NAIROBI, Kenya: The African Union launches the “operational phase” this weekend of a long-awaited trade accord, but analysts say the continent faces an uphill task to transform the pact into reality.

The 55-nation AU, gathering for a summit in Niger, will give the formal push to a deal to phase out tariffs on trade from the Cape of Good Hope to Cairo.

By doing so, say supporters of the African Continental Free Trade Area (AfCTA), business between African nations will boom.

The economy of Africa, with a GDP of $2.5 trillion today, will reach takeoff just as its 1.2 billion population doubles over the next three decades, they predict.

“It’s a remarkable achievement, and one that can even be described as historic,” AU Commission chief Moussa Faki Mahamat said Thursday in the Niger capital Niamey.

Backers were given something to celebrate ahead of the summit: on Tuesday, Nigeria, the continent’s largest and most populous economy, said it would sign after long holding back.

Talks on free trade began back in 2002, culminating in a deal that in late May crossed the threshold of ratification by at least 22 countries.

That tally is now 25 out of 55 AU members. Benin and Eritrea are the last countries yet to sign.

‘Made in Africa’

The sunny mood may well sour when the AU is confronted with the realities of the task at hand, say observers.

“Negotiations on some very important points have not yet been completed,” said Trudi Hartzenberg, director at Tralac, a specialist trade law organization based in South Africa.

A timetable for lowering customs duties, rules for certifying “Made in Africa” products, and arbitration mechanisms to settle trade disputes are among the hurdles not even close to being resolved.

In its first phase, the zone will eliminate customs duties on 90 percent of goods.

Tariffs will be scrapped over a longer period on seven percent of “sensitive” goods — a potential means for a country to protect national sectors from foreign imports, say analysts. Tariffs on the remaining three percent of goods will remain in place.

At the Niamey meet the AU is expected to choose the location of a secretariat, with Ghana and eSwatini (formerly Swaziland) among the names doing the rounds.

Critics say many economies are hugely dependent on agriculture or on primary resources such as minerals and forestry, and lack the diversity necessary for vibrant two-way trade.

The share of trade done by African nations with each other is very low — just 16 percent, compared to 65 percent among European countries.

“Africa trades with the rest of the world, but it does not trade with itself,” said Jakkie Cilliers from the Institute for Security Studies, a South African-based think tank.

‘Not a magic bullet’

AfCFA fans claim this slender intra-African trade could be boosted by 60 percent within a few years.

But others caution that benefits on this scale will take far longer to achieve.

“The (free trade) agreement between Canada and the EU took seven years to negotiate and that was just between one country and a fairly economically integrated group of 28 states, not 55 countries, each at very different stages of economic development,” said Elissa Jobson at the International Crisis Group (ICG) think tank.

Cilliers said the AfCFA would take “about a decade to produce its positive effects.”

“This is not a magic bullet,” he said.

The average tariffs on intra-African trade, of 6.1 percent, are higher than on exports to non-African countries.

This discrepancy is cited as a reason why intra-African trade is so low.

But, say observers, import duties are not the only obstacles to freer business.

Corruption, decrepit infrastructure and lengthy waiting times at borders are also hefty barriers.

In a report published in April, the International Monetary Fund said “improving trade logistics, such as customs services, and addressing poor infrastructure could be up to four times more effective in boosting trade than tariff reductions.”

Step by step, Africa inches toward ‘historic’ free trade zone

Step by step, Africa inches toward ‘historic’ free trade zone

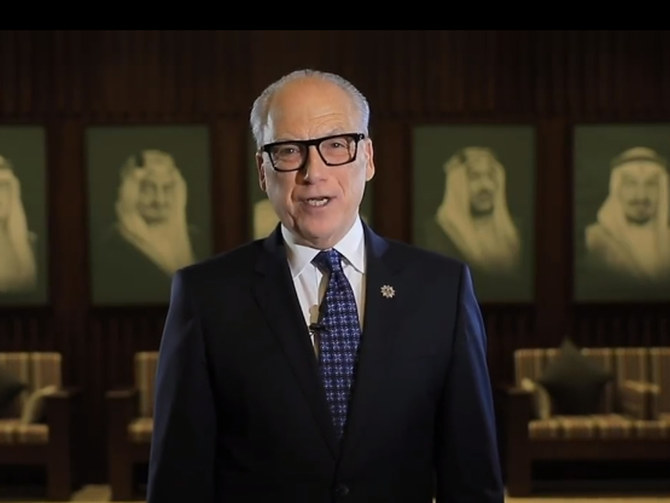

Diriyah Co. CEO appointed UN Tourism ambassador

RIYADH: Saudi historical destination developer Diriyah Co.’s CEO, Jerry Inzerillo, has been appointed as a UN Tourism ambassador, joining an elite group including Lionel Messi, Georgio Armani, and Placido Domingo.

