SAN FRANCISCO: As a teenager working for his dad’s construction business, Noah Ready-Campbell dreamed that robots could take over the dirty, tedious parts of his job, such as digging and leveling soil for building projects.

Now the former Google engineer is turning that dream into a reality with Built Robotics, a startup that’s developing technology to allow bulldozers, excavators and other construction vehicles to operate themselves.

“The idea behind Built Robotics is to use automation technology make construction safer, faster and cheaper,” said Ready-Campbell, standing in a dirt lot where a small bulldozer moved mounds of earth without a human operator.

The San Francisco startup is part of a wave of automation that’s transforming the construction industry, which has lagged behind other sectors in technological innovation.

Backed by venture capital, tech startups are developing robots, drones, software and other technologies to help the construction industry to boost speed, safety and productivity.

Autonomous machines are changing the nature of construction work in an industry that’s struggling to find enough skilled workers while facing a backlog of building projects.

“We need all of the robots we can get, plus all of the workers working, in order to have economic growth,” said Michael Chui, a partner at McKinsey Global Institute in San Francisco. “As machines do some of the work that people used to do, the people have to migrate and transition to other forms of work, which means lots of retraining.”

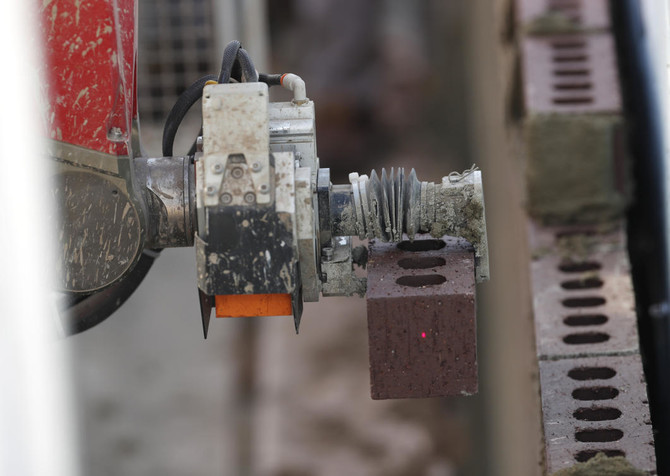

Workers at Berich Masonry in Englewood, Colorado, recently spent several weeks learning how to operate a bricklaying robot known as SAM. That’s short for Semi-Automated Mason, a $400,000 machine which is made by Victor, New York-based Construction Robotics. The machine can lay about 3,000 bricks in an eight-hour shift — several times more than a mason working by hand.

SAM’s mechanical arm picked up bricks, covered them with mortar and carefully placed them to form the outside wall of a new elementary school. Working on a scaffold, workers loaded the machine with bricks and scraped off excess mortar left behind by the robot.

The goal, said company president Todd Berich, is to use technology to take on more work and keep his existing customers happy. “Right now I have to tell them ‘no’ because we’re at capacity,” he said.

Bricklayer Michael Walsh says the robot lessens the load on his body, but he doesn’t think it will take his job. “It ain’t going to replace people,” Walsh said.

The International Union of Bricklayers and Allied Craftworkers isn’t too concerned that robots will displace its members anytime soon, according to policy director Brian Kennedy.

“There are lots of things that SAM isn’t capable of doing that you need skilled bricklayers to do,” Kennedy said. “We support anything that supports the masonry industry. We don’t stand in the way of technology.”

The rise of construction robots comes as the building industry faces a severe labor shortage.

A recent survey by the Associated General Contractors of America found that 70 percent of construction firms are having trouble finding skilled workers.

“To get qualified people to handle a loader or a haul truck or even run a plant, they’re hard to find right now,” said Mike Moy, a mining plant manager at Lehigh Hanson. “Nobody wants to get their hands dirty anymore. They want a nice, clean job in an office.”

At his company’s mining plant in Sunol, California, Moy is saving time and money by using a drone to measure the giant piles of rock and sand his company sells for construction.

The autonomous quadcopter can survey the entire 90-acre site in 25 minutes. Previously, the company hired a contractor who would take a whole day to measure the piles with a truck-mounted laser.

The drone is made by Silicon Valley-based Kespry, which converts the survey data into detailed 3-D maps and charges an annual subscription fee for its services. The startup also provides drones and mapping services to insurance companies surveying homes damaged by natural disasters.

“Not only is it safer and faster, but you get more data, as much as ten to a hundred times more data,” said Kespry CEO George Mathew. “This becomes a complete game changer for a lot of the industrial work that’s being accomplished today.”

At Built Robotics, Ready-Campbell, the company’s founder and CEO, envisions the future of construction work as a partnership between humans and smart machines.

“The robots basically do the 80 percent of the work, which is more repetitive, more dangerous, more monotonous,” he said. “And then the operator does the more skilled work, where you really need a lot of finesse and experience.”

Built Robotics recently used its automated bulldozer — retrofitted with sensors and autonomous driving technology — to grade the earth on a construction site in San Jose. The project allows the startup to both test its technology and generate some revenue.

