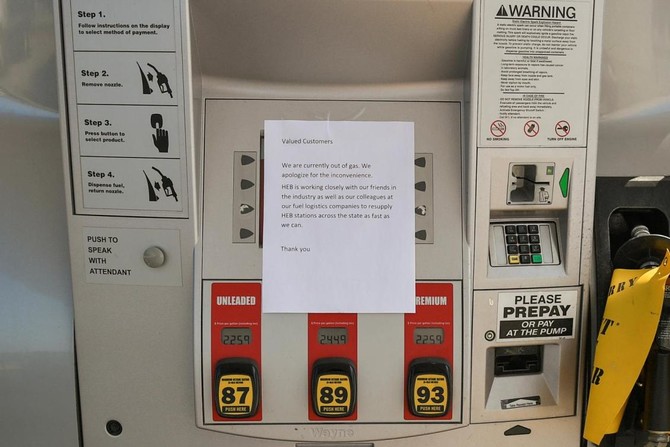

HOUSTON: A number of key Texas refineries worked to reopen or resume normal operations on Saturday, a week after Hurricane Harvey knocked out nearly one quarter of the US refining capacity and sent gasoline prices to two-year highs.

While much of the region’s refining infrastructure still remained offline from Harvey, which made landfall as a Category 4 hurricane last week and drenched Texas as a tropical storm, the restarts were a first step in alleviating concerns about US fuel supplies.

Exxon Mobil said it was restarting its 560,500 barrel per day (bpd) facility in Baytown, Texas, the second-biggest US oil refinery, after it was inundated by flooding.

Phillips 66 said it was working to resume operations at its 247,000 bpd Sweeny refinery as well as its Beaumont terminal.

The announcements come after Valero Energy said late on Friday it was ramping up production at its Corpus Christi, Texas-area refineries, as well as evaluating its 335,000 bpd Port Arthur, Texas, refinery for damage from Harvey. The refinery was shut on Wednesday.

Retail gasoline prices have risen more than 17.5 cents since August 23, before Harvey hit, amid worries the storm would trigger supply shortages.

Pump prices were at $2.59 a gallon on Saturday, according to motorists advocacy group AAA, up 3 percent from Friday and 16.7 percent higher on average than a year ago.

In another positive sign for the industry, Occidental Petroleum said it had loaded and shipped the first crude cargo from its Ingleside terminal in Corpus Christi after Hurricane Harvey first made landfall.

The Port of Corpus Christi, a major energy industry shipping hub, was partially open and hoped to resume normal operations next week, officials said.

But much energy infrastructure remained offline, including the largest US refinery, the 603,000 bpd facility in Port Arthur, Texas, owned by Motiva Enterprises. Motiva has told customers to prepare for fuel shortages, said a source at convenience store and gas station chain Circle K.

In some Texas cities, including Dallas, there were long lines at gas stations on Friday.

At a QMart filling station west of Houston on Saturday, cars were clogging the pumps soon after a tanker arrived to replenish its pumps.

“We had a half a tank, but decided to get more, just in case,” said Maria Linares, a school teacher whose husband was topping their car’s tank.

The Phillips 66 brand station has not raised its fuel prices since before Harvey, said Assistant Manager Jalal Sadruddin, by policy of the station owner, Q-Mart.

“Right now, we have about 4,000 gallons, maybe two or three days’ worth,” he said. The station received a tanker load of gasoline on Saturday but was out of diesel, he said. An Exxon brand station across the street was out of fuel.

“In all this area, no one has it but us,” Sadruddin said.

Nearly half of US refining capacity is in the Gulf Coast region, an area with proximity to plentiful supplies from Texas oil fields to Mexican and Venezuelan oil imports. The majority of Texas ports remained closed to large vessels, limiting discharge of imported crude.

Texas refineries begin restart after hit from Hurricane Harvey

Texas refineries begin restart after hit from Hurricane Harvey

Saudi Arabia leads Q1 IPO activity in MENA: EY report

RIYADH: Saudi Arabia emerged as a dominant force in initial public offering activity for the region in the first quarter of 2024, according to multinational professional services EY.

With nine IPOs launched during this period, the Kingdom, along with the UAE, contributed to a total of 10 listings, generating combined proceeds of $1.2 billion, as detailed in the MENA IPO Eye Q1 2024 report.

