LONDON: Asset managers are tightening controls on personal communication tools such as WhatsApp as they join banks in trying to ensure employees play by the rules when they do business with clients remotely.

Regulators had already begun to clamp down on the use of unauthorized messaging tools to discuss potentially market-moving matters, but the issue gathered urgency when the pandemic forced more finance staff to work from home in 2020.

Most of the companies caught in communications and record-keeping probes by the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have been banks — which have collectively been fined or have set aside more than $1 billion to cover regulatory penalties.

But fund firms with billions of dollars in assets are also increasing their scrutiny of how staff and clients interact.

“It is the hottest topic in the industry right now,” said one deals banker, who declined to be named in keeping with his employer’s rules on speaking to the media.

Reuters reported last year the SEC was looking into whether Wall Street banks had adequately documented employees’ work-related communications, and JPMorgan was fined $200 million in December for “widespread” failures.

German asset manager DWS said last month it had set aside 12 million euros ($12 million) to cover potential US fines linked to investigations into its employees’ use of unapproved devices and record-keeping requirements, joining a host of banks making similar provisions, including Bank of America, Morgan Stanley and Credit Suisse.

Sources at several other investment firms — described in the financial community as the ‘buy-side’ — including Amundi, AXA Investment Management, BNP Paribas Asset Management and JPMorgan Asset Management, told Reuters they have deployed tools to keep all communications between staff and clients compliant.

Spokespeople for the SEC and CFTC declined to comment on whether their investigations could extend beyond the banks, but industry sources expect authorities to cast their nets wider across the finance industry and even into government.

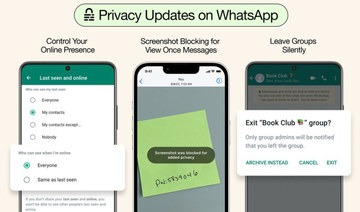

Last month Britain’s Information Commissioner’s Office (ICO), the country’s top data protection watchdog, called for a review of the use of WhatsApp, private emails and other messaging apps by government officials after an investigation found “inadequate data security” during the pandemic.

Regulations governing financial institutions have progressively been tightened since the global financial crisis of 2007-9 and companies have long recorded staff communications to and from office phones.

This practice is designed to deter and uncover infringements such as insider trading and “front-running,” or trading on information that is not yet public, as well as ensuring best practice in terms of treatment of customers.

But with thousands of finance workers and their clientele still working remotely after decamping from company offices at the start of the pandemic, some sensitive conversations that should be recorded remain at risk of being inadvertently held over informal or unauthorized channels.

Brad Levy, CEO of business messaging software firm Symphony, said concerns on managing that risk had driven a surge in interest for software upgrades that make conversations on popular messenging tools including Meta Platforms’ WhatsApp recordable.

“Most believe the breadth of these investigations will go wider as they go deeper,” Levy said.

“Many markets participants have retention and surveillance requirements so are likely to take a view, including being more proactive without being a direct target.”

He said Symphony’s user base has more than doubled since the pandemic to 600,000, spanning 1,000 financial institutions including JPMorgan and Goldman Sachs.

Symphony peer Movius also said its business lines specializing in making WhatsApp and other tools recordable have more than doubled in size in the space of a year, with sales to asset managers a growing component.

“Many on the buy-side have recognized that you can’t just rely on SMS and voice calls,” said Movius Chief Executive Ananth Siva, adding that the company was also seeking to work with other highly-regulated industries including health care.

Movius software integrates third-party communications tools such as email, Zoom, Microsoft Teams and WhatsApp into one system that can be recorded and archived as required, he said.

Amundi, AXA IM, BNPP AM and JPMorgan Asset Management all confirmed they had adopted Symphony software but declined to comment on the full breadth of services they used or when these had been rolled out.

Amundi and AXA IM both confirmed they used Symphony services for team communications, while AXA IM also said they used it for market information.

