LISBON: Portugal’s minority Socialist government presented on Wednesday a proposal to raise the monthly minimum wage by nearly 6 percent to 635 euros ($700) next year, remaining the lowest in western Europe.

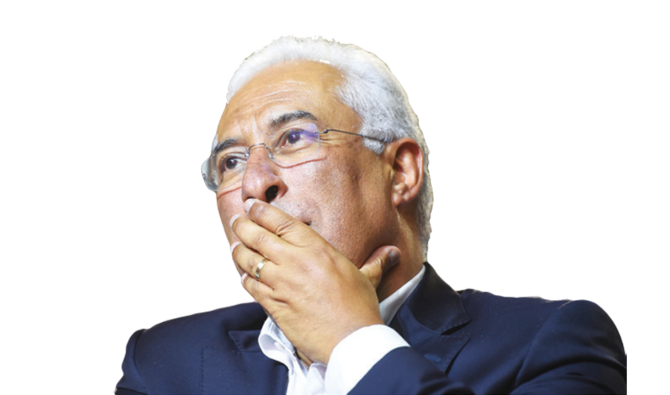

Prime Minister Antonio Costa promised to raise the monthly minimum wage by 25 percent to €750 by 2023 when he began his second term in office last month.

“This trajectory contributes to the recovery of income and the improvement of social cohesion levels,” the government said in the plan, seen by Reuters. “The increase has coincided with significant dynamism in the economy and the labor market.”

One in five workers in Portugal are on the minimum wage and the employment status of 890,000 people was last year officially described as precarious, a term used to refer to nonstandard forms of employment, including temporary work and fixed-term contracts.

Costa’s center-left Socialists, who presided over four years of strong economic growth and budget deficit cuts, won an Oct. 6 election, expanding their parliamentary representation as the biggest party but still just shy of a majority.

Now governing alone, Costa relied on support from two far-left parties — the Communists and Left Bloc — in the last four years and the wage plan is likely to be well received by them.

Job insecurity

Handed over to workers’ unions and others during a meeting on Wednesday, the government’s proposal said the new minimum wage of €635 will be implemented on Jan. 1, 2020.

Increases will be negotiated and reviewed every year until it reaches the €750 target in 2023.

Between 2015, when the Socialists took power, and 2019, the minimum wage increased 14 percent, from €505 to €600, way below neighboring Spain’s €1,050.

“But the salary increases have not yet reached the pace of growth needed to ensure a balanced distribution of income,” the government said, adding Portugal “remains one of the countries with the highest income inequality rates in the European Union.”

Analysts see job insecurity as a big flaw of the economy, which is cooling after recording its strongest expansion in almost two decades in 2017 as Portugal recovered from a debt crisis that required an international bailout.

Portugal’s biggest workers’ union CTGP said the increase to €635 is “insufficient,” arguing the country is now “in a position to go much further.”