ISLAMABAD: Pakistan’s Punjab Information Technology Board (PITB) on Wednesday dismissed reports of a massive data breech of citizens’ personal information.

“There is no data breach of government of Punjab IT systems,” Burhan Rasool, PITB General Manager (IT) told Arab News.

“Those spreading baseless propaganda are doing a national disservice,” he added.

An investigation published by Technology news website TechJuice was followed up by local news organisations. It was claimed that leaked information included Computerized National Identity Card information, National Database & Registration Authority family tree data and databases of registered mobile users.”

“Some elements want to derail the technological development in Punjab through the propaganda campaign, but they won’t succeed,” Rasool said.

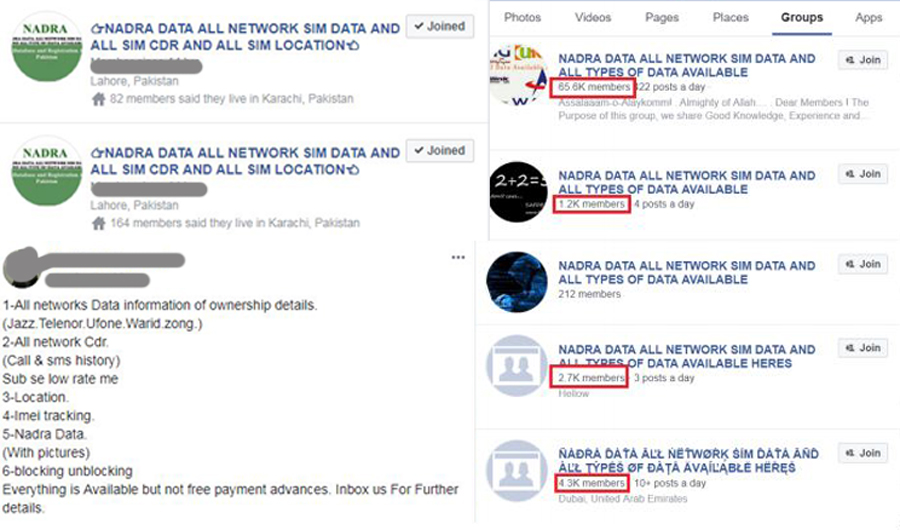

Citizens data allegedly stolen from NADRA as shown in the report by TechJuice. (Photo courtesy: TechJuice)

“Elements behind this malicious campaign will be traced and brought to justice.”

He attempted to reassure the public by adding that a system is in place to ensure security and privacy of the citizens’ data.

However, the TechJuice report said that data had been extracted and was being sold on Facebook and WhatsApp.

The PITB has access to the country’s National Database and Registration Authority’s (NADRA) server for digitizing the data of citizens by linking their Computerized National Identity Card (CNIC) numbers to numerous public departments.

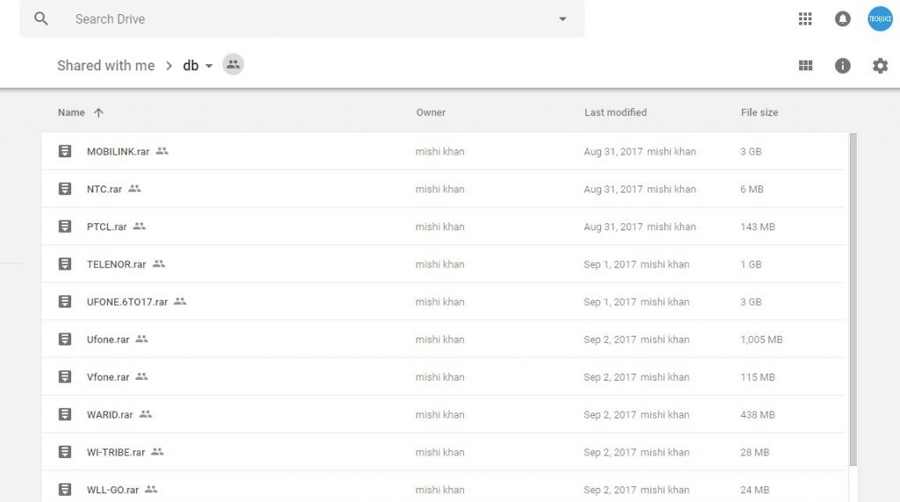

Citizens data allegedly stolen from telecom companies displayed in the investigative report by TechJuice. (Photo courtesy: TechJuice)