Amundi, BNPP AM and JP Morgan AM declined to comment on whether they thought regulators would seek to investigate record keeping at asset managers after enforcement actions against the banks were completed.

A spokesperson for BNPP AM said it had banned the use of WhatsApp for client communications due to compliance, legal and risk considerations including General Data Protection Regulation (GDPR).

Asset managers on alert after ‘WhatsApp’ crackdown on banks

https://arab.news/jn646

Asset managers on alert after ‘WhatsApp’ crackdown on banks

- Demand for software to record, archive messaging on the rise

- Continued remote working underscores risk of compliance missteps with banks paying hundreds of millions of dollars in regulatory fines

Eastern European mercenaries suspected of attacking Iranian journalist Pouria Zeraati

- UK security services believe criminal proxies with links to Tehran carried out London knife attack

LONDON: Police said on Friday that a group of Eastern European mercenaries is suspected to have carried out the knife attack on Iranian journalist Pouria Zeraati in late March.

Zeraati was stabbed repeatedly by three men in an attack outside his south London home.

The Iran International presenter lost a significant amount of blood and was hospitalized for several days. He has since returned to work, but is now living in a secure location.

Iran International and its staff have faced repeated threats, believed to be linked to the Iranian regime, which designated the broadcaster as a terrorist organization for its coverage of the 2022 protests.

Iran’s charge d’affaires, Seyed Mehdi Hosseini Matin, denied any government involvement in the attack on Zeraati.

Investigators revealed that the suspects fled the UK immediately after the incident, with reports suggesting they traveled to Heathrow Airport before boarding commercial flights to different destinations.

Police are pursuing leads in Albania as part of their investigation.

Counterterrorism units and Britain’s security services leading the inquiry believe that the attack is another instance of the Iranian regime employing criminal proxies to target its critics on foreign soil.

This method allows Tehran to maintain plausible deniability and avoids raising suspicions when suspects enter the country.

Zeraati was attacked on March 29 as he left his home home to travel to work. His weekly show serves as a source of impartial and uncensored news for many Iranians at home and abroad.

In an interview with BBC Radio 4’s “Today” program this week, Zeraati said that while he is physically “much better,” mental recovery from the assault “will take time.”

Court orders release of prominent Palestinian professor suspected of incitement

- Nadera Shalhoub-Kevorkian was under investigation after questioning Hamas atrocities, criticizing Israel

- Insufficient justification for arrest, says court

- Detention part of a broader campaign, says lawyer

LONDON: The prominent Hebrew University of Jerusalem professor, Nadera Shalhoub-Kevorkian, was released on Friday after a court order rejected police findings.

The criminologist and law professor was arrested the previous day on suspicion of incitement. She had been under investigation for remarks regarding the Oct. 7 attacks by Hamas and for saying Israelis were committing “genocidal crimes” in the Gaza Strip and should fear the consequences.

On Friday, the court dismissed a police request to extend her remand, citing insufficient justification for the arrest, according to Hebrew media reports.

Protesters gathered outside the courthouse to demonstrate against Shalhoub-Kevorkian’s arrest.

Israeli Channel 12, which first reported the news, did not specify where Shalhoub was arrested but her lawyer later confirmed she was apprehended at her home in the Armenian Quarter of Jerusalem.

“She’s not been in good health recently and was arrested in her home,” Alaa Mahajna said. “Police searched the house and seized her computer and cellphone, [Palestinian] poetry books and work-related papers.”

Mahajna described Shalhoub-Kevorkian’s arrest as part of a broader campaign against her, which has included numerous threats to her life and of violence.

The professor was suspended by her university last month after calling for the abolition of Zionism and suggesting that accounts of sexual assault during the Hamas-led attacks on Israel were fabricated.

The suspension was initially criticized by the university community as a blow to academic freedom in Israel. However, the decision was later reversed following an apology from Shalhoub-Kevorkian and an admission that sexual assaults took place.