The appointment was made during the global body’s first-ever sustainability week, being held in New York from April 15 to 19, according to a press statement.

Inzerillo has been honored for his “lifelong commitment” to employing “innovative design and development strategies” that bolster local communities and cultivate new and undiscovered tourism destinations, it added.

“The UN Tourism is enormously proud to welcome Inzerillo as our newest tourism ambassador. In this new role, he will help to amplify the UN Tourism’s key messages of the ability of tourism to drive change and achieve sustainable growth,” said Secretary-General Zurab Pololikashvili.

Diriyah is located on the outskirts of the Kingdom’s capital city, Riyadh. At its core is the UNESCO World Heritage Site of At-Turaif, the historic capital of the First Saudi State.

Upon completion, the Diriyah project will host 100,000 residents, workers, students, and visitors, offering a diverse range of cultural, entertainment, retail, hospitality, educational, and residential spaces.

Developing tourist destinations like Diriyah is crucial for Saudi Arabia, as the Kingdom pursues economic diversification, in line with the goals outlined in Vision 2030.

“In the area of tourism, we have the privilege to work in one of the world’s fastest growing sectors that employ 320 million people today and will add a further 100 million within the next decade. But with that privilege comes enormous responsibility to ensure that our developments are innovative, actionable and have real and enduring impact,” said Inzerillo.

Spearheaded by Inzerillo, Diriyah Co.’s development strategies adhere to the highest international sustainability, preservation, and conservation standards. They aim to support the mobility, health, and well-being of the local community.

“A key part of our master planning strategy is that our commitment to sustainable practices must also extend beyond the day-to-day operations of Diriyah Co.,” he added.

In January, Inzerillo told Arab News that Riyadh will be undergoing consistent transformative change “every year” that will allow visitors and residents to feel a palpable difference.

He added that visitors to the Kingdom’s capital do not need to look forward to 2030 to begin to witness the changes that the tourism sector is undergoing.

Formerly known as the World Tourism Organization, UN Tourism is a global agency responsible for promoting responsible, sustainable, and universally accessible tourism.

As a leading international organization, it advocates for tourism as a catalyst for economic growth, inclusive development, and environmental sustainability.

Closing Bell: Saudi benchmark index edges down 1.64% to 12,500

RIYADH: Saudi Arabia’s Tadawul All Share Index shed 207.91 points or 1.64 percent on Tuesday to close at 12,500.43.

The total trading turnover of the benchmark index was SR10.22 billion ($2.72 billion), with 42 stocks advancing and 186 declining.

Nomu, Saudi Arabia’s parallel market, also lost 239.21 points to close at 26,309.38. The MSCI Tadawul Index shed 31.821 points to 1,578.42.

The best-performing stock was Red Sea International Co. The firm’s share price soared by 10 percent to SR33.

Other top performers were Etihad Atheeb Telecommunication Co. and Saudi Steel Pipe Co., whose share prices surged by 6.57 percent and 4.59 percent respectively.

Meanwhile, ACWA Power’s share price hit SR427 on Tuesday, an all-time high since the company’s listing on the main market. However, the company closed its trading at SR417.

The worst performer of the day was Advanced Petrochemical Co., as its share price dipped by 5.30 percent to SR42.90.

On the announcements front, United Electronics Co. revealed that its net profit for the first quarter of this year climbed 11 percent to SR93.9 million.

In a Tadawul statement, the company, also known as eXtra said that the rise in net profit was driven by a 10 percent year on year rise in total revenues.

Meanwhile, Al-Moammar Information Systems announced that its board of directors has recommended the payment of a cash dividend at 8 percent of capital, or SR0.8 a share for the first quarter of 2024.

Moreover, the company’s board also recommended a three-year dividend policy until 2026.

“The policy will be submitted for approval at the upcoming general assembly meeting, the date of which will be announced later. The policy aims to maintain a minimum dividend per share of 50 percent of net profits annually,” said Al-Moammar Information Systems in a statement.

Saudi companies to attend energy conference in Dubai

RIYADH: Comprehensive knowledge sharing is set to unravel at Dubai’s Middle East Energy conference, with over 17 Saudi companies participating in the event.

The gathering, hosted at the Dubai World Trade Centre starting April 17, highlights the Middle East and Africa’s most extensive energy event, now in its 49th edition.

A rescheduling to include an additional day on April 19 follows unexpected adverse weather conditions that led to pushing the event’s opening day from April 16 to April 17.

This year, the Middle East Energy conference will expand across 14 halls, covering 28,500 sq. meters and will welcome more than 1,500 exhibitors and feature 14 national pavilions, showcasing the breadth of the global energy sector.

Saudi Arabia is well-represented, with companies like Bahra Advanced Cable Manufacture Co. Ltd., Jeddah Cables Co., and Riyadh Cables Group Co. leading the contingent.

Other participants include MEMF Electrical Industries Co., Electrical Industries Co., and International Tube & Conduit Co. Ltd.