“I’m very excited about where autonomous machines could be used in our industry,” said Kyle Trew, a contractor who worked with Built Robotics on the San Jose project. “Hopefully I can use this as a tool to get an edge on some of my competitors.”

Robots break new ground in construction industry

Robots break new ground in construction industry

Alvarez & Marsal opens regional headquarters in Riyadh

RIYADH: Underscoring international confidence in the Saudi economy, global consulting firm Alvarez & Marsal has become yet another company to have opened its regional headquarters in Riyadh.

In a press statement, the US firm stated that the inauguration of the new regional headquarters underscores its commitment to contributing to the country’s transformation agenda.

“As the company continues to deepen its roots in the country, with expertise across various sectors — from banking and tax to healthcare and disputes and investigations — this strategic move aims to leverage local insights in the Kingdom to drive sustainable growth and innovation.” the company said.

Additionally, A&M announced that it has included 13 skilled Saudi graduates in the inaugural batch of its Bidayah Graduate Program.

The company stated that these candidates were selected from a competitive pool of applicants, describing the chosen individuals as representing the bright future of the Kingdom and reflecting the potential that A&M sees in local talent.

James Dervin, managing director of A&M in the Middle East and co-head in the region, stated that the program is designed to develop the next generation of execution-focused leaders in management consulting. It is guided by the A&M principles of leadership, action, and results.

“Over the course of 12 months, participants will undergo rigorous training, engage in live project work, and receive mentorship from seasoned industry experts,” he said.

Dervin added: “Coupled with the incorporation of our regional headquarters in Saudi Arabia, the program underscores A&M’s commitment to investing in the professional development of Saudi nationals and aligning with the Kingdom’s ambitious Vision 2030,”

He further noted that the new graduates will have a significant, positive impact on his firm and the clients it serves.

Commenting on the close alignment of A&M’s global brand with the local market dynamic in Saudi Arabia, Bryan Marsal, A&M’s CEO and co-founder, said: “The all-encompassing nature of the Saudi Arabian transformation is driving significant demand for A&M’s distinctive ‘get-stuff-done’ brand of services — for our ability to fix problems, our ‘skin in the game’, and our freedom from audit conflicts.”

With over 9,000-strong workforce across six continents, A&M generates tangible results for corporations, boards, private equity firms, law firms, and government agencies grappling with intricate challenges, according to its website.

More than 180 major global companies and organizations have already established regional headquarters in the Saudi capital. These include Apple, Microsoft and Alibaba, as well as the IMF, IBM, and Google.

Other notable entities on the list include German consultancy firm TUV Rheinland, PwC Middle East, Aramex and Amazon.

UAE banks’ aggregate capital, reserves exceed $136bn

RIYADH: UAE-based banks’ aggregate capital and reserves reached 501.5 billion dirhams ($136 billion) at the end of February, up 14.4 percent year-on-year, according to new data.

The latest statistics from the Central Bank of the UAE showed that on a monthly basis, the total capital and reserves grew 0.95 percent, reflecting an increase of approximately 4.7 billion dirhams, according to the Emirates News Agency, also known as WAM.

This rise in figures falls in line with the central bank’s goal of enhancing monetary and financial stability in the country.

Moreover, the data indicated that national banks accounted for around 86.5 percent of the aggregate capital and reserves of banks operating in the UAE. At the end of February, they recorded a total of 433.7 billion dirhams, an annual rise of 14.6 percent.

On the other hand, the share of foreign banks settled at 13.5 percent, hitting 67.8 billion dirhams at the end of the same month, reflecting a 13.2 percent surge compared to the same period a year earlier.

Furthermore, at the end of February, the total capital and reserves of banks operating in Dubai alone stood at 246.4 billion dirhams, logging a year-on-year growth of 15.1 percent.

Additionally, banks operating in Abu Dhabi recorded around 217 billion dirhams, up 13 percent from the corresponding period in 2023.

Meanwhile, the cumulative capital and reserves of banks operating in other emirates combined reached an estimated 38.1 billion, reflecting a 15.5 percent climb in comparison to the same period a year prior.

In March, a top executive at Roland Berger said that UAE bank branches were witnessing the highest revenues in the region, amounting to $18.6 million per branch.

This was driven by the nation’s digital transformation, which enabled financial institutions in the Gulf Cooperation Council to reduce the number of banking branches by 328 within three years, Saumitra Sehgal, the global consulting firm’s head of financial services in the Middle East, told WAM, at the time.

Sehgal also pointed out at the time that the number of bank branches across GCC nations decreased from 4,067 at the end of 2019 to 3,739 by December 2022.

He further noted that banks in the UAE saw the highest number of outlets merge and reduce with the support of digital transformation between 2019 and 2022.

Saudi financial robo-advisory firm Abyan Capital secures $18m in funding

RIYADH: Financial robo-advisory firm Abyan Capital has secured $18 million in funding in further evidence of the growing confidence in the Kingdom’s artificial intelligence sector.

Led by STV, the funding round also saw participation from Aramco’s Wa’ed Ventures and RZM Investment.

Robo-advisors are digital platforms that utilize AI and machine learning algorithms to automate and optimize investment processes.

