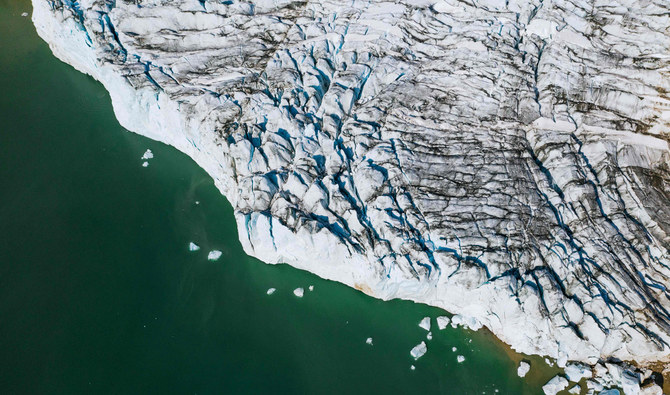

TASIILAQ, Greenland: From a helicopter, Greenland’s brilliant white ice and dark mountains make the desolation seem to go on forever. And the few people who live here — its whole population wouldn’t fill a football stadium — are poor, with a high rate of substance abuse and suicide.

One scientist called it the “end of the planet.”

When US President Donald Trump floated the idea of buying Greenland, it was met with derision, seen as an awkward and inappropriate approach of an erstwhile ally.

But it might also be an Aladdin’s Cave of oil, natural gas and rare earth minerals just waiting to be tapped as the ice recedes.

The northern island and the rest of the Arctic aren’t just hotter due to global warming. As melting ice opens shipping lanes and reveals incredible riches, the region is seen as a new geopolitical and economic asset, with the US, Russia, China and others wanting in.

“An independent Greenland could, for example, offer basing rights to either Russia or China or both,” said Fen Hampson, the former head of the international security program at the Center for International Governance Innovation think tank in Waterloo, Ontario, who is now a professor at Carleton University.

He noted the desire by some there to secede as a semi-autonomous territory of Denmark.

“I am not saying this would happen, but it is a scenario that would have major geostrategic implications, especially if the Northwest Passage becomes a transit route for shipping, which is what is happening in the Russian Arctic.”

In April, Russian President Vladimir Putin put forward an ambitious program to reaffirm his country’s presence in the Arctic, including efforts to build ports and other infrastructure and expand its icebreaker fleet. Russia wants to stake its claim in the region that is believed to hold up to one-fourth of the Earth’s undiscovered oil and gas.

China sees Greenland as a possible source of rare earths and other minerals and a port for shipping through the Arctic to the eastern US It called last year for joint development of a “Polar Silk Road” as part of Beijing’s Belt and Road Initiative to build railways, ports and other facilities in dozens of countries.

But while global warming pushes the cold and ice farther north each year, experts caution that the race to the Arctic is an incredibly challenging marathon, not a sprint.

The melting of the Greenland ice sheet creates uncertainty and danger for offshore oil and gas developers, threatening rigs and ships.

“All that ice doesn’t suddenly melt; it creates icebergs that you have to navigate around,” said Victoria Herrmann, managing director of the Arctic Institute, a nonprofit focused on Arctic security.

On the other hand, while mining in Greenland has been expensive due to the environment, development costs have fallen as the ice has melted, making it more attractive to potential buyers, she said.

Strategically, Greenland forms part of what the US views as a key corridor for naval operations between the Arctic and the North Atlantic. It is also part of the broader Arctic region, considered strategically important because of its proximity to the US and economically vital for its natural resources.

Hampson noted it was an American protectorate during World War II, when Nazi Germany occupied Denmark, and the US was allowed to build radar stations and rent-free bases on its territory after the war. That includes today’s Thule Air Force Base, 1,200 kilometers (745 miles) south of the North Pole.

After the war, the US proposed buying Greenland for $100 million after flirting with the idea of swapping land in Alaska for parts of the Arctic island. The US also thought about buying Greenland 80 years earlier.

Trump “may not be as crazy as he sounds despite his ham-fisted offer, which clearly upset the Danes, and rightly so,” Hampson said.