Since hostilities began last year, numerous dissenting voices in Israel have faced arrest for expressing solidarity with victims of the bombardment in Gaza.

In October, well-known ultra-Orthodox Israeli journalist Israel Frey was forced into hiding following a violent attack on his home.

Bayan Khateeb, a student at the Technion-Israel Institute of Technology, was arrested last year for incitement after posting an Instagram story showing the preparation of a popular spicy egg dish with the caption: “We will soon be eating the victory shakshuka.”

Sony, Apollo discuss joint bid for Paramount, says source

- Paramount is already in an exclusive deal with Skydance Media over possible merger

LONDON: Sony Pictures Entertainment and Apollo Global Management are discussing making a joint bid for Paramount Global, according to a person familiar with the matter.

The companies have yet to approach Paramount, which is in exclusive deal talks with Skydance Media, an independent studio led by David Ellison, though some investors have urged Paramount to explore other options.

The competing bid, which is still being structured, would offer cash for all outstanding Paramount shares and take the company private, the source said.

Sony would hold a majority stake in the joint venture and operate the media company, and its library of films, including such classics as “Star Trek,” “Mission:Impossible” and “Indiana Jones,” and television characters like SpongeBob SquarePants, according to the source.

Sony Pictures Entertainment Chairman Tony Vinciquerra, a veteran media executive with deep experience in film and television, would likely run the studio and take advantage of Sony’s marketing and distribution.

Apollo would likely assume control of the CBS broadcast network and its local television stations, because of restrictions on foreign ownership of broadcast stations, the source said. Sony’s parent corporation is headquartered in Tokyo.

The New York Times first reported the Sony-Apollo discussions. Paramount and Sony declined comment. Apollo could not be reached for comment.

The private equity firm previously made a $26 billion offer to buy Paramount Global, whose enterprise value at the end of 2023 was about $22.5 billion.

A special committee of Paramount’s board elected to continue with its advanced deal talks with Skydance, rather than chase a deal “that might not actually come to fruition,” said two people with knowledge of the board’s action.

The board committee is evaluating the possible acquisition of the smaller independent studio in a stock deal worth $4 billion to $5 billion.

Skydance is negotiating separately to acquire National Amusements, a company that holds the Redstone family’s controlling interest in Paramount, according to a person familiar with the deal terms. That transaction is contingent upon a Skydance-Paramount merger.

Meta releases beefed-up AI models, eyes integration into its apps

- AI model Llama 3 takes step towards human-level intelligence, Meta claims

- Company also announced new AI Assistant integration into its major social media apps

SAN FRANCISCO: Meta on Thursday introduced an improved AI assistant built on new versions of its open-source Llama large language model.

Meta AI is smarter and faster due to advances in the publicly available Llama 3, the tech titan said in a blog post.

“The bottom line is we believe Meta AI is now the most intelligent AI assistant that you can freely use,” Meta co-founder and chief executive Mark Zuckerberg said in a video on Instagram.

Being open source means that developers outside of Meta are free to customize Llama 3 as they wish and the company may then incorporate those improvements and insights in an updated version.

“We’re excited about the potential that generative AI technology can have for people who use Meta products and for the broader ecosystem,” Meta said.

“We also want to make sure we’re developing and releasing this technology in a way that anticipates and works to reduce risk.”

That effort includes incorporating protections in the way Meta designs and releases Llama models and being cautious when it adds generative AI features to Facebook, Instagram, WhatsApp, and Messenger, according to Meta.

“We’re also making Meta AI much easier to use across our apps. We built it into the search box right at the top of WhatsApp, Facebook, and Instagram messenger, so any time you have a question, you can just ask it right there,” said Zuckerberg in the video.

AI models, Meta’s included, have been known to occasionally go off the rails, giving inaccurate or bizarre responses in episodes referred to as “hallucinations.”

Examples shared on social media included Meta AI claiming to have a child in the New York City school system during an online forum conversation.

