HONG KONG: Haier, the world’s biggest maker of household appliances, is planning a major restructuring that will see its main unit Haier Smart Home list in Hong Kong to take another group company valued at $7.7bn private, two people with direct knowledge of the matter said.

Under the deal, Haier Smart Home, formerly known as Qingdao Haier and already listed in Shanghai, would offer minority shareholders in unit Haier Electronics Group newly issued Hong Kong stock for their shares, they said.

Financial advisers have been hired to work on the deal, which would give Haier Smart Home access to cash at Haier Electronics, the sources said, declining to be identified as negotiations were private.

Haier Electronics, which makes and sells appliances such as washing machines, held about 20bn yuan ($2.8bn) in cash and short term investments as of end-June, according to Refinitiv.

One of the sources added the plan was also part of the Haier group’s efforts to streamline its overseas operations.

Haier Smart Home currently owns 45% of Haier Electronics and unlisted parent Haier Group Corp. holds 12%, while minority shareholders include Vanguard Group, Norges Bank Investment Management and BlackRock, according to Refinitiv data.

The plan is still preliminary and would be subject to regulatory approval, the sources said, adding that the aim was to complete the deal in the second half of next year.

A representative from Haier Smart Home’s investors relations office said the team was not aware of the plan. Haier Group and Haier Electronics did not respond to requests for comment.

The Haier group was founded in 1984 by Chinese businessman Zhang Ruimin who built up a small loss-making factory into a major consumer brand. Major acquisitions have included New Zealand appliances brand Fisher & Paykel in 2012 for NZ$927 million and the $5.6bn purchase of General Electrics’ appliances business in 2016.

Haier Smart Home, which has a market value of some $15.4bn, also listed in Germany last year — the first listing of a Chinese company under the D-share program aimed at increasing foreign investment in Chinese firms.

Hong Kong-listed companies have announced a record 24 take-private deals this year, often citing uncertain market conditions or undervalued shares as reasons for the deals.

Haier Smart Home plans Hong Kong listing to take $7.7bn unit private

https://arab.news/zfhhy

Haier Smart Home plans Hong Kong listing to take $7.7bn unit private

- Haier Smart Home would offer minority shareholders in unit Haier Electronics Group newly issued Hong Kong stock for their shares

- Haier Electronics makes and sells appliances such as washing machines

Saudi chair of IMFC acknowledges impact of global crises, says they should be discussed in other forums

- Thanks expressed to outgoing chair Nadia Calvino for her leadership

RIYADH: The International Monetary and Financial Committee on Friday held its biannual meeting in Washington DC to discuss the global macroeconomic and financial impact of current conflicts.

The IMFC members focused on the war in Ukraine, the humanitarian crisis in Gaza, and shipping disruptions in the Red Sea, said Mohammed Al-Jadaan, the Saudi minister of finance and the body’s chair.

Al-Jadaan said IMFC members acknowledged that the crises had significant impacts on the global economy, but added that the body was not the forum to resolve geopolitical and security issues, and that they should be discussed in other forums.

He said: “The IMFC’s role is to advise and report on the supervision and management of the international monetary and financial system. This includes responses to events that may disrupt the system.

“Of course, the world and the IMF (International Monetary Fund) itself have faced multiple global disruptions over the last few years. Prospects are improving, which is very positive, but numerous challenges remain, and we need to be vigilant and ready to address them. Today’s era must not be of war and conflict.”

The Saudi minister chairs the IMFC, the policy advisory body to the IMF’s board of governors, and was speaking during the committee’s gathering at the Spring Meetings of the IMF and World Bank.

The IMFC thanked outgoing chair Nadia Calvino for her leadership and welcomed Al-Jadaan as her replacement.

Al-Jadaan said: “A soft landing for the global economy appears to be drawing closer.

“Economic activity has proved more resilient than expected in many parts of the world, though it continues to diverge across countries.”

But as ongoing conflicts continue to burden the global economy, this has led to some weak growth prospects in the medium term.