Greenland is part of the Danish realm along with the Faeroe Islands, another semi-autonomous territory, and has its own government and parliament. Greenland’s 56,000 residents got extensive home rule in 1979 but Denmark still handles foreign and defense policies, with an annual subsidy of $670 million.

Its indigenous people are not wealthy, and vehicles, restaurants, stores and basic services are few.

Trump said Sunday he’s interested in Greenland “strategically,” but its purchase is “not No. 1 on the burner.”

Although Danish Prime Minister Mette Frederiksen called Trump’s idea to purchase Greenland an “absurd discussion,” prompting him to call her “nasty” and cancel an upcoming visit to Copenhagen, she also acknowledged its importance to both nations.

“The developments in the Arctic region calls for further cooperation between the US and Greenland, the Faeroe Islands and Denmark,” she said. “Therefore I would like to underline our invitation for a stronger cooperation on Arctic affairs still stands.”

Greenland is thought to have the largest deposits outside China of rare earth minerals used to make batteries and cellphones.

Such minerals were deemed critical to economic and national security by the US Interior Department last year, and as demand rises “deposits outside of China will be sought to serve as a counterbalance to any market control that could be exerted by a single large producer,” said Kenneth Medlock, senior director at the Center for Energy Studies at Rice University.

Off Greenland’s shores, the US Geological Survey estimates there could be 17.5 billion undiscovered barrels of oil and 148 trillion cubic feet of natural gas, though the remote location and harsh weather have limited exploration. Around the Arctic Circle, there’s potential for 90 billion barrels of oil.

Only 14 offshore wells were drilled in the past 40 years, according to S&P Global Analytics. So far, no oil in exploitable quantities has been found.

“It’s very speculative, but in theory they could have a lot of oil,” said Michael Lynch, president of Strategic Energy & Economic Research Inc. “It’s perceived as being the new Alaska, where the old Alaska was thought to be worthless and turned out to have huge reserves. And it’s one of the few places on Earth that’s lightly populated, and it’s close to the US“

Michael Byers, an Arctic expert at the University of British Columbia, suggests there are better approaches for Washington than the politically awkward suggestion of purchasing Greenland.

“There’s no security concern that would be dealt with better if Greenland became a part of the United States. It’s part of the NATO alliance,” he said. “As for resources, Greenland is open to foreign investment. Arctic resources are expensive and that is why there is not more activity taking place. That’s the barrier. It’s not about Greenland restricting access.”

That’s been the approach taken by China, which has had mixed success. Greenland officials have visited China to look for investors but Beijing’s interest also has provoked political unease.

In 2016, Denmark reversed plans to sell Groennedal, a former US naval base that the Danish military had used as its command center for Greenland after a Hong Kong company, General Nice Group, emerged as a bidder, according to defensewatch.dk, a Danish news outlet.

Last year, then-US Defense Secretary James Mattis successfully pressured Denmark not to let China bankroll three commercial airports on Greenland, over fears they could give Beijing a military foothold near Canada, The Wall Street Journal reported.

Beijing’s biggest Greenland-related investment to date is an ownership stake by a Chinese company in Australia-based Greenland Minerals Ltd., which plans to mine rare earths and uranium.

“People talk about China, but China can access Arctic resources through foreign investment,” Byers said. “And foreign investment is a lot cheaper than trying to conquer something.”

Climate change turns Arctic into strategic, economic hotspot

Climate change turns Arctic into strategic, economic hotspot

- The race to the Arctic is an incredibly challenging marathon, not a sprint

UBS gets green light to open Saudi branch for banking operations

RIYADH: In a move aimed at enhancing Saudi Arabia’s financial landscape, the Kingdom has granted permission for a branch of the Swiss bank UBS to operate within the nation.

According to the Saudi Press Agency, the approval was granted during a session chaired by the Custodian of the Two Holy Mosques, King Salman bin Abdulaziz Al-Saud, held by the Cabinet in Jeddah on April 23.

The session commenced with King Salman briefing the Cabinet on the recent communications and discussions held between the Kingdom and several countries regarding shared relations, regional issues, and global developments, as reported by SPA.