Founded in 2022 by Abdullah Al-Jeraiwi, Omar Al-Mania and Saleh Al-Aqeel, Abyan Capital is a financial services company that provides an automated solution and portfolio management for long-term investments.

“Abyan Capital stands out by unlocking the SR300 billion ($80 billion) investment management and wealth advisory sector for investors from all backgrounds in Saudi Arabia, through its mobile-first, robo-advisory model,” Yazeed Al-Turki, principal at STV, said in a statement.

In a short period of time, he said Abyan has enabled a large base of first-time investors to access multiple wealth management solutions, underscoring the team’s commitment to innovation and inclusivity.

“We are delighted to partner with Abdullah, Saleh and the team on their journey to redefine the wealth management ecosystem in the Kingdom,” Al-Turki added.

The company aims to utilize its newly secured funds to further enhance its platform, expand its suite of financial products, and accelerate its market penetration across the investment solution value chain.

“Today, we are proud that in a very short amount of time, Abyan has exceeded deposits of over SR1.4 billion and more than 100,000 portfolios invested. And we will be launching new diversified products soon with a goal to make Abyan the digital retail investment house,” said Al-Jeraiwi, the CEO.

Closing Bell: TASI ends the week in green at 12,352

RIYADH: Saudi Arabia’s Tadawul All Share Index ended the week by gaining 6.68 points, or 0.05 percent, to close at 12,352.33 on Thursday.

The total trading turnover of the benchmark index was SR6.55 billion ($1.74 billion) as 120 stocks advanced, while 103 retreated.

The parallel market, Nomu, also gained 95.60 points, or 0.36 percent, to close the trading session at 26,457.81. This comes as 29 stocks advanced, while as many as 27 retreated.

On the other hand, the MSCI Tadawul Index slipped by 2.37 points, or 0.15 percent, to close at 1,547.20.

The best-performing stock on the benchmark index was Al-Baha Investment and Development Co., as its share price surged by 7.69 percent.

Other top performers included Raydan Food Co. and the Company for Cooperative Insurance, whose share prices soared by 7.29 percent and 6.63 percent, to stand at SR30.90 and SR160.80 respectively.

Electrical Industries Co. and the Mediterranean and Gulf Insurance and Reinsurance Co. also fared well during the last trading session of the week.

The worst performer was Saudi Chemical Co., whose share price dropped by 5.36 percent to SR7.77.

Power and Water Utility Co. for Jubail and Yanbu as well as the National Company for Glass Industries, underperformed as their share prices dropped by 5.22 percent and 4.82 percent to stand at SR63.50 and SR42.45, respectively.

On the announcements, Bank AlJazira announced its interim financial results for the period ending March 31 with net profit amounting to SR300.4 million compared to SR279.3 million in the previous quarter.

In an official statement on Tadawul, the bank attributed the increase in the net income to a decrease in total operating expenses by 6 percent.

“The decrease in total operating expenses is mainly due a decrease in net impairment charge for financing and other financial assets, other general and administrative expenses, salaries and employee-related expenses and other operating expenses against an increase in depreciation and amortization expenses,” the statement said.

Conversely, there has been a slight decrease of 0.2 percent in total operating income, primarily attributed to a reduction in net financing and investment gains. Additionally, the rise in net income was partially tempered by increased zakat charges over the period.

GCC central banks hold interest rates steady for 6th time following Fed’s move

RIYADH: Gulf Cooperation Council central banks have held interest rates steady for the sixth time as the US Federal Reserve keeps its benchmark level between 5.25 percent and 5.50 percent.

As most currencies in the region are pegged to the US dollar, monetary policy follows the decisions taken in Washington, with policymakers opting to lock the rate at the level it has been since July.

The freeze comes as the rate-setting panel cites “a lack of further progress toward the committee’s 2 percent inflation objective.”

Vijay Valecha, chief investment officer at Century Financial, told Arab News: “This decision marks the sixth consecutive time that the central bank has chosen to keep rates unchanged. Market expectations have adjusted, now forecasting only one rate cut by year-end compared to the six anticipated at the beginning of 2024.”

He added: “The monetary policies of most central banks in the GCC countries, including the UAE, Saudi Arabia, Bahrain, Oman, and Qatar, typically mirror those of the Fed due to their currencies being pegged to the US dollar. Kuwait is the exception in the bloc, as its dinar is linked to a basket of currencies.”

Valecha continued by stating that as a result, interest rates in GCC markets are also anticipated to remain stable in the near future, which bodes well for the profitability of GCC banks.

This decision implies that the Saudi Central Bank, also known as SAMA, will maintain its repo rates at the current level of 6 percent.

The UAE central bank, along with Kuwait, Qatar, Oman, and Bahrain, also mirrored the Fed’s move.

Repo rates, which represent a form of short-term borrowing primarily involving government securities, underscore the close economic ties and financial dynamics between the GCC countries and the global economic landscape, particularly the US.

The US central bank also stated that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

This indicates that rate cuts are not on the cards anytime soon, until inflation cools down and moves sustainably toward the 2 percent target set by the US Fed.