Al-Jadaan said: “Even though inflation has fallen in most regions, owing to the unwinding of supply shocks and the effects of tight monetary policy, its persistence warrants caution.

“While risks to the outlook are now broadly balanced, downside risks remain, hinging on the near-term paths for inflation and interest rates, asset prices and financial stability, fiscal policy actions, as well as geopolitical developments.”

Other pressing challenges were also affecting the global economy, such as climate change, elevated debt vulnerabilities, rising inequality, and the risk of geoeconomic fragmentation, he added.

The Saudi minister said: “Against this background, our policy priorities are to achieve price stability, strengthen fiscal sustainability, and safeguard financial stability, while promoting inclusive and sustainable growth.

“We will proceed with rebuilding fiscal buffers, carefully tailoring actions to country-specific circumstances, while protecting the most vulnerable and growth-enhancing investment.”

Al-Jadaan said central banks remained strongly committed to achieving price stability and would continue to communicate policy objectives to help limit negative spillovers.

He added: “We continue working to address data, supervisory, and regulatory gaps in the financial sector, especially nonbank financial institutions, where relevant, and stand ready to deploy macroprudential policy tools to mitigate systemic risks.”

He said the IMF stresses the importance of international cooperation to improve the resilience of the global economy and the international monetary system, adding that members will “act collectively, as appropriate, to support climate and digital transitions, including artificial intelligence, while accounting for country-specific circumstances.”

During the meeting, which was held in the presence of the IMF’s Managing Director Kristalina Georgieva, Al-Jadaan reiterated the IMF’s commitments on exchange rates, addressing excessive global imbalances, governance, and avoiding protectionist measures.

He said: “We will also continue working together to strengthen the global financial safety net, address global debt vulnerabilities (and support) vulnerable countries as they undertake reforms to tackle their vulnerabilities and address their financing needs.”

Al-Jadaan also said the IMF would continue its “critical and catalytic role in providing financial assistance to help members address their balance of payments problems and achieve economic stability and inclusive growth.”

He added that the body was looking to welcome a new 25th chair on the IMF’s Executive Board for Sub-Saharan Africa in November to improve representation and the overall balance of regional representation.

He said: “We support the IMF’s strengthened efforts to attract and develop talent to support existing and new priority areas, and to further improve staff diversity and inclusion, responding to the specific challenges identified in the FY2022-FY2023 Diversity and Inclusion Report.”

He also announced that the next IMFC 24 members’ meeting was expected to be held in October. Representatives usually meet twice a year, at the Bank-Fund Annual and Spring Meetings, to outline the proposed agenda for the IMF’s work program.

GCC countries should strengthen supply chains to ensure industrial growth: Oliver Wyman

RIYADH: Countries in the Gulf Cooperation Council region should develop supply chain resilience strategies as they embark on large-scale industrialization of their economies, a report said.

According to management consulting company Oliver Wyman, current risk levels in the logistics sector need to be mitigated, especially for countries like Saudi Arabia and the UAE which depend on high-criticality products such as transformers and minerals which are crucial for industrial growth.

“In Saudi Arabia, 75 percent of transformer imports originate from only three countries. Any potential disruption in transformer supply could significantly impact several sectors such as power, manufacturing, transportation, and healthcare,” the report said.

It added that logistical issues could impact power supply, leading to decreased industrial productivity, infrastructure vulnerabilities in systems that require constant energy supply, and economic instability.

“As GCC countries scale up their economic diversification plans, including their industrial sectors, it is vital that they redouble initiatives to increase supply chain resilience to ensure the smooth functioning of all sectors and aspects of society in the event of unexpected upheavals in the supply chain,” said Frederic Ozeir, partner and head of Automotive and Manufacturing Industries, India, Middle East and Africa region at Oliver Wyman.

The vitality of supply chain resilience

Oliver Wyman noted that vulnerabilities in global supply chains came under greater scrutiny in recent years following the pandemic and numerous climate-change-induced natural disasters, in addition to cybersecurity threats, logistics challenges, and geopolitical issues.