In this context, the Cabinet reaffirmed Saudi Arabia’s steadfast stance toward promoting security and stability in the region and the world.

The Minister of Media, Salman bin Yousef Al-Dossary, stated in a press release following the session that the Cabinet praised the outcomes of the second ministerial meeting of the dialogue between the Gulf Cooperation Council countries and Central Asian countries.

He emphasized the Kingdom’s commitment to continue strengthening communication channels with various countries worldwide and supporting areas of joint coordination, including multilateral efforts.

Additionally, the Cabinet expressed its appreciation for the participants of the forthcoming World Economic Forum special meeting, set to take place in Riyadh in the upcoming week, highlighting the Kingdom’s dedication to encouraging global collaboration and tackling shared challenges.

Moreover, the Cabinet announced that the World Bank had selected Saudi Arabia as a center for knowledge dissemination to promote worldwide awareness of economic reforms, underscoring its leadership in achieving significant progress in global competitiveness indicators.

Al-Dossary further highlighted that the Cabinet applauded the achievement of five Saudi cities in obtaining advanced positions in the 2024 Smart Cities Index.

Following today’s session, the Cabinet approved cooperation agreements with Qatar, the Dominican Republic and the UK as well as Turkey, Chad, Portugal, Hong Kong, and Yemen.

Additionally, the body authorized discussions regarding statistical collaboration with Australia and maritime cooperation with Egypt. It also endorsed anti-corruption agreements with South Korea, archival partnerships with Greece, and financial technology collaboration with Singapore.

Authorization was granted for negotiations on science and technology cooperation with the Bahamas. A unified law for international road transport within GCC countries was approved, and additional compensation was granted to Tabah village’s affected families in the Hail region.

Furthermore, final accounts for various government entities were approved.

UAE and Oman establish $35bn investment partnerships across multiple sectors

RIYADH: Trade and economic ties between the UAE and Oman are set to further strengthen thanks to the signing of investment deals worth 129 billion dirhams ($35.12 billion).

According to a press statement, these agreements cover multiple sectors, including renewable energy, green metals, railway, digital infrastructure, and technology investments.

Economic ties between the UAE and Oman have remained robust in recent years, with non-oil trade volumes reaching approximately 50 billion dirhams in 2023.

“The UAE and Oman have strong historical relations that are founded on shared values, goals and principles. The agreements represent a major milestone in our bilateral ties, as they pave the way for us to leverage our collective strength to realize our shared vision of advancement and prosperity,” said Mohamed Hassan Al-Suwaidi, UAE’s minister of investment.

One of the major agreements signed by both countries was an industrial and energy megaproject valued at 117 billion dirhams. This project encompasses renewable energy initiatives, including solar and wind projects, alongside green metals production facilities.

The deal’s signatories included Abu Dhabi National Energy Co., Abu Dhabi Future Energy Co., and Emirates Global Aluminium, as well as Emirates Steel Arkan, OQ Alternative Energy, and Oman Electricity Transmission Co.

Another agreement, valued at 660 million dirhams, was signed between Abu Dhabi Developmental Holding Co. and Oman Investment Authority to establish a technology-focused fund.

A UAE-Oman rail connectivity project, valued at 11 billion dirhams, was also inked by both countries.

Additionally, UAE’s Ministry of Investment and the Ministry of Commerce and Trade signed another deal with Oman’s Ministry of Investment Promotion to cooperate in multiple sectors, including digital infrastructure, food security, and energy.

Etihad Rail, Mubadala, and Omani Asyad Group Co. signed a shareholding partnership valued at 3 billion dirhams.

Both countries also announced the formation of a UAE-Oman alliance to enhance bilateral economic and trade relations.

The UAE’s Ministry of Investment, in the press statement, further noted that the signing of these agreements will serve to bolster relations across key sectors and foster socio-economic benefits, contributing toward a stable and prosperous future for both countries.

