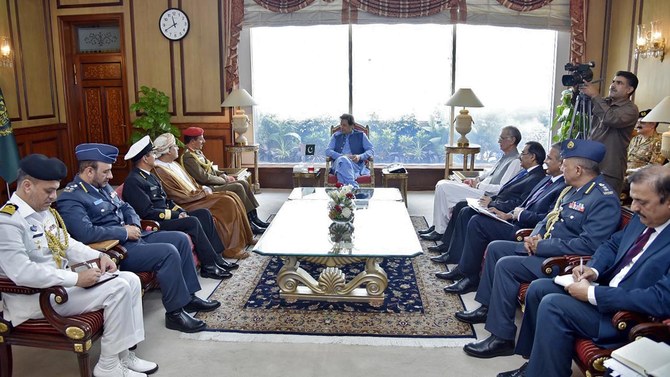

ISLAMABAD: Chief of Staff of Sultan’s Armed Forces of Oman Lt. Gen. Ahmed Bin Harith Al-Nabhani called on Prime Minister Imran Khan on Thursday and discussed bilateral, regional and international issues, PM Office said in a statement.

During the meeting, PM Khan highlighted the close and cordial relations between the two countries and “reiterated the resolve to further deepen bilateral cooperation in diverse fields. Matters related to enhancement of trade and transportation links were also discussed,” read the statement.

Lt. Gen. Al-Nabhani conveyed the cordial greetings of Sultan of Oman Qaboos bin Said Al-Said.

“He noted the strong Oman-Pakistan bilateral relations and expressed satisfaction over the existing level of defense cooperation, including frequent exchange of visits, training exchange programs and joint exercises,” the statement added.

Premier Khan apprised the visiting general on the situation in Indian-administered Kashmir, including the inhuman lockdown, curfew and communications blockade which, he pointed out, had continued since August 5 and severely impacted the lives of over eight million Kashmiris.

He stressed that the implementation of the United Nations Security Councils (UNSC) resolutions was the only solution to the protracted dispute.

General Ahmed Bin Harith Al-Nabhani expressed admiration for the prime minister’s speech at the United Nations General Assembly and lauded his initiative for de-escalation of tensions in the Gulf region.

Earlier this week, Oman’s general met with Pakistan Army Chief General Qamar Javed Bajwa on Tuesday and lauded the role of his institution in fighting terrorism.

PM Khan reiterates resolve to deepen ties with Oman

PM Khan reiterates resolve to deepen ties with Oman

- Both sides discussed enhancement of trade and transportation links between the two countries

- Khan expressed satisfaction on existing level of defense cooperation

Pakistani province issues flood alert and warns of heavy loss of life due to glacial melting

- The country has witnessed days of extreme weather, killing scores of people, destroying property

- Experts say Pakistan is experiencing heavier rains than normal in April because of climate change

PESHAWAR: A Pakistani province has issued a flood alert due to glacial melting and warned of heavy loss of life, officials said Saturday.

The country has witnessed days of extreme weather, killing scores of people and destroying property and farmland. Experts say Pakistan is experiencing heavier rains than normal in April because of climate change.

In the mountainous northwest province of Khyber Pakhtunkhwa, which has been hit particularly hard by the deluges, authorities issued a flood alert because of the melting of glaciers in several districts.

They said the flood could worsen and that people should move to safer locations ahead of any danger.

“If timely safety measures are not taken, there is a possibility of heavy loss of life and property due to the expected flood situation,” said Muhammad Qaiser Khan, from the local disaster management authority.

Latest figures from the province said that 46 people, including 25 children, have died in the past five days due to rain-related incidents.

At least 2,875 houses and 26 schools have either collapsed or been damaged.

The southwest province of Baluchistan has also been battered by rainfall. It said it had limited resources to deal with the current situation but if the rains continued, it would look to the central government for help.

In 2022, downpours swelled rivers and at one point inundated one-third of Pakistan, killing 1,739 people. The floods also caused $30 billion in damage.

Pakistan’s monsoon season starts in June.

Punjab seeks suspension of cellular services during Sunday’s by-polls in 13 cities

- By-elections will be held on 21 national, provincial seats in Punjab, Khyber Pakhtunkhwa and Balochistan provinces

- Pakistan’s national polls in Feb. were marred by mobile service shutdown, result delays, leading to rigging allegations

ISLAMABAD: The provincial government in Pakistan’s eastern Punjab province has requested for the suspension of mobile phone services in 13 cities during the by-elections on Sunday, according to the Punjab home department.

By-elections on 21 national and provincial seats in Punjab, Khyber Pakhtunkhwa (KP) and Balochistan provinces are scheduled to be held on April 21. Electioneering in these constituencies came to an end at midnight on Friday, according to a deadline set by the Election Commission of Pakistan (ECP).