During these years, industries across the spectrum have been forced to grapple with production delays, shortages, and an increase in prices, as well as growing demand and unexpected bottlenecks, which have highlighted the critical importance of resilient logistical chains.

“For example, of all the electrical machinery and equipment imported to both Saudi Arabia and the UAE, 60 percent and 65 percent, respectively, are imported from just three countries. Similarly, for excavation machinery and valves, Saudi Arabia and the UAE import 50 percent and 55 percent of the total from three countries,” said Oliver Wyman.

The US-based firm added that various sectors are directly dependent on the industrial supply chain, and any disruptions could have a domino effect which will amplify vulnerabilities in vital sectors that are important for health, safety, and security.

Highlighting the necessity to maintain a functional supply chain, the report noted that the healthcare industry relies on the timely delivery of medical equipment and pharmaceuticals, while the power sector hinges on a steady inflow of critical machinery and components, such as turbines, generators, and transformers.

Moreover, GCC countries are heavily reliant on desalination machinery such as membranes, pumps, and valves because desalination is the source of most of the urban water in the region.

Saudi Arabia leading the region to ensure supply chain resilience

Oliver Wyman, in its report, also lauded Saudi Arabia’s efforts to ensure a healthy logistics sector in the Kingdom, as well as the whole region.

“In 2022, KSA launched the Global Supply Chain Resilience Initiative as part of its National Investment Strategy. This aims to position the Kingdom as a location of choice for leading global industrial companies, attracting investments in supply chains in order to mitigate the impact of global disruptions,” said the report.

The study added that the UAE is also focussing on improving food supply chains through various programs such as those that support local and sustainable food production, as well as by establishing new logistics hubs and deploying cutting-edge technological solutions.

Key actions to bolster supply chain resilience in the GCC

According to the report, governments in the GCC region should develop supply chain resilience strategies that seamlessly align with their national industrialization programs.

Moreover, such strategies should be supported by a set of enablers covering governance, private sector involvement, capabilities, and technology.

Oliver Wyman also underscored the necessity of having a collaborative governance framework between different countries to strengthen the supply chain in the Middle East region.

“GCC ministries of industry and mining can work with other ministries, especially those of vital sectors to ensure supply chain resilience. As an example, a GCC Ministry of Industry that collaborates with its counterpart in the Ministry of Health would be able to better develop appropriate actions for ensuring resilience of the supply chain of medical devices,” said the report.

The report also added that GCC governments should leverage the private sector as a crucial partner in their supply chain strategies.

According to the report, countries in the region can ensure supply chain durability by incentivizing logistical resilience initiatives among the private sector, and implementing inspection and corrective actions.

Moreover, the consulting firm added that GCC countries should establish specialized teams within their ministries of industry, comprising professionals with expertise in risk assessment and management, logistics operations, data analytics, and technology to build up the logistics network.

“Various capabilities are also required across the industrial sector, such as risk assessment and management, advanced technology integration and utilization, data analytics and business continuity planning, cybersecurity, and collaboration and information sharing,” the report added.

The study highlighted that nations in the region should also encourage the adoption of technology through advanced manufacturing policies that will drive the use of 3D printing, robotics, augmented reality, and automation.

Industrial cybersecurity requirements should also be considered given the connectivity and data sharing within factories, driven by automation and the Internet of Things, the consulting firm added.

Oliver Wyman noted that GCC countries should adopt a holistic approach that combines localization with other supply chain resilience levers to safeguard the industrial growth of these nations.

“Achieving supply chain resilience in the industrial sector is not a one-size-fits-all endeavor. The levers deployed to fortify supply chains, such as localization, shoring, and partnerships, must be applied to the supply chain components of products with high criticality and risk,” Ozeir.

The study concluded that supply chain resilience is not just a choice for GCC nations, but a necessity, and one that will guarantee the sustainability of their burgeoning and all-important industrial sectors.