Influx of Chinese models to drive Mideast EV sales amid global surge

- The IEA report disclosed that global EV sales grew by approximately 25 percent in Q1 of 2024

RIYADH: The entry of Chinese car models in the Middle East could drive regional electric vehicle sales, as global figures are projected to reach 17 million units by 2024.

According to the latest International Energy Agency report, this marks a 21.42 percent increase from the previous year, with nearly 60 percent of new electric car registrations in 2023 occurring in China, followed by 10 percent in the US and 25 percent in Europe.

“The continued momentum behind electric cars is clear in our data, although it is stronger in some markets than others. Rather than tapering off, the global EV revolution appears to be gearing up for a new phase of growth,” said Fatih Birol, executive director of the IEA.

The Global EV Outlook 2024 stated that the electric car market in Africa, Eurasia, and the Middle East is still in its nascent stage, with such vehicles representing just under 1 percent of total sales in these regions.

However, the decision of Chinese carmakers to explore these regions, along with producing vehicles domestically, could change this trend, allowing the market to expand in the coming years.

“In Uzbekistan, BYD (Chinese automaker) set up a joint venture with UzAuto Motors in 2023 to produce 50,000 electric cars annually, and Chery International established a partnership with ADM Jizzakh,” stated the IEA in the report.

This partnership has already led to a steep increase in electric car sales in Uzbekistan, reaching around 10,000 in 2023.

It added: “In the Middle East, Jordan boasts the highest electric car sales share, at more than 45 percent, supported by much lower import duties relative to ICE (internal combustion engine) cars, followed by the UAE, with 13 percent.”

Moreover, in July last year, Saudi Arabia’s Ministry of Investment signed a $5.6 billion deal with Chinese electric car maker Human Horizons to collaborate on the development, manufacture, and sale of vehicles.

Steady growth

The IEA report disclosed that global sales of electric cars grew by approximately 25 percent in the first quarter of this year compared to the same quarter in 2023.

Highlighting the growth of the EV market, the report revealed that the number of electric cars sold globally in the first three months of this year is roughly equivalent to the total units sold in 2020.

The steady growth in the first quarter of this year was driven by China, with 1.9 million EVs sold, marking a 35 percent rise compared to the same period in 2023.

In Europe, the first quarter of 2024 witnessed year-on-year growth of over 5 percent, slightly surpassing the growth in overall car sales and thus maintaining the EV sales share at a similar level to that of last year.

The US also experienced a 15 percent increase in sales in this segment during the first three months of this year, compared to the same period in 2023.

According to Birol, the rise in investments in the electric battery sector is a strong indication of the rise of the EV appetite globally.

“The wave of investment in battery manufacturing suggests the EV supply chain is advancing to meet automakers’ ambitious plans for expansion. As a result, the share of EVs on the roads is expected to continue to climb rapidly,” said the executive director of IEA.

He added: “Based on today’s policy settings alone, almost one in three cars on the roads in China by 2030 is set to be electric, and almost one in five in both the US and the EU. This shift will have major ramifications for both the auto industry and the energy sector.”

EV prices to fall

The report highlighted that the pace of the transition to EVs may not be consistent and will hinge on affordability.

IEA added that manufacturers have taken significant steps to deliver on the strengthening EV ambitions of governments by making significant financial commitments.

“Thanks to high levels of investment over the past five years, the world’s capacity to produce batteries for EVs is well positioned to keep up with demand, even as it rises sharply over the next decade,” said the report.

According to the intergovernmental organization, more than 60 percent of electric cars sold in 2023 were already less expensive to buy than their conventional equivalents in China.

However, the purchase prices for cars with internal combustion engines remained cheaper on average compared to EVs in the US and the EU.

The report suggested that intensifying market competition and improving battery technologies are expected to reduce the prices of electric cars in the coming years.

“Even where upfront prices are high, the lower operating costs of EVs mean the initial investment pays back over time,” said IEA.

Moreover, growing electric car exports from Chinese automakers, which accounted for more than half of all electric car sales in 2023, could add to downward pressure on purchase prices.

IEA also underscored the vitality of ensuring the availability of public charging slots to maintain the steady growth of the electric car market globally.

