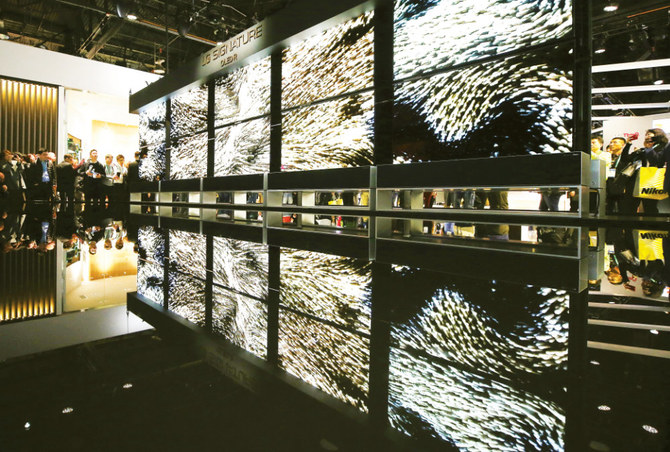

SEOUL: South Korea’s LG Display reported a profit for July-September, ending a six-quarter run of loss, helped by shipments for Apple Inc’s new iPhone and stay-at-home trends boosting panel demand for TVs and laptops.

LG Display expects rising panel shipments and sales in the current quarter as well and suggested it has pushed back plans to phase out all of its domestic liquid crystal display (LCD) TV panel production by year end to respond to TV demand.

It also painted a positive outlook for its sales to Apple, which would offset the suspension of sales to China’s Huawei as a result of US sanctions.

LG Display posted a third-quarter operating profit of 164 billion won ($145 million) versus a loss of 437 billion won a year earlier.

That topped the 64 billion won expected by 17 analysts, Refinitiv SmartEstimate data showed. Revenue rose 16 percent to 6.7 trillion won, LG Display said in a regulatory filing.

FASTFACT

$145 MILLION

LG Display posted a third-quarter operating profit of 164 billion won ($145 million) versus a loss of 437 billion won a year earlier.

LG Display, which supplies mobile OLED panels for Apple’s iPhone 12, said an expanded supply of mobile OLED panels to an identified strategic customer in North America, helped lift its earnings and it is using its full production capacity to respond to demand from the customer.

It said it will be able to resume business with Huawei after the company along with other suppliers gain US export licences.

“Strategically speaking, it’s a very important client for the company, but when it comes to the volume itself, we are not at the stage of providing mass volume, so when it comes to the impact on business itself, it’s more than manageable.” Chief Financial Officer Suh Dong-hee said during an earnings briefing.

LG Display, which said in January it would halt domestic production of LCD TV panels by year end, said there is no change to its plan to revamp its LCD business structure, but suggested that it would keep some of capacity for the time being to respond to solid demand for TVs.

It said the start of its China OLED TV display fab contributed to its earnings rise, and expected annual sales to reach around 4.5 million units this year, although this would fall short of its earlier target of 6 million, as the pandemic hit demand for high-end TVs earlier in the year.