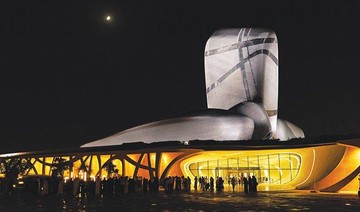

Future Hospitality Summit to shine spotlight on Saudi Arabia’s growing tourism industry

RIYADH: More than 1,200 investors from across the world will descend on Riyadh at the end of April for what is expected to be the biggest Future Hospitality Summit ever seen in Saudi Arabia.

The event - set to be held at Al Faisaliah Hotel from April 29 to May 1 – will focus on sustainable tourism and technology-driven hospitality under the theme, “Invest in Tomorrow: Today, Together.”

Industry leaders will discuss sustainable development, investment prospects, entrepreneurship, and human capital, as well as gain insights into the continued expansion of Saudi Arabia’s hospitality and tourism sectors.

The upcoming three-day conference, which will feature more than 150 speakers, marks the seventh industry event for the Saudi market hosted by The Bench, a British business events firm.

Jonathan Worsley, chairman of the company, said: “The objectives of FHS Saudi Arabia are strategically aligned with Vision 2030, and our carefully curated program will focus on the development and sustainable growth of the hospitality industry in Saudi Arabia, the adoption of tech, innovation, and entrepreneurship in the sector, as well as investment and job creation opportunities.”

It will emphasize strategies to foster the growth of Saudi Arabia’s hospitality sector, positioning it as a key driver of the Kingdom’s economic diversification efforts.

Additionally, it will facilitate collaboration in the tourism industry by spotlighting its potential and opportunities for partnerships.

Day 1

The first morning of the conference will be exclusively dedicated to the Global Restaurant Investment Forum, exploring Riyadh’s growing dining culture through main-stage presentations, case studies, and panel discussions.

Founded in 2015, GRIF has been a three-day conference held in Dubai and Amsterdam. This year it will be incorporated at FHS Saudi Arabia. It is mainly dedicated to investors who want to meet owners of restaurant concepts, operators and franchisors looking for growth, equity, or partners.

GRIF Culinary Tours of game-changing restaurant concepts in the culinary landscape in Saudi Arabia will take place again, as well as the Startup Den – where entrepreneurs pitch their business ideas to a panel of investor judges.

The most recent speakers who have confirmed their participation include Martin Raymond, who serves as the co-founder of the Future Laboratory and holds the position of editor-in-chief at LS:N Global. Christopher Sanderson, also a co-founder of the Future Laboratory, will be joining him.

Additionally, Mohammed Jawa, the founder and chairman of MJS Holding, Faisal Shaker, co-founder and CEO of Modern Food Company, and Nawal AlKhalawi, the founder and CEO of Asfar Experience, will address attendees.

The programme will kick off in the afternoon on April 29 with the FHS Intelligence Talks, moderated by Fritz Dickamp, managing director of Studio 49.

Topics include “The Future of Wellness – New Data on Wellness Travel,” moderated by Aradhana Khowala, CEO and founder of Aptamind Partners, in conversation with Susie Ellis, chair and CEO at Global Wellness Institute and Global Wellness Summit, and “The Hotel of the Future” presented by Turab Saleem, partner and head of Hospitality, Tourism and Leisure Advisory at Knight Frank Middle East and North Africa.

“We are offering delegates opportunities to immerse themselves in the dynamic essence of Saudi Arabia’s market. Our enriched program encompasses an array of engaging presentations, short-but-powerful ‘10X Talks’, multifaceted panel discussions, fireside chats, case studies, and captivating site tours,” Worsley said.

He added: “Furthermore, the event is peppered with ample networking opportunities over three days, all carefully curated to foster an environment of learning, dialogue, exploration, and meaningful connections.”

Day 2

On the second day, the conference will kick off with welcome remarks by Prince Bandar bin Saud bin Khalid, secretary general of the King Faisal Foundation, and chairman of the board of Al Khozama.

Plenary sessions will cover a wide range of topics including “Hospitality Investment Opportunities in Saudi Arabia in Alignment with Vision 2030” presented by Mahmoud Abdulhadi, deputy minister of Destination Enablement at the Ministry of Tourism.