According to the report, the number of public charging points installed globally was up 40 percent in 2023 compared to 2022, and growth for fast chargers outpaced that of slower ones.

However, IEA added that charging networks globally need to grow sixfold by 2035 to meet the level of electric vehicle deployment in line with the pledges made by governments.

“At the same time, policy support and careful planning are essential to make sure greater demand for electricity from charging does not overstretch electricity grids,” concluded the report.

Closing Bell: Tasi slips for the second consecutive day

RIYADH: Saudi Arabia’s Tadawul All Share Index continued its downward trend for the second consecutive day as it shed 24.52 points to close at 12,484.41.

The total trading turnover of the benchmark index was SR8.44 billion ($2.25 billion), with 71 of the listed stocks advancing and 157 declining.

On the other hand, Saudi Arabia’s parallel market Nomu gained 95.74 points on Tuesday to close at 26,691.96.

However, the MSCI Tadawul Index slipped by 0.24 percent to 1,563.40.

The best-performing stock of the day was United Cooperative Assurance Co. The firm’s share price rose by 6.67 percent to SR13.44.

Other top performers include Etihad Atheeb Telecommunication Co. and Gulf Union Alahlia Cooperative Insurance Co., whose share prices surged by 4.84 percent and 4.54 percent, respectively.

The worst performer in the main market was Fitaihi Holding Group, as its share price slipped by 4.77 percent to SR4.19.

The parallel market’s positive performance was driven by Osool and Bakheet Investment Co., whose share price soared by 7.83 percent to SR36.50.

On the announcements front, Middle East Paper Co. said it has started its cardboard factory project, which will have a production capacity of 450,000 tonnes.

In a statement to Tadawul, MEPCO revealed that the feasibility study for the project has been completed with a final budget of SR1.78 billion.

The company went on to say that the undertaking would be completed in 42 months.

The initiative will be funded by the MEPCO’s internal resources, by long-term loans from local banks and the use of funds resulting from the issuance of the shares to Saudi Arabia’s Public Investment Fund, the statement added.

Meanwhile, in another statement, MEPCO revealed that it signed another agreement with J.M. Voith SE & Co. KG, for manufacturing, supplying and supervising the installation of the main machine for the cardboard project.

Egypt increases funding needed in 2024-2025 budget by over $59bn

RIYADH: Egypt has increased the amount of funding required in its 2024-2025 budget by over 2.8 trillion pounds ($59 billion) following successive shock waves.

In the financial statement of the new draft budget, Minister of Finance Mohamed Maait highlighted that the changes are reflective of the continuous struggles that the North African country has been facing following the COVID-19 epidemic.

The added funding aims to alleviate the inflationary effects that have been burdening the Egyptian public, improve the standard of living, and meet the developmental needs of citizens, the report said.

The allocation of spending in the budget will also seemingly reflect the needs of individuals by increasing spending on health and education and aiming to improve job opportunities.

Egypt’s economy has witnessed blows over the last half year due to the ongoing crisis in Gaza, which has slowed tourism growth and cut into Suez Canal revenue, two of the country’s biggest sources of foreign currency.

Amid a staggering shortage of foreign currency and rapidly increasing inflation, the challenges prompted the International Monetary Fund to expand its financial support to Egypt to $8 billion in an attempt to shore up the country’s economy.

In a statement in March, the IMF board said its decision would enable Egypt to immediately receive about $820 million.

Similarly, the UAE, represented by a private consortium led by the Abu Dhabi Developmental Holding Co., signed a landmark agreement with Egypt in February to invest $35 billion in Ras El-Hekma, a region on the Mediterranean coast 350 km northwest of Cairo.

Since securing the deal, which marked the single largest foreign direct investment in the North African country, the nation launched some long-sought reforms with the central bank delivering a 600 basis-point interest rate hike and a pledge to unshackle its currency alongside a devaluation.

This led S&P Global Ratings to note that it has been encouraged by the rush of financial support to Egypt, therefore lifting its economic outlook for the country to positive from stable after the long-awaited currency devaluation, which is poised to ease foreign currency shortages.