Saudi Arabia maintained its stronghold on the listing front with a diverse array of offerings across a range of sectors.

Modern Mills Co. led the pack with a substantial IPO amounting to $724 million, followed by MBC Group with $222 million and Middle East Pharmaceutical Industries Co. with $131 million.

These companies were predominantly listed on the Tadawul Main Market, while the remaining six took place on the parallel market Nomu, raising a collective total of $57 million.

“The region has retained a robust pipeline, with several companies in the GCC (Gulf Cooperation Council) and North Africa having announced their intentions to list,” Brad Watson, EY MENA Strategy and Transactions Leader, added.

The largest IPO in the region during the first quarter of 2024 came from the UAE’s Parkin Co. PJSC, totaling $400 million.

Oversubscribed 165 times, the listing marked the third Roads and Transport Authority asset to be floated, following Salik and the Dubai Taxi Co.

Additionally, significant upcoming listings in the UAE, including Spinneys, LuLu Group, and Etihad Airways, underscore the country’s vibrant IPO market.

The region is witnessing a growing emphasis on environmental, social, and governance alongside stock market growth.

The UAE’s introduction of mandatory ESG reporting guidelines for companies listed on the Abu Dhabi Securities Exchange reflects a commitment to transparency and sustainability.

This move aligns with broader moves, such as the Saudi Green Initiative which aims to plant 10 billion trees by 2030 and transition toward renewable energy sources, highlighting the region’s dedication to a greener future.

Gregory Hughes, EY MENA IPO Leader, emphasized the continued strength of stock market debuts activity in the region, and said: “The successful listing of Parkin Co. PJSC on the DFM demonstrated a continued commitment toward the Dubai government’s privatization program that involves listing state-owned companies as part of the nation’s economic diversification drive.”

Saudi Arabia’s $100bn tech investment shows global leadership on AI, says Microsoft executive

RIYADH: Saudi Arabia’s plan to invest $100 billion in technology is propelling the Kingdom to the forefront of innovation and talent development worldwide, said a senior Microsoft Arabia executive.

In February, the Kingdom launched Alat, a technology and artificial intelligence firm backed by the Public Investment Fund, with the aim of pouring funds into Saudi Arabia’s technological sector.

In an interview with Arab News, Turki Badhris, president of Microsoft Arabia, elaborated on how the Kingdom’s numerous giga-projects and initiatives are harnessing the transformative power of AI.

“Saudi Arabia is playing, I’m not going to say a regional, but a global role when it comes to leading in AI vision,” he said, later adding: “That illustrates the forward-thinking of the Kingdom, leadership, not only to position Saudi Arabia as a regional hub for AI, but also as a global hub for innovation and talent.”

Badhris also emphasized that the establishment of a global AI center for Arabic demonstrates the Kingdom’s commitment to promoting the regional language and fostering innovation internationally.

This aligns with Microsoft’s mission to empower individuals and organizations in Saudi Arabia, contributing to unlocking the Kingdom’s full potential in the field of AI and technology.

“The recent investment by Microsoft in cloud and AI will contribute to and catalyze the next phase of growth of the ICT market in Saudi Arabia. Our recent announcement on Feb. 23 of bringing Microsoft Cloud Data Center to Saudi will accelerate and diversify the growth of the economy of Saudi Arabia,” he told Arab News.

Underscoring Microsoft’s commitment to the Kingdom, Badhris stated that the convergence of cloud and AI technologies will have a significant impact on accelerating Saudi Arabia’s gross domestic product growth.

Furthermore, he forecasted that by 2024, there will be a notable increase in the number of businesses transitioning to cloud computing.

“That is a great step in transforming their business, and then the next step will be definitely leveraging AI and to many of their business models and workloads,” Badhris continued.

He added: “We are working closely with the Ministry of Communication and Technology to make sure that we have a smooth, accelerated landing of our data center in Saudi Arabia.”

Additionally, Badhris emphasized the significant impact that AI and cloud technologies will have on various industries. Microsoft is dedicated to unleashing the potential of these technologies across all sectors in Saudi Arabia.

The company is undergoing a transformation to become an AI-driven organization, embedding AI capabilities into its products at every level.

“We have a cloud specialized for healthcare, the same for education, logistics, sustainability, and other sectors. We also have a big ecosystem of partners who are building their IP solutions and bringing them to Microsoft Azure,” Badhris stated.

