THULASENDRAPURAM, India: A tiny, lush-green Indian village surrounded by rice paddy fields was beaming with joy Wednesday hours before its descendant, Kamala Harris, takes her oath of office and becomes the US vice president.

Harris is set to make history as the first woman, first woman of color and first person of South Asian descent to hold the vice presidency.

In her maternal grandfather’s hometown of Thulasendrapuram, about 350 kilometers (215 miles) from the southern coastal city of Chennai, people were jubilant and gearing up for celebrations.

“We are feeling very proud that an Indian is being elected as the vice president of America,” said Anukampa Madhavasimhan, a teacher.

Harris’ grandfather moved to Chennai, the capital of Tamil Nadu state, decades ago. Harris’ late mother was also born in India, before moving to the US to study at the University of California. She married a Jamaican man, and they named their daughter Kamala, a Sanskrit word for “lotus flower.”

Ahead of the inauguration, special prayers for her success were held at the town temple during which the idol of Hindu deity Ayyanar, a form of Lord Shiva, was washed with milk and decked with flowers by the priest.

Ahead of the US elections in November, villagers in Thulasendrapuram also pulled together a ceremony at the temple to wish Harris good luck. After her win, they set off firecrackers and distributed sweets and flowers as a religious offering.

Posters of Harris from the November celebrations still adorn walls in the village and many hope she ascends to the presidency in 2024. President-elect Joe Biden has skirted questions about whether he will seek reelection or retire.

“For the next four years, if she supports India, she will be the president,” said G Manikandan, who has followed Harris politically and whose shop proudly displays a wall calendar with pictures of Biden and Harris.

On Tuesday, an organization that promotes vegetarianism sent food packets for the village children as gifts to celebrate Harris’ success.

Indian village cheers for incoming US vice president Kamala Harris

https://arab.news/7mnqp

Indian village cheers for incoming US vice president Kamala Harris

- First woman, first woman of color and first person of South Asian descent to hold the vice presidency

- People from her maternal grandfather’s hometown jubilant and gearing up for celebrations

IMF surcharges on borrowings exacerbate global inequities: report

BENGALURU: Countries, mostly middle and lower-income, have been burdened by surcharges on top of interest payments on their borrowings from the International Monetary Fund, widening global inequities, according to a report by US think tanks.

WHY IT’S IMPORTANT

Indebted member countries paid about $6.4 billion in surcharges between 2020-2023, the report from Boston University’s Global Development Policy Center and Columbia University’s Initiative for Policy Dialogue released on Tuesday showed.

And the number of countries paying these surcharges has more than doubled in the last four years.

The IMF is expected to charge an estimated $9.8 billion in surcharges in the next five years, according to an earlier report by the Center for Economic and Policy Research.

Critics of the policy argue that surcharges do not hasten repayment and instead punish countries already struggling with liquidity constraints, increase the risk of debt distress and divert scarce resources that could be used to boost the struggling economies.

BY THE NUMBERS

Countries such as Ukraine, Egypt, Argentina, Barbados and Pakistan pay the most in surcharges, the report showed, accounting for 90 percent of the IMF’s surcharge revenues.

These surcharges, levied on top of the fund’s increasingly steeper basic rate, are IMF’s single largest source of revenue, accounting for 50 percent of total revenue in 2023.

KEY QUOTES

“IMF surcharges are inherently pro-cyclical as they increase debt service payments when a borrowing country is most need of emergency financing," Global Development Policy Center’s Director Kevin Gallagher said.

“Increasing surcharges and global shocks are compounding the economic pressure on vulnerable countries.”

CONTEXT

Data published by the Institute of International Finance earlier this year showed global debt levels hit a record of $313 trillion in 2023, while the debt-to-GDP ratio — a reading indicating a country’s ability to pay back debts — across emerging economies also scaled fresh peaks.

IMF shareholders agreed last week on the importance of addressing challenges faced by low-income countries, Managing Director Kristalina Georgieva said on Friday.

China’s wealth fund joins with Bahrain’s Investcorp for $1bn Middle East investment

RIYADH: China’s growing interest in the Middle East continues as the country’s sovereign wealth fund partnered with Bahrain’s Investcorp to establish a $1 billion investment pot.

According to a press statement, Investcorp Golden Horizon fund will assist companies across Saudi Arabia, the wider Gulf Cooperation Council region and China.

The reserve will be anchored by reputable institutional and private investors from the GCC, as well as China Investment Corp.

The press statement revealed that target companies are expected to have high growth potential in sectors including consumer, health care, logistics and business services.

“During the past couple of years, we have built several bilateral funds with leading financial institutions to facilitate industrial cooperation between China and major economies in the world,” said Bin Qi, executive vice president and chief information officer at CIC.

He added: “Currently, we are working closely with Investcorp to build a similar bilateral fund to strengthen financial and industrial ties between China and GCC countries.”

This commitment from CIC comes when the GCC’s appeal to institutional investors is gathering pace, thanks to its stable regulatory environment and pro-business policies, driven by economic diversification efforts in the region and strategic privatization mandates.

“This commitment by CIC, one of the world’s largest sovereign wealth funds, is a testament to Investcorp’s unparalleled franchise in the GCC and reinforces the trust placed in the firm’s global platform and teams. We are looking forward to building on this relationship and growing our partnership in the future,” said Mohammed Al-Ardhi, executive chairman of Investcorp.

Co-CEO of Investcorp Hazem Ben-Gacem said the launch of the new fund will facilitate cross-border cooperation and investments between the GCC and China.