A panel discussion on “A Blueprint for Successful Market Entry and Investment,” will be moderated by Edie Rodriquez, a Saudi Tourism Authority board member, with panelists Qusai Al-Fakhri, CEO of Tourism Development Fund, Fahad bin Mushayt, CEO of ASFAR, and Guy Hutchinson, president of Hilton MEA.

Also appearing will be Haitham Mattar, a special advisor to UN Tourism and managing director MEA and South West Asia at IHG Hotels & Resorts.

In addition, there will be a case study on “Public and Private Sector Collaboration to Accelerate Lifestyle Developments and Promote New Destinations,” moderated by Mohammed Islam, host and founder of the Mo Show Podcast Saudi Arabia, as well as a panel on “Maximising Financial Resilience Through Multi-asset Allocation” chaired by Matthew Martin, Saudi Arabia bureau chief at Bloomberg.

Moreover, sustainable hospitality investment and development will take center stage in the FHS program, alongside a significant emphasis on technology.

Industry leaders will delve into discussions on the future of artificial intelligence and the metaverse in hospitality, explore the convergence of AI, IT, and human interaction for enhancing guest experiences, and offer valuable insights on tech stack investment strategies for both owners and operators.

A fresh addition to FHS Saudi Arabia this year is the “Destination Tomorrow: Unveiling of Investment Opportunities” platform, designed to highlight innovative and emerging locations and attractions within the Kingdom’s hospitality and tourism sector.

Its primary goal is to facilitate connections between project developers, entrepreneurs, visionaries, investors, and other essential stakeholders.

Another inaugural event at this year’s FHS is the Speakers Corner, offering a distinctive chance for attendees to share personal narratives of overcoming challenges and achieving success in the industry.

Startup Den

The highly anticipated Startup Den returns this year, following its success at FHS Saudi Arabia 2023.

The panel of judges for this year include Prince Saud Al-Saud, executive director of TDF Grow, Salma Arafa, an innovation expert at UN Tourism, and Maya Ayoub, the founder and CEO of District Twelve and also country director of Saudi Arabia Women in Tech.

“The Bench is passionate about supporting start-ups and providing an opportunity for entrepreneurs to pitch their business to an expert panel of judges and investors,” Worsely said, adding: “This year, 10 finalists will take to the stage to present their business concept in what is set to be another thrilling competition.”

FHS Saudi Arabia is placing a greater emphasis on female representation than ever before, as a testament to The Bench’s dedication to empowering women in the hospitality industry and acknowledging their role within the sector.

“Women’s contribution to the workforce has been at the helm of the historic growth and development we witness today in the region. Our unique campaign seeks to inspire Saudi executive women, champion gender diversity in hospitality, and highlight the pivotal role females play in this ever-growing sector,” Tanja Millner, production director at The Bench, said.

She added: “We are delighted to introduce FHS Women Power, an initiative focused on facilitating and empowering Saudi national women working in the hospitality sector with complimentary tickets to FHS Saudi Arabia.

Last year, FHS Saudi Arabia welcomed over 1,100 delegates and featured 150 speakers from over 35 countries with 71 sponsors and partners.

Oil Updates – prices slip after Iran plays down reported Israeli attack

LONDON: Oil slipped on Friday following an earlier price spike of more than $3 after Iran played down reported Israeli attacks on its soil, in a sign that an escalation of hostilities in the Middle East might be avoided, according to Reuters.

Brent futures were down 48 cents, or 0.6 percent, at $86.63 a barrel by 2:55 p.m. Saudi time. The most active US West Texas Intermediate contract was down 38 cents, or 0.5 percent, to $82.35.

Explosions were heard in the Iranian city of Isfahan on Friday in what sources described as an Israeli attack, but Tehran played down the incident and indicated it had no plans for retaliation in a response that could ease concerns about escalation into a region-wide war.

Iran struck Israel with a barrage of drones and ballistic missiles on Saturday in retaliation for a presumed Israeli air strike on April 1 that destroyed a building in Iran’s embassy compound in Damascus and killed several top Iranian officers.

