SOFIA: Eurozone finance ministers on Friday set a two-month countdown to agree Greece’s high-wire exit from eight years of bailout programs with divisions deep over how much debt relief Athens needs.

Mario Centeno, the head of the Eurogroup, said reform efforts were still required from Greece before it could end its massive rescue program as expected on August 20.

Greece has been at the mercy of three bailout programs since 2010 when its public finances collapsed, pushing the country into a deep economic depression and bringing crisis to the eurozone.

Athens has yet to rubberstamp its last reforms, including a round of controversial privatizations, with eurozone ministers demanding full delivery ahead of ministerial talks in Luxembourg on June 21.

“On the basis of a successful review, the Eurogroup will decide in June all the elements that can help facilitate the exit of Greece from the program by August,” said Centeno, who is also Portuguese finance mister.

Ministers meeting in Sofia did not get down to the thorny issue of debt relief, but EU Economic Affairs Commissioner Pierre Moscovici said “we of course need to reach an agreement on a strong set of commitments to ease Greece’s debt burden.”

The topic of debt relief is hugely sensitive with Greece’s debt to European taxpayers standing at nearly 180 percent of annual output, a level that many fear is unsustainable.

But powerful Germany, Greece’s biggest creditor, is extremely reluctant to pare down the pile and will demand that Greece meet strict targets even after the bailout as a condition.

Opposite the hard-liners, which also includes the Netherlands and other northern eurozone countries, are France and the European Central Bank, which argue that reduced debt is crucial in order for Greece to gain the trust of the markets.

France has proposed that debt relief be tied to economic growth, where Greece would see its debt rates automatically reduced in tough times and set higher in the good ones.

“The more automatic they can be, the less conditional they can be, the more they can contribute to the confidence building exercise (for investors),” ECB board member Benoit Coeure told a news conference in Sofia.

Whichever option is finally chosen, Athens, which has pledged to implement reforms even after it has left the aid program, will be monitored very closely in order to avert yet another rescue.

In order to give Greece an 18-month cushion, eurozone officials said creditors were considering a 10 to 12 billion euro cash buffer as a goodbye handshake for Athens.

That figure will likely raise hackles in Berlin and heap pressure on Athens to deliver swiftly on its last round of bailout reforms.

“The next two months will be very intense,” said Klaus Regling, the eurozone’s rescue fund chief.

Eurozone sets June deadline for Greece debt deal

Eurozone sets June deadline for Greece debt deal

Cashless payments in Saudi Arabia to rise by 7.6% in 2024

RIYADH: Cashless payments in Saudi Arabia are expected to surge by 7.6 percent in 2024 to SR550 billion ($146.8 billion) as compared to SR511.5 billion the previous year, a report said.

The report issued by GlobalData, a London-based data analytics and consulting company, projected the Saudi card payments market to grow at an annual rate of 6.4 percent between 2024 and 2028 to reach SR705.2 billion.

The uptick comes amid the Saudi government’s push for a cashless society by encouraging consumers to switch to cards for financial transactions.

“While cash has traditionally been a preferred method of payment in Saudi Arabia, its usage is on the decline in line with the rising consumer preference for electronic payments,” said Ravi Sharma, a lead banking and payments analyst at GlobalData.

He added: “The country has a robust digital payment infrastructure, supported by a developing card market and a well-established card acceptance infrastructure.”

Sharma further noted that Saudi Arabia’s government is taking effective steps to enhance the infrastructure in the country by encouraging merchants to adopt at least one electronic payment option apart from cash.

The report, however, added that cash remains an integral part of the Saudi consumer payments landscape, particularly for lower-value transactions, but the usage of hard currency is showing signs of decline.

Promoting digital payments is crucial for Saudi Arabia, as the Kingdom’s Vision 2030 aims to reduce cash transactions and increase the share of electronic payments to 70 percent of all transactions by 2025.

“The (COVID-19) pandemic changed the way Saudi consumers make payments, with an increasing number of consumers preferring contactless payments,” said Sharma.

He added: “Contactless cards have been on the rise in the country with the Saudi Arabian central bank reporting 363.4 million transactions using NFC-enabled mada cards in February 2024 compared to 331.7 million in February 2023.”