Trade and economic relationships between the Middle East and China have always been strong.

In 2023, China’s exports to Saudi Arabia and the UAE amounted to $42.86 billion and $55.68 billion respectively.

On the other hand, the Asian giant’s imports from Saudi Arabia totaled $64.36 billion in 2023.

In November, Saudi Arabia’s central bank, also known as SAMA, and the People’s Bank of China signed a local currency swap agreement worth $6.93 billion.

SAMA, in a statement, said that the three-year agreement “has been established in the context of financial cooperation between the Saudi Central Bank and the People’s Bank of China.”

The Asian country’s central bank said that the agreement will help strengthen financial cooperation between Saudi Arabia and China, promote the use of local currencies, and strengthen trade and investments between nations.

Moroccan director Asmae El-Moudir joins Cannes’ Un Certain Regard jury

DUBAI: The Cannes Film Festival announced on Thursday that Moroccan director, screenwriter and producer Asmae El-Moudir will be part of the Un Certain Regard jury at the 77th edition of the event, set to take place from May 14-25.

She will be joined by French Senegalese screenwriter and director Maïmouna Doucouré, German Luxembourg actress Vicky Krieps and American film critic, director, and writer Todd McCarthy.

Xavier Dolan will be the president of the Un Certain Regard jury.

The team will oversee the awarding of prizes for the Un Certain Regard section, which highlights art and discovery films by emerging auteurs, from a selection of 18 works, including eight debut films.

El-Moudir is the director of the critically acclaimed film “The Mother of All Lies.”

The movie took the honors in the Un Certain Regard section, as well as winning the prestigious L’oeil d’Or prize for best documentary at the festival in 2023. The film explores El-Moudir’s personal journey, unraveling the mysteries of her family’s history against the backdrop of the 1981 bread riots in Casablanca.

El-Moudir is not the only Arab joining the Cannes team.

Moroccan Belgian actress Lubna Azabal this week was appointed the president of the Short Film and La Cinef Jury of the festival. The La Cinef prizes are the festival’s selection dedicated to film schools.

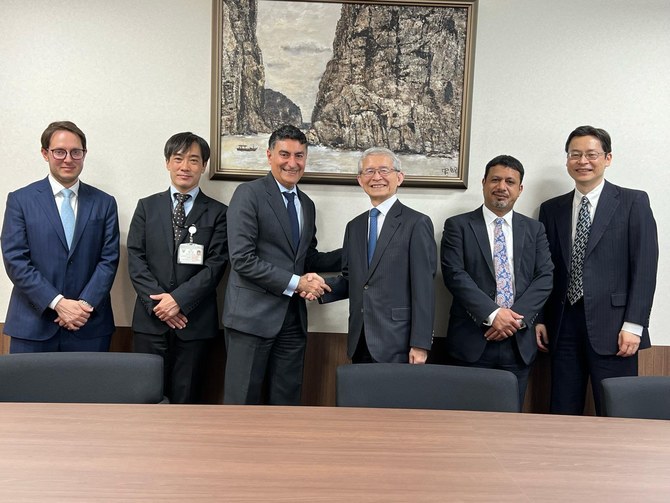

Saudi Arabia, Japan officials discuss investment ties

DUBAI: Saudi Arabia’s Ambassador to Japan Dr. Ghazi Binzagr met with Nobuyori Kodaira, chairman of the Japan Cooperation Center for the Middle East, on Thursday in Tokyo to discuss improving mutual investments.

The two officials highlighted the role that the JCCME plays in supporting Japan’s investments in Saudi Arabia, in sectors including healthcare, industry and entertainment.

The JCCME set up its regional headquarters in Riyadh in the 1990s. It now has an office in Dammam with an investment desk, while a water desk has been opened in Jeddah.

In 2018, the JCCME set up an investment-promotion scheme to fulfil the aims of the Saudi-Japan Vision 2030, within the framework of the Saudi Vision 2030 plan.

Pakistani PM seeks business community’s support to double exports in five years

- Pakistan’s total exports during the current fiscal year, or July-March, stood at $22.93

- Pakistan wants to double exports through focus on textiles, agriculture, mining and IT

KARACHI: Prime Minister Shehbaz Sharif on Wednesday sought support from Pakistan’s business community to double export volume during the next five years of his government’s term.

Addressing business leaders in a ceremony held in the southern port city of Karachi, Sharif said the government, in consultation with the business community, would form a comprehensive policy framework to ensure export-led growth and resolve Pakistan’s foreign exchange reserve crisis.

Pakistan’s total exports during the current fiscal year, or July-March, stood at $22.93, which it wants to double through a focus on sectors like textiles, agriculture, mines and minerals and information technology.

“You are actually the backbone of the national economy as without your support, the government cannot bring the country out of economic crisis,” the prime minister told the business community, urging it to sit with his government to resolve issues and challenges.

“We should get together in the larger national interest. The brilliant minds should together find ways to overcome the challenges and problems hindering the country’s development and prosperity.”

Sharif’s meeting with the business leaders came as Pakistan is seeking a new long-term and larger IMF loan, with finance minister Muhammad Aurangzeb saying Islamabad could secure a staff-level agreement on the fresh program by early July.

The global lending agency has confirmed its executive board meeting for April 29 to discuss the approval of $1.1 billion funding for the South Asian state, the second and last tranche of a $3 billion standby arrangement with the IMF, which it secured last summer to avert a sovereign default and which runs out this month.