“Whilst the initial spike in oil may have highlighted the initial fear of further escalation, we have seen both equities and crude reverse some of those preliminary moves,” said Joshua Mahony, chief market analyst at Scope Markets.

“Events of the past week appear to be more about showing their willingness to act rather than actually seeking to incite a war ...For markets this is a best case scenario.”

Investors had been closely monitoring Israel’s reaction to the April 13 Iranian drone attacks and have been gradually unwinding oil’s risk premium this week.

Prices have fallen more than 4 percent since Monday and are set for their biggest weekly loss since early February.

“The oil market is nonetheless concerned as there is too much oil supply at stake,” said Bjarne Schieldrop, commodities analyst at SEB Research.

Meanwhile, US lawmakers have tucked sanctions on Iran’s oil exports into a pending Ukraine aid package which targets ships, ports or refineries that process Iranian crude and transactions from Chinese financial institutions involving purchases of petroleum from Iran.

Iran is the third largest oil producer in the Organization of the Petroleum Exporting Countries, according to Reuters data.

The US also announced sanctions this week on Iran targeting its unmanned aerial vehicle production.

Saudi Arabia’s AI adoption ignites technological advancement and economic growth

- Adoption of AI will help foster a knowledge-based economy and equip Saudi youth with skills for the digital age

- Key initiatives, include the National Strategy for Data and AI, aim to establish Saudi Arabia as a global AI leader by 2030

RIYADH: As artificial intelligence gains global attention and becomes a buzzword, Saudi Arabia is positioned for accelerated adoption to enhance efficiency across its industries.

Over the years, AI has evolved into a transformative technology revolutionizing numerous industries and domains. Its development and adoption across sectors have spurred significant advancements, already reshaping how people live and work globally.

According to a recent report by the professional services firm PwC, the projected economic impact of AI in the Middle East by 2030 is $320 billion, with an estimated $135.2 billion attributed to Saudi Arabia.

The report also highlights an annual growth rate in AI contribution ranging between 20 percent and 34 percent across the region, with the UAE experiencing the fastest growth, followed by Saudi Arabia.

“Such growth and demand for AI demonstrated that the impact on industries can be substantial and wide-ranging both in Saudi Arabia and the wider region,” said Slava Bogdan, CEO & co-founder at Flowwow, to Arab News.

Flowwow, a global gifting marketplace, simplifies gift-giving and connects local brands with customers. It hosts over 14,000 local brands from 1,000 cities and operates in over 30 countries, including the UAE, Spain, the UK, and Brazil.

“Whether it’s hospitality, manufacturing, telecommunication, or business technologies, where Flowwow sits, I could say that AI solutions, firstly, could automate repetitive tasks, allowing employees to focus on more strategic and creative work, especially in data analysis, customer service, and marketing,” Bogdan said.

The CEO further explained how the firm’s marketers frequently utilize AI to target audiences, enhance creatives, or conduct competitive analysis, particularly in global markets like the Middle East and North Africa. This reduces decision-making time and allows for more strategic tasks that necessitate a tailored approach.

“Moreover, AI algorithms can analyze large amounts of data to identify patterns and trends, helping businesses make more informed decisions,” Bogdan explained.

“This attribute can lead to better forecasting, resource allocation, and risk management, especially in the financial sector, having had 25 percent of all regional AI investments,” he added.

Speaking to Arab News, Brahim Laaidi, partner at Bain & Co., emphasized that AI adoption in sectors like energy and healthcare aids “the Kingdom’s economic diversification and fosters a knowledge-based economy, enhancing efficiency and driving growth.”

Moreover, AI is recognized for enhancing customer experience and reducing costs for firms in various ways.

DID YOU KNOW?

• Saudi Arabia was one of the first nations to utilize data and artificial intelligence technologies to achieve its Vision 2030 goals.

• There are five prominent types of AI: machine learning, natural language processing, computer vision, speech recognition and robots.