In terms of card preference, debit cards dominate the overall card payment space, accounting for 85 percent of the overall card payment value in 2023.

GlobalData pointed out that the government’s financial inclusion initiatives, consumers’ preference for debt-free payments, and prudent consumer spending have resulted in the domination of debit cards in the Kingdom.

“Saudi consumers are gradually embracing electronic payments, moving away from cash, supported by government push, improvements in payment infrastructure, growing consumer awareness, and rising adoption of newer technology like contactless,” added Sharma.

In April, data released by the Saudi Central Bank revealed that payments made through point-of-sale terminals in the Kingdom experienced a significant 20 percent annual increase in February, totaling SR53.72 billion.

The largest portion of POS spending in February was allocated to beverages and food, comprising 15.7 percent or SR8.43 billion.

This was followed by spending on restaurants and cafes, accounting for 15 percent of the total, reaching SR8.02 billion.

Saudi Arabia, China discuss collaboration in urban development during Beijing meeting

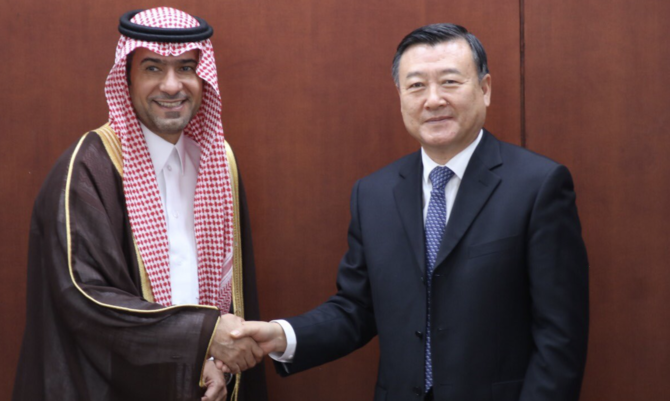

RIYADH: Saudi Arabia and China stand to gain by sharing expertise in city planning, sustainable urban development, and construction technology as officials from both sides met in Beijing.

Saudi Minister of Municipal and Rural Affairs and Housing Majid Al-Hogail and Chinese Minister of Housing and Urban-Rural Development Ni Hong held discussions to explore cooperation opportunities in developing housing policies and programs for residential communities.

This move extends from the Chinese President’s visit to the Kingdom in December 2022 and the agreements signed between the two nations during that time.

Following the meeting in Beijing, Al-Hogail stated in a post on X: “Our leaders have completed an agreement on the importance of strengthening the partnership and aligning Saudi Vision 2030 with the Belt and Road Initiative, which will reflect positively on the aspirations and economic standing of Saudi Arabia and China globally.”

He added: “We are working to enhance fruitful cooperation between the two countries in various fields including developing urban areas and attracting the best Chinese construction companies to benefit from their expertise in enhancing housing units in various regions of the Kingdom, with the aim of achieving the goals of the housing program — one of the programs of the Kingdom’s Vision 2030 — by providing various housing and financing options for citizens.”

Furthermore, the two countries reviewed successful experiences in providing housing solutions and options, along with enhancing opportunities for citizens to own homes. They also discussed ways to facilitate the exchange of experiences in urban management and the application of best practices in this regard.

The meeting was part of an official visit by Al-Hogail to the Chinese capital. During his visit, he is scheduled to meet with senior officials in the Chinese government, heads of construction companies, and banks to strengthen the partnership in the construction sector. The trip also aims to attract top international companies in real estate development.

Aramco acquires 40% stake in GO, marking first entry into Pakistani fuel retail market

- Saudi oil giant Aramco inked agreement to buy 40 percent stake in Gas and Oil Pakistan Ltd. in December 2023

- Acquisition to bring much-needed foreign direct investment in Pakistan’s energy sector, says competition commission

KARACHI: The Competition Commission of Pakistan this week approved Saudi oil giant Aramco’s decision to acquire a 40 percent stake in local company Gas & Oil Pakistan Ltd, officially marking the Saudi company’s entry into Pakistan’s fuels retail market.

Aramco and Gas signed the agreement to acquire 40 percent stake in Gas and Oil Pakistan Ltd., a licensed oil marketing company, in December 2023.