He continued: “As just a matter of fact, we just rolled out last week the support of our copilot, M365, with an additional 16 languages and one of them Arabic, and that is showing the commitment of Microsoft to localization to the Arab countries.”

Badhris emphasized that Microsoft collaborates with organizations across diverse sectors, encompassing both public and private domains, and of all sizes, spanning from startups to large enterprises.

“We are working with startups and SMEs because we believe that the majority of the economic impact is coming from startups and SMEs. For example, we collaborated lately with the Ministry of Investment, MISA, in a big initiative called Alliance to Innovate,” he said.

The executive emphasized that despite the progress made in Saudi Arabia, there is still much more potential to be unlocked, stating that “this is just the start.”

He said: “I still believe that we are scratching the surface in Saudi Arabia. Technology is evolving at a very fast pace, and definitely we really need to be up to the speed of this evolution and bring the best from around the world to Saudi Arabia.”

Saudi Arabia to boost private sector investments in manufacturing: deputy minister

RIYADH: Saudi Arabia aims to bolster private sector investment in the manufacturing industry, capitalizing on the Kingdom’s swift growth, according to a top official.

During his opening speech on the second day of the Riyadh International Industry Week 2024, Deputy Minister of Industry and Mineral Resources for Industrial Affairs Khalil bin Salamah pointed out that partnership with non-government bodies is of great importance in achieving industrial development in the Kingdom.

He affirmed that building strategic partnerships with the private sector contributes to driving economic growth in the Kingdom, and the integration and harmony of work between government and non-government entities contributes to overcoming the obstacles, according to the Saudi Press Agency.

Bin Salamah added: “We look forward to leading the private sector in increasing investment in the manufacturing sector and leveraging the rapid growth in the Kingdom.”

Private sector investments in Saudi Arabia’s industrial field more than doubled in the first quarter of 2024, surpassing SR7 billion ($1.8 billion), according to a report released by the Saudi Authority for Industrial Cities and Technology Zones, also known as MODON, in April.

The deputy minister went on to explain that the national industrial strategy was built primarily in partnership with the private sector, and there is a partnership-based business model within the industrial system.

The Kingdom is set to boost private sector investments with the desire to enhance cooperation between core and transformational companies to develop businesses and create new opportunities, the top official affirmed.

Bin Salamah stated: “We are currently working on maximizing current production capacities, where a committee has been established to integrate petrochemical supply chains, addressing challenges related to the availability and competitiveness of petrochemical materials.”

He added: “We encourage all companies in the sector to collaborate with us to address challenges and contribute to finding appropriate solutions.”

The deputy minister highlighted that the Kingdom is a leading country in the petrochemical industry, enabling it to expand supply chains to support economic growth and enhance supply chains of related industries.

He added that the Ministry of Industry and Mineral Resources is working with the Ministry of Energy and the government system to empower the sector by enhancing the integration of petrochemical supply chains in the Kingdom.

These efforts, according to Bin Salamah, aim to ensure the availability and competitiveness of petrochemical materials used to produce specialized products, enabling sector growth and enhancing supply chain integration.

He further explained that the Kingdom aims to strengthen its industrial base and diversify its economy, with attracting private sector investments being a fundamental part of its industrial strategy.

The deputy minister emphasized that the industrial system plays a pivotal role in enabling growth and development in the industrial sector in the Kingdom through enhancing integration between sectors and their supply chains, developing basic and specialized infrastructure and facilities, and encouraging investment in joint projects between companies operating in various sectors.

He pointed out that the ministry is keen on creating continuous industrial momentum in the Kingdom, noting that the Industry Week includes four major industrial exhibitions under one roof, including the Saudi Plastics & Petrochem, Saudi Print & Pack, Saudi Smart Manufacturing, and Smart Logistics Services.

Saudi Arabia records 16% surge in credit card loans in Q1 2024

RIYADH: Saudi Arabia recorded a 16 percent annual surge in credit card loans in the first quarter of 2024 to reach SR27.25 billion ($7.3 billion), the latest central bank data showed.

The Saudi Central Bank, also known as SAMA, figures indicate a shift in consumer behaviors about cashless payment options and show that the Kingdom is on track to become a cashless society.