In a letter to the interior ministry, the Punjab government requested suspension of mobile phone services in Talagang, Chakwal, Kallar Kahar, Gujrat, Ali Pur Chatha, Zafarwal, Bhakkar, Kasur, Sheikhupura, Lahore, Sadiqabad, Kot Chutta and Dera Ghazi Khan.

“I have been directed to request that mobile Internet services may kindly be suspended on 21st April, 2024 for maintaining law and order situation and to avoid any untoward incident [in the aforementioned areas],” a section office of the Punjab home department wrote in his letter to the interior ministry.

The seats, which are up for grabs in Sunday’s by-polls, were left vacant due to postponement of polls or were vacated by lawmakers, who won multiple seats, in national election in February.

The request by the Punjab home department comes amid expectations of a fierce competition between candidates backed by jailed former prime minister Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party and rival political groups.

Pakistan’s national election on Feb. 8 was marred by a mobile service shutdown and unusually delayed results, leading to accusations that the vote was rigged and drawing concern from rights groups and foreign governments.

Several political parties, including Khan’s PTI, and candidates had held protests and challenged many of the results before the ECP. However, the outgoing caretaker government and the ECP had denied allegations of any systematic rigging of the vote.

Police say attack on Japanese nationals in Karachi can be a case of ‘mistaken identity’

- In the past, Baloch separatists have claimed responsibility for attacks on Chinese nationals in the Pakistani port city

- However, Friday’s suicide attack on a van was the first incident in Pakistan that appeared to target Japanese nationals

KARACHI: The suicide attack on Japanese nationals in Pakistan’s southern city of Karachi could be a case of “mistaken identity” as no group has claimed responsibility for it, a senior police officer said on Saturday.

The Japanese nationals were traveling on Friday in a Hiace van to an industrial area, where they worked at Pak Suzuki Motors, when the suicide bomber detonated his explosive-laden vest near the van, according to police.

A police team escorting the vehicle returned fire after coming under attack, killing an accomplice of the suicide bomber. Officials said one of the attackers was identified as Sohail Ahmed, a resident of Panjgur district in the southwestern Balochistan province.

However, Ghulam Nabi Memon, the provincial police chief, said no militant group had accepted responsibility for the attack and it seemed they didn’t intend to attack the Japanese.

“For now, it seems to us to be a case of mistaken identity,” Memon told Arab News. “We are reviewing security protocols. The police and intelligence agencies are making efforts [to arrest the perpetrators].”

In the past, Baloch separatists have claimed responsibility for attacks on Chinese nationals in the Pakistani port city. However, this is the first time that the Japanese have come under such an attack.

A police officer, who spoke on the condition of anonymity, told Arab News that police suspected the attack was carried out by the outlawed Balochistan Liberation Army (BLA). The group has claimed several attacks, including the ones on the Chinese consulate in Karachi, Karachi Stock Exchange, and a suicide attack on Chinese teachers at Karachi University.

A BLA spokesperson didn’t respond to Arab News request for a comment on the attack.

Hours after the attack, Baloch activists shared videos on X, claiming raids were conducted on the homes of their supporters in Karachi.

A police officer, who requested anonymity, confirmed that raids were made to arrest the perpetrators and facilitators of the incident, but declined to share if any arrests were made.

“All I can share is that we are going in the right direction and an important breakthrough will be made soon,” he said.

On Friday, a police handout said the provincial police chief had chaired a high-level meeting, wherein he emphasized the need to establish a dedicated unit for the protection of Chinese nationals.

The police chief also stressed strict implementation of the standard operation procedures (SOPs) regarding the security of foreign delegates and regular issuance of security adviseries by authorities.

“Further discussions centered on enhancing security measures for all Chinese residents, experts, staff, and other foreign guests/delegates in Sindh,” the handout read.

In recent weeks, militants have targeted Chinese nationals working in Pakistan on projects relating to the China-Pakistan Economic Corridor (CPEC), a major segment of Beijing’s Belt and Road infrastructure initiative, which will connect China to the Arabian Sea and help Islamabad expand and modernize its economy through a network of roads, railways, pipelines and ports in Pakistan.

In March, five Chinese nationals and their Pakistani driver were killed in northwest Pakistan, when a suicide bomber rammed his explosive-laden car into the bus carrying them to Dasu Dam, the biggest hydropower project in Pakistan, where they worked.

Saudi cadet bags gold medal as fresh batch graduates from Pakistan Military Academy

- Forty-nine cadets from “friendly countries” graduate from Pakistan Military Academy in Kakul, says army

- The PMA provides initial training to Pakistani cadets and recruits from friendly countries such as Saudi Arabia

ISLAMABAD: The Pakistan Army awarded the Chairman Joint Chiefs of Staff Committee Overseas Gold Medal to a Saudi cadet in recognition of his performance, as a fresh batch of local and international cadets graduated from the Pakistan Military Academy (PMA) on Saturday, the army’s media wing said.

