and given more time to Afghan nationals before sending them back to their country.