In an April report by GlobalData, Ravi Sharma, a banking and payments analyst, emphasized the transition from cash to electronic payments, noting: “While cash has traditionally been a preferred method of payment in Saudi Arabia, its usage is on the decline in line with the rising consumer preference for electronic payments.”

GlobalData’s payment card analytics revealed that card payments value in Saudi Arabia registered a growth of 17.8 percent in 2022, followed by 9.7 percent in 2023 to reach SR511.5 billion.

Commenting on the payments trend in Saudi Arabia, Sharma said: “The country has a robust digital payment infrastructure, supported by a developing card market and a well-established card acceptance infrastructure. The government is taking steps to enhance the infrastructure in the country by encouraging merchants to adopt at least one electronic payment option apart from cash.”

The increase in credit card loans can also be attributed to recent collaborations to introduce new credit card offerings and payment solutions across the Kingdom.

One such collaboration involves Mastercard partnering with a digital payments technology company Loop to issue Bank Identification Numbers for credit cards. A BIN is used to determine the issuing financial institution that a credit card belongs to. They also help in the speedier execution of financial transactions and offer a shield to cardholders from identity theft and fraud.

These innovative payment solutions are expected to facilitate seamless and secure digital payments for consumers, merchants, and fintechs, thereby driving digitization in daily transactions.

This move comes at a time when the Kingdom’s small and medium enterprises and fintech community are thriving, presenting a favorable environment for digital payment solutions.

On the contrary, SAMA data revealed a slight 1 percent uptick in consumer loans, totaling approximately SR451 billion in the three months ending March. Within this category, education loans surged by 24 percent to SR8 billion, while travel and tourism loans saw a 19 percent increase to SR990 million.

Consumer loans typically involve borrowing a specific amount of money, to be repaid over a fixed period with interest. One advantage of consumer loans is that they often come with lower interest rates compared to credit card loans, making them a cost-effective option for large purchases or long-term financing needs. Additionally, consumer loans provide borrowers with a structured repayment plan, allowing them to budget and manage their debt more effectively.

On the other hand, credit card loans do not have a fixed repayment period, and borrowers can repay the borrowed amount over time, as long as they make at least the minimum monthly payments. One of the key advantages is the convenience and flexibility they offer, allowing individuals to make purchases and manage expenses without the need to carry large amounts of cash.

Additionally, they come with rewards programs, cashback incentives, and other perks that can provide additional benefits to cardholders.

Oil Updates – prices rise on US crude storage draw, China imports show year-on-year gain

SINGAPORE: Oil prices rose on Thursday as falling US crude inventories amid rising refinery intake and a year-on-year increase in Chinese imports last month supported higher demand expectations for the world’s two largest crude consuming nations, according to Reuters.

Brent crude futures for July rose 27 cents, or 0.3 percent, to $83.85 a barrel by 9:50 a.m. Saudi time. US West Texas Intermediate crude for June was up 34 cents, or 0.4 percent to $79.33 per barrel.

“Oil markets were buoyed by a larger-than-expected draw in the US inventory data. The improved China’s trade balance data added to the upside momentum,” said Tina Teng, an independent market analyst, adding that crude prices may continue to track economic factors looking ahead.

Crude inventories in the US, the world’s biggest oil user, dropped last week by 1.4 million barrels to 459.5 million barrels, according to the Energy Information Administration, more than analysts’ expectations for a 1.1 million-barrel draw. Stockpiles fell as refinery activity increased by 307,000 barrels per day in the period.

This caused gasoline stocks to swell by more than 900,000 barrels to 228 million barrels, while distillate stockpiles including diesel and heating oil rose by 600,000 barrels to 116.4 million barrels.

“The market shrugged off the builds in gasoline and distillate fuels as refiners ramp up for the upcoming driving season,” analysts at ANZ Research said in a note on Thursday.

Shipments of crude in April to China, the world’s biggest oil importer, were 44.72 million metric tons, or about 10.88 million bpd, according to China’s customs data released on Thursday. That was up 5.45 percent from the relatively low 10.4 million bpd imported in April 2023.

Hopes for a ceasefire in the Israel-Hamas conflict Gaza kept oil prices from moving higher. The US said earlier in the week that negotiations should be able to close the gaps between Israel and Hamas.

“While there may be some short-term relief for oil prices, it may be difficult to return to April’s high above the $90 per barrel level, where geopolitical tensions were at its peak,” said Yeap Jun Rong, market strategist at IG.