General Sahir Shamshad Mirza, chairman joint chiefs of staff committee, was the chief guest at the passing out parade of the 149th PMA Long Course at the academy in Kakul. General Metin Gürak, the chief of the Turkish general staff who is on an official visit to Pakistan, was the guest of honor at the ceremony.

Gen. Mirza reviewed and spoke to cadets at the parade while General Gürak presented the awards to the distinguished cadets, the Inter-Services Public Relations (ISPR) said.

“The Chairman Joint Chiefs of Staff Committee Overseas Gold Medal was awarded to Friendly Country Senior Under Officer Fahad Bin Aqil Al Towarqi Al Fallaj from Kingdom of Saudi Arabia,” the ISPR said.

The army’s media wing said 49 cadets from “friendly countries” also graduated at the ceremony. The coveted Sword of Honour was awarded to Academy Senior Under Officer Muhammad Nauman Abdullah.

The President’s Gold medal was awarded to Company Senior Under Officer Muhammad Abdullah Javed of the 149th PMA Long Course, the army’s media wing said.

“Since its inception, PMA has remained the cradle of leadership and center of excellence for cadets joining the premier institution of Army,” Gen. Mirza was quoted as saying by the ISPR.

“Over the years, PMA has also trained scores of foreign cadets whose brilliant performance in their respective Armies stands testament to the professional ethos of PMA.”

The PMA in Kakul, Abbottabad, provides initial training to Pakistan Army cadets and recruits from friendly countries, including Saudi Arabia, the Middle East and elsewhere in the world.

Pakistan and Saudi Arabia enjoy fraternal relations, leading the two countries to cooperate in trade, defense and other vital sectors.

The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the cash-strapped South Asian country’s largest source of remittances.

Pakistan to hold by-elections on 21 national, provincial assembly seats on Sunday

- Polling will be held on seats vacated by candidates or where polling was postponed due to various reasons

- Polling will take place on seats vacated by PM Shehbaz Sharif, Chief Ministers Maryam Nawaz and Ali Amin Gandapur

ISLAMABAD: Pakistan will conduct by-elections on 21 national and provincial seats on Sunday, state-run media reported on Saturday, marking the country’s first major electoral exercise since the contentious general elections of Feb. 8.

The by-elections would be held on the national and provincial assembly seats that were vacated by candidates following the Feb. 8 elections.

Polling on Sunday is scheduled to be held on five National Assembly seats, 12 Punjab Assembly seats, two Khyber Pakhtunkhwa (KP) Assembly seats and two Balochistan Assembly seats.

“Polling will start at 8:00 in the morning and it will continue till 5:00 p.m. without any break,” Radio Pakistan said.

Polling for NA-8 Bajaur and PK-22 Bajaur were postponed on Feb. 8 after the murder of a candidate, Rehan Zeb Khan. Polling will also be held in NA-44 Dera Ismail Khan, where the National Assembly seat was vacated by Ali Amin Gandapur, who retained his provisional assembly seat to become KP’s chief minister.

Similarly, Punjab Chief Minister Maryam Nawaz Sharif vacated her NA-119 seat in Pakistan’s eastern city of Lahore, choosing instead to keep the PP-159 constituency that she also won.

Prime Minister Shehbaz Sharif won elections on two provincial and National Assembly seats. He left the NA-132 Kasur and Lahore’s PP-158 and PP-164 seats vacant, preferring to retain the NA-123 Lahore constituency.

Pakistan Peoples Party (PPP) Chairman Bilawal Bhutto-Zardari won two National Assembly seats. He retained the NA-194 Larkana constituency, leaving the NA-196 seat in Qamber Shahdadkot vacant.

Pakistan’s Feb. 8 elections were marred by delayed results, a countrywide shutdown of mobile phone services and rigging allegations. Jailed former prime minister Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) accused Pakistan’s election regulator of manipulating the results of the elections, claiming in reality it had won over 180 National Assembly seats.

The Election Commission of Pakistan (ECP) rejected the PTI’s allegations, saying polling results were delayed due to the shutdown of mobile phone services countrywide. Pakistan’s caretaker administration had said the mobile services were suspended due to security reasons, rejecting rigging allegations by Khan’s party.

Independent candidates backed by Khan secured the highest number of seats in the National Assembly. However, the Pakistan Muslim League-Nawaz (PML-N) emerged as the largest party in the National Assembly, as a court decision prevented Khan-backed candidates from contesting polls with the PTI’s symbol.