The conference will also feature Middle East Specialized Cables Co., Red Sea Cable Co., and United Transformers Electric Co., alongside Al-Haitam for Industries & Economic Development and Asharqiyah Cables Co. for Industry.

With more than 250 speakers and three high-level strategic conferences, including the leadership summit, technical seminars, and the Intersolar and Electrical Energy Storage Middle East conference, the event promises crucial insights into energy transition, real-world solutions, and emerging challenges in sustainability and cybersecurity.

These dialogues are key as the sector seeks to transform rapidly to meet global energy demands responsibly.

Industry experts believe the region plays a significant role in the road to net-zero.

stc Group top workplace in Saudi Arabia, LinkedIn study finds

RIYADH: Telecommunications major stc Group has been named the best workplace in Saudi Arabia by the professional networking platform LinkedIn.

According to a press statement, the firm was followed in second place by hospitality giga-project Red Sea Global, with energy giant Saudi Arabian Oil Co., also known as Aramco, ranked third.

Motor vehicle manufacturing company Ceer took fourth place on the list, while ROSHN, backed by the Kingdom’s Public Investment Fund, and Riyad Bank, secured fifth and sixth spots, respectively.

“LinkedIn top companies is an annual list created by data on its platform, which will help professionals identify the top workplaces to grow their careers. The list uncovers the organizations leading the way in growth and learning opportunities for their employees, equity in the workplace, and strong company culture,” according to the report.

Business consulting firm Bain & Co. was named the top organization in the UAE, followed by Mastercard and Procter & Gamble.

“This year’s lists show how companies in the UAE and Saudi Arabia are continuing to grow and expand, which further cements the region’s reputation as a leading business hub,” said Salma Altantawy, senior news editor at LinkedIn.

She added: “Our research has previously indicated professionals’ appetite for new career moves in 2024, and this list recognizes those employers that can be a top choice for professionals looking to make those moves.”

Saudi Entertainment Ventures, also known as SEVEN, was named the tenth-top company in Saudi Arabia, an indication of the sector’s growth in the Kingdom.

“Entertainment companies Miral and Saudi Entertainment Ventures have joined the top 15 companies in the UAE and Saudi Arabia in 2024. Both companies took 10th place in their respective countries, which shows the rise of the entertainment industry across the region,” said LinkedIn in the report.

According to the survey, a majority of regional professionals are considering switching jobs this year and the UAE has seen a growth in hiring over the last 12 months.

In February, stc Group revealed that its net profit in 2023 rose 9 percent to SR13.3 billion ($3.55 billion) compared to the previous year.

In a Tadawul statement, the company revealed that the rise in profit was driven by an SR4.90 billion year-on-year rise in revenues.

ACWA Power secures landmark $80m bridge loan from Bank of China for Uzbekistan projects

RIYADH: Saudi energy giant ACWA Power has secured an $80 million equity bridge loan from the Bank of China for its Uzbekistan initiatives.

According to an official press release, the payment is split equally between Chinese yuan and US dollars, marking the first loan cooperation deal by a bank from the Asian country using its native currency involving a company from the Kingdom.

ACWA Power said the fund will boost its Tashkent 200 megawatts solar photovoltaic power plant and 500 MW per hour battery energy storage system project in Uzbekistan.

“This transaction culminated the initial agreement reached during the 3rd BRF (Belt and Road Forum) summit in October 2023, where ACWA Power was represented by its chairman as a keynote speaker,” the company said in a statement.

ACWA Power’s Chief Financial Officer, Abdulhameed Al-Muhaidib, highlighted the significance of this milestone, citing its alignment with Saudi Arabia’s Vision 2030 and China’s Belt and Road initiative.

He said: “We are delighted to deepen our cooperation with Bank of China to bring renewable energy at competitive tariffs to our key markets, including Uzbekistan.”

ACWA Power has a longstanding relationship with Chinese entities, dating back over 15 years, with investments from the Asian country in the company’s projects exceeding $10 billion.

The General Manager of the Bank of China, Pan Xinyuan, said: “I believe that the Belt and Road Initiative is in harmony with Saudi Arabia’s Vision 2030. Bank of China will further leverage its strengths to support the cooperation between Saudi enterprises like ACWA Power and their Chinese partners for win-win objectives.”

He added: “Looking ahead, Bank of China will continue to improve financial connectivity to push the Belt and Road economies on a track of sustainable and high-quality development.”

ACWA Power has been collaborating with multiple countries to develop its plants.

Earlier this month, the company signed a $800 million agreement with Senegal’s Ministry of Water to develop a desalination facility.

It announced the inking of a water purchase agreement for the construction of the facility in Dakar, Senegal in a statement on the Saudi stock exchange, Tadawul.

ACWA Power will be responsible for the infrastructure, design and financing as well as construction, operation and maintenance of the Grande Cote seawater desalination plant in the West African country.