• The Saudi Data and AI Authority has created AI ethics principles in accordance with the Kingdom’s commitment to human rights.

• SDAIA estimates SR412.5 billion ($109.96 billion) in global spending on AI by 2024 end.

“AI chatbots and virtual assistants provide 24/7 customer support, reducing costs. Multiple Saudi firms and banks use chatbots for customer service,” highlighted Laaidi.

He also illustrated how AI analyzes customer behavior to create personalized experiences, citing examples like Netflix and Spotify, which utilize AI to tailor content based on user preferences and listening habits.

Laaidi also highlighted how “AI facilitates segmentation based on behavior and profitability for targeted marketing. Coca-Cola utilizes AI for consumer segmentation.”

“In a nutshell, for most enterprises, the focus remains on leveraging narrow or vertical AI solutions to enhance specific business processes, improve customer experiences, or optimize operations,” he added.

According to Jad Haddad, head of Digital IMEA at management consulting firm Oliver Wyman, AI essentially democratizes access to intelligence, making it cheaper and more widely available.

This can generate significant efficiencies by augmenting employee capabilities, enabling them to complete tasks faster, and automating certain processes without human intervention.

Oliver Wyman estimates that up to 35 percent of tasks globally may be augmented or automated by AI in the next three years.

“In Saudi Arabia, considering the current economic structure, Oliver Wyman estimates that up to 17 percent of tasks may be affected within that time frame,” Haddad told Arab News.

AI projects and employment

It is evident that the Kingdom has been significantly investing in AI in recent years.

Key initiatives, according to Laaidi, include the National Strategy for Data and AI, aiming to establish Saudi Arabia as a global AI leader by 2030. Additionally, Neom, a planned smart city, is poised to leverage AI in urban planning and environmental management.

“The Saudi Data and Artificial Intelligence Authority was established in 2020 to regulate AI development, and Tonomous collaborates with global tech leaders to enhance the city’s projects,” he added.

Laaidi continued by stating that AI and Robotics Centers, formed through partnerships with universities and international entities, are advancing AI in the Kingdom. From a technology industry perspective, it offers diverse applications and significant benefits.

According to Cristina Carranza, global head of business development at GGTech Entertainment, AI stands as a powerful tool with vast potential to enhance operational efficiency across various domains.

“We use AI selectively, focusing on specific areas where it can augment human skills and improve processes,” Carranza told Arab News.

She gives examples of how AI algorithms are utilized to analyze player data and preferences, enabling them to tailor game experiences and enhance player engagement. “In addition, AI-driven predictive analytics help us anticipate market trends and make informed decisions.”

However, Carranza emphasized the importance of acknowledging that while AI is embraced as a tool for progress, there is a recognition of the necessity of human oversight and control.

“We believe in a symbiotic relationship between humans and AI, where the technology enhances our capabilities but is always subject to human direction and control,” she added,

New dimensions

From GGTech Entertainment’s perspective, AI opens up exciting new dimensions in gaming and entertainment.

Carranza revealed that one significant area involves the optimization of game design processes, where AI algorithms analyze player feedback and behavior data to inform the creation of more engaging and immersive gaming experiences.

“Additionally, AI-powered tools enhance player interaction through personalized recommendations and real-time assistance, fostering deeper engagement and loyalty,” she explained.

The global head further addressed how AI-driven analytics offer valuable insights into player behavior and market trends, empowering GGTech to make data-driven decisions and maintain a competitive edge in the industry.

Bridging skill gaps

The Kingdom’s journey to become an AI leader involves challenges encompassing ethical and legal aspects, data availability and quality, as well as skill gaps, infrastructure requirements, public trust, and the need for international collaborations.

“To navigate these dilemmas, the SDAIA and the National Data Management Office have been established to construct ethical guidelines and improve data governance,” Laaidi explained.

Similarly, the National Cybersecurity Authority continues to safeguard Saudi Arabia's digital infrastructure, including AI systems.