Meta AI has been consistently updated and improved since its initial release last year, according to the company.

“Meta’s slower approach to building its AI has put the company behind in terms of consumer awareness and usage, but it still has time to catch up,” said Sonata Insights chief analyst Debra Aho Williamson.

“Its social media apps represent a massive user base that it can use to test AI experiences.”

By weaving AI into its family of apps, Meta will quickly get features powered by the technology to billions of people and benefit from seeing what users do with it.

Meta cited the example of refining the way its AI answers prompts regarding political or social issues to summarize relevant points about the topic instead of offering a single point of view.

Llama 3 has been tuned to better discern whether prompts are innocuous or out-of-bounds, according to Meta.

“Large language models tend to overgeneralize, and we don’t intend for it to refuse to answer prompts like ‘How do I kill a computer program?’ even though we don’t want it to respond to prompts like ‘How do I kill my neighbor?’,” Meta explained.

Meta said it lets users know when they are interacting with AI on its platform and puts visible markers on photorealistic images that were in fact generated by AI.

Beginning in May, Meta will start labeling video, audio, and images “Made with AI” when it detects or is told content is generated by the technology.

Llama 3, for now, is based in English but in the coming months Meta will release more capable models able to converse in multiple languages, the company said.

Authors withdraw from PEN America Literary Awards in protest against stance on Gaza

- 30 writers sign open letter criticizing organization for its ‘failure to confront the genocide of the Palestinian people and defend our fellow writers in Gaza’

- They call on its CEO, Suzanne Nossel, its president, Jennifer Finney Boylan, and the entire executive committee to resign

DUBAI: Thirty authors and translators have signed an open letter to PEN America in which they declined, or withdrew their work from consideration for, the organization’s 2024 Literary Awards, in protest against its “failure to confront the genocide of the Palestinian people and defend our fellow writers in Gaza.”

In the letter, sent to the board of trustees this week, the writers said they “wholeheartedly reject PEN America and its failure to confront the genocide in Gaza” and demanded the resignations of the organization’s CEO, Suzanne Nossel, its president, Jennifer Finney Boylan, and its entire executive committee.

The signatories include the co-founder of the PEN World Voices Festival, Esther Allen, as well as Joseph Earl Thomas, Kelly X. Hui, Nick Mandernach, Alejandro Varela, Maya Binyam and Julia Sanches.

Allen this month said she had declined the PEN/Ralph Manheim Award for Translation. She posted a message on social media platform X on April 5 in which she said she had done so in solidarity with more than 1,300 writers who had criticized PEN America for its silence “on the genocidal murder of Palestinians,” and “in celebration and memory of, and in mourning for, all the Palestinians silenced forever by US-backed Israeli forces.”

Similarly, Binyam recently withdrew her debut novel “Hangman” from consideration for the PEN/Jean Stein and PEN/Hemingway awards.

In an email to PEN America, a copy of which she posted on X on April 11, she said she considered it “shameful that this recognition (of her work) should exist under the banner of PEN America, whose leadership has been steadfast in its dismissal of the ongoing genocide, and of the historic struggle for Palestinian liberation.”

In their open letter this week, the signatories said: “Writers have a responsibility to be good stewards of history in order to be good stewards of our communities.”

They added that they “stand in solidarity with a free Palestine,” and refuse “to be honored by an organization that acts as a cultural front for American imperialism” or “take part in celebrations that will serve to overshadow PEN’s complicity in normalizing genocide.”

In response, PEN America said: “Words matter and this letter deserves close scrutiny for its alarming language and characterizations.

“The current war in Gaza is horrific. But we cannot agree that the answer to its wrenching dilemmas and consequences lies in a shutting down of conversation and the closing down of viewpoints.

“We respect all writers for acting out of their consciences and will continue in our mission to defend their freedom to express themselves.”

The awards are due to be handed out during a ceremony on April 29 in Manhattan.