Gas and Oil Pakistan Ltd. is involved in the procurement, storage, sale, and marketing of petroleum products and lubricants. It is also one of Pakistan’s largest retail and storage companies.

Aramco is a global integrated energy and chemicals company that produces approximately one in every eight barrels of the world’s oil supply and develops cutting-edge energy technologies.

Aramco Asia Singapore Pte. Ltd., a Singaporean company wholly owned by Saudi Aramco, filed the pre-merger application with the CCP. It specializes in sales, marketing, procurement, logistics, and related services, with a focus on prospecting, exploring, drilling, extracting, processing, manufacturing, refining, and marketing hydrocarbon substances.

“The Competition Commission of Pakistan approved a 40 percent equity stake acquisition in Gas & Oil Pakistan Ltd. by Aramco, a global leader in integrated energy and chemicals,” the CCP said in a statement on Monday. “This transaction marks Aramco’s first entry into Pakistan’s fuels retail market, underscoring its confidence in the country’s economic potential and its commitment to its growth.”

The CCP said it had authorized the merger after determining that the acquisition would not result in the acquirers’ “dominance” in the relevant market post-transaction.

“Aramco’s acquisition indicates a significant milestone in Pakistan’s energy sector, bringing advanced expertise and technology to the fuels retail market,” it said. “This development is expected to boost competition, elevate service standards, and provide consumers with a broader range of high-quality products.”

The CCP said the acquisition would help bring much-needed foreign direct investment in Pakistan’s energy sector, contributing to economic growth and development of the country.

In February 2019, Pakistan and Saudi Arabia inked investment deals totaling $21 billion during the visit of Saudi Crown Prince Mohammed Bin Salman to Islamabad. The agreements included about $10 billion for an Aramco oil refinery and $1 billion for a petrochemical complex at the strategic Gwadar Port in Balochistan.

Pakistan’s Prime Minister Shehbaz Sharif, who is in Saudi Arabia for a special meeting of the World Economic Forum, held meetings this week with Saudi Arabia’s ministers of energy, economy and planning, and environment, according to his office.

In a meeting with Saudi Energy Minister Prince Abdulaziz bin Salman on Monday evening, Sharif highlighted initiatives undertaken by Pakistan to facilitate investment in the energy sector. The Saudi side showed keen interest in Pakistan’s energy projects highlighted by Sharif, the Prime Minister’s Office said.

The proposed projects included building new and improving existing energy infrastructure, increasing focus on renewable energy, and bringing efficiency across entire energy ecosystem in Pakistan, according to the statement.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both countries have been closely working to increase bilateral trade and investment deals, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion.

IHG’s luxury brand Hotel Indigo set to debut in Alkhobar, expanding Saudi footprint

RIYADH: The Saudi hospitality landscape is poised to welcome a new luxury hotel brand following a management agreement between UK-based IHG Hotels & Resorts and REFAD Real Estate Co.

Signed on the sidelines of the Future Hospitality Summit in Riyadh, the deal will bring the lifestyle brand Hotel Indigo & Residences, featuring 200 keys, to Alkhobar by September 2027.

Supported by the Kingdom’s Tourism Development Fund, the hotel will also include serviced apartments.

Speaking to Arab News, Haitham Mattar, managing director at IHG Hotels & Resorts in India, Middle East and Africa, said: “It’s on the corniche of Alkhobar. It brings authentic, cultural experiences into the hotel, and this is where we found this unique partnership with Refad. Their interest in the brand, also the brand positioning in Saudi Arabia.”

He revealed that the company has so far signed five Hotel Indigo hotels in Saudi Arabia.

The executive also noted that the luxury brand is expanding in the Middle East, following the success of an existing Hotel Indigo in Dubai.

Commenting on the agreement, Mattar said: “This strategic addition not only fuels our growth in Saudi but also reaffirms our commitment to providing exceptional hospitality experiences in key markets.”

He continued: “With the Kingdom having increased its 2030 visitor target from 100 to 150 million, there is a need to bring in lifestyle hotels offering compelling guest experiences that will only further strengthen its robust hospitality sector in line with the goals of Vision 2030.”