Laaidi emphasized Saudi Arabia’s prioritization of STEM education and training to bridge skill gaps, citing initiatives like the Prince Mohammed bin Salman College of Cyber Security aimed at fostering local talent in AI-related fields.

He highlighted the importance of focusing on STEM disciplines for developing a workforce equipped with the necessary skills for an AI-driven future.

Opinion

This section contains relevant reference points, placed in (Opinion field)

“Substantial investments are being made in infrastructure, with emphasis on high-performance computing and cloud computing capabilities to support AI development and deployment. Building public trust is also a key venture for the Kingdom,” the partner stressed.

In addition, the Kingdom seeks international collaborations with leading AI research entities worldwide to expedite AI capabilities. “By addressing these challenges strategically, Saudi Arabia aims to create a conducive environment for AI development and adoption,” he emphasized.

From a technological perspective, the adoption of AI can present challenges in navigating ethical considerations and ensuring human control.

“At GGTech, we recognize the importance of maintaining human oversight and ethical standards while leveraging AI technologies. To address this challenge, we prioritize transparency and accountability in our AI algorithms and processes, ensuring they are aligned with our values and ethical guidelines,” Carranza described.

She further added that they invest in ongoing training and education for team members to enhance their understanding of AI and its implications, enabling them to make informed decisions and mitigate potential risks.

Reskilling Saudi workforce

Undoubtedly, marketers and creative leaders should prepare for the changes in their professional field resulting from AI adoption.

Bogdan explained that one of the crucial skills is the ability to ask AI the right questions and write clear prompts. He emphasized that it is necessary to understand, at least at a basic level, how AI algorithms work.

“At Flowwow, we acquaint employees with the different instruments to make AI a helpful assistant that allows us to analyze competitors’ websites, fact-check and edit texts, test tasks, and answers,” he continued.

The CEO highlighted that as the Kingdom invests resources to integrate AI into every sector, it creates more opportunities for entrepreneurs to establish their businesses and startups equipped with AI tools.

“Hence, apps and services developed with AI solutions will be on the edge. In this case, product managers and programmers should gain a thorough understanding of machine learning to create up-to-date apps,” Bogdan highlighted.

The CEO stressed that it will mostly be up to companies to invest in continuous learning and upskilling through educational short courses for their workers. “This investment is crucial to ensure that the workforce remains competitive and competent in leveraging advancements in AI effectively.”

Saudi Vision 2030

AI is a driving force behind Saudi Arabia’s Vision 2030, fueling economic diversification, smart cities, and public service transformation.

According to Laaidi, “AI boosts innovation across non-oil sectors, enables intelligent urban planning in projects like NEOM, and promotes Industry 4.0 through automation and predictive maintenance.”

“AI also improves government services via chatbots, automation, and analytics. In healthcare, AI enhances medical imaging, drug discovery, and personalized medicine,” he highlighted.

On top of that, Laaidi emphasized how AI educational tools prepare the workforce and optimize resource allocation, while support for clean energy promotes sustainability.

“Vision 2030 powered by AI seamlessly connects economic domains, accelerating progress and innovation across the Kingdom,” he affirmed.

On another note, GGTech Entertainment's use of AI aligns with the goals of Saudi Vision 2030 by driving innovation, promoting economic diversification, and empowering Saudi youth with advanced skills and capabilities, according to the firm's global head.

“One way AI contributes to this vision is by enhancing gaming experiences and promoting the Kingdom as a global hub for entertainment and technology,” said Carranza.

By utilizing AI-powered tools for game design, player interaction, and analytics, GGTech Entertainment is delivering cutting-edge gaming experiences that showcase Saudi Arabia’s technological prowess and creativity to a global audience, she emphasized.

“In addition, the use of AI creates opportunities for job creation and economic growth in the Kingdom. As GGTech expands its AI capabilities, it is investing in the development of a skilled workforce with expertise in AI technologies and data analytics,” the company’s global head said.

She concluded by highlighting how this not only aligns with the goals of Saudi Vision 2030 to foster a knowledge-based economy but also equips Saudi youth with the skills they need to thrive in the digital age.