Mattar further elaborated on the significant investment and expansion plans for the hotel industry in Saudi Arabia over the next three to five years, including SR2.5 billion ($667 million) to renovate and upgrade existing facilities.

"His Excellency, Ahmed Al-Khateeb, the minister of tourism, has given us a very specific mandate to ensure that we uplift and elevate our hotel product,” he said.

This is to “to ensure that these hotels are well-positioned to receive international travelers, that the ministry and the government are seeking. We have a commitment from our owners to staff that are waiting, especially our Intercontinental brand,” Mattar added.

The managing director said the focus is on the Intercontinental brand, which currently has 10 to 11 hotels in Saudi Arabia and is part of a broader pipeline of 39 new hotels set to open across the region.

“We have a huge concentration of hotels coming up in the Makkah Medinah area, but also we are going into the secondary market. So, for example, Hotel Indigo is also going to Abha, in the Asir region, a very special location as well, in the mountains of Saudi Arabia, and we are also covering new opportunities in Riyadh, Jeddah, as well as Eastern Province,” Mattar explained.

As part of Saudi Arabia’s tourism strategy, which involves developing ten key destinations focusing on a mix of major cities and lesser-known regions, the list of destinations includes Madinah, Riyadh, and several secondary and tertiary markets like the Asir region, Qasim, and Al-Jouf, as well as Jazan, Abha, and Baha.

“This is where, you know, the natural assets of Saudi Arabia are. This is where the future of tourism is going to be. This is where the cultural and historical sites are also placed, and some of the places, as I see it,” Mattar emphasized.

He added that the Ministry of Tourism focuses on exploiting those assets and showcasing them to the world, emphasizing that it’s not just about city escapes in Riyadh and Jeddah, but also about the historical and spiritual offerings in Makkah and Madinah.

Hotel Indigo and Residence will provide guests with a range of dining options, including the Neighborhood Café and Lobby Lounge, as well as an Executive Lounge for a diverse culinary experience.

Business travelers will have access to facilities, including five meeting rooms and a ballroom spanning 290 sq. m., all equipped with the latest technology.

Closing Bell: Saudi main index gains 25 points to close at 12,395

RIYADH: Saudi Arabia’s Tadawul All Share Index continued its upward momentum for the second consecutive day, gaining 25 points to close at 12,394.91.

The total trading turnover of the benchmark index was SR7.47 billion ($1.99 billion) with 187 of the listed stocks advancing and 36 declining.

The Kingdom’s parallel market Nomu also edged up by 0.41 percent to 26,336.28.

However, the MSCI Tadawul Index shed 9.12 points to close at 1,560.69.

Makkah Construction and Development Co. was the best-performing stock of the day with its share price surging by 7.88 percent to SR106.80.

Other top performers on the main market were National Agricultural Development Co. and Saudi Reinsurance Co., whose share prices soared by 7.34 percent and 7.23 percent respectively.

The worst performer on the benchmark index was Saudi Electricity Co., as its share price slipped by 3.72 percent to SR18.62.

On the announcements front, ACWA Power said that shareholders approved the board of directors’ recommendation to distribute a cash dividend of SR0.45 per share for 2023.

Shareholders of the utility developer also green signaled the board’s recommendation to increase capital by SR14.62 million from retained earnings.

On Tuesday, Almunajem Foods Co. said that it signed a share purchase agreement with Balady Poultry Trading Co.

Under the deal, Almunajem Foods Co. will buy a 23 percent stake from Balady Poultry Trading Co.’s shareholders totalling SR181.33 million.

The company, in a Tadawul statement, revealed that the deal will be completed only after obtaining the necessary approvals from the relevant authorities, including the Kingdom\s General Authority for Competition.

Meanwhile, Yamama Cement Co. announced its financial results for the first quarter of this year.

In a Tadawul statement, the cement manufacturer said that its net profit increased by 2.34 percent in the first three months of 2024 to SR115.03 million, compared to the same period of the previous year.

The company attributed the rise in profit to lower cost of sales and higher revenues.

The National Co. for Glass Industries, also known as Zoujaj revealed that its net profit in the first quarter of this year surged by 166.27 percent to SR22.9 million, compared to the same quarter of the preceding year.