KARACHI: The Pakistan stock exchange (PSX) plunged a massive 816 points on Monday — a day after the government announced a $6 billion International Monetary Fund (IMF) package — with the benchmark KSE 100 losing 2.3 percent during intra-day trading and cementing fears that investor sentiments remain bleakly uncertain.

For a few minutes when trading opened, all seemed well with upwards activity and a move into the green zone by more than 500 points before the PSX experienced one of the bourse’s worst bearish spells, pushing the index to close below 34,000 points.

“The market opened on a buoyant note before panic-prone investors started to jettison shares,” said Muhammad Faizan, an analyst and head of foreign institutional sales, Next Capital Limited, a brokerage. He said this occurred due to concerns of tough conditions attached with the IMF bailout package, leading to heavy sell-offs in the market that pushed the index to close at 33,900 points.

Pakistani authorities and the IMF team on Sunday reached a staff level agreement on economic policies to be supported by a three-year agreement for about $6 billion which is subject to IMF management approval and to the timely implementation of the Fund’s conditions.

According to Ahsan Mehanti, Chief Executive at Arif Habib Corporation, a capital market company, “Expected increase in taxes and utility prices, sharp fall in expected growth rate, projections for 6.5-7 percent fiscal deficit to GDP, and expected tightening in SBP policy rates played a catalyst role in bearish close.”

With inflation climbing to over 8 percent, the rupee losing a third of its value over the past year, and foreign exchange reserves barely enough to cover two months of exports, Pakistan was forced to turn to the IMF for its 13th bailout package last year.

Outlining critical steps Pakistan needed to take for fiscal strategy, the IMF said the upcoming budget, to be announced this month, would aim for a primary deficit of 0.6 percent of GDP supported by tax policy revenue mobilization measures to eliminate exemptions, curtail special treatments, and improve tax administration.

Economists say that impact of the IMF bailout program and the promises made to secure the money by Pakistani authorities will be reflected in this month’s budget.

“The most prominent thing in the budget would be the imposition of around Rs. 700 billion in new taxes,” according to Dr. Hafeez Pasha, former finance minister, who spoke to Arab News on Monday. “The major portion of taxes will be through the reduction of exemptions being given on many items including medicine, medical equipment and fertilizers,” he said, and added that a removal of the exemptions would hugely affect ordinary citizens.

The IMF has asked that Pakistan’s deficit be reduced to between 1-1.5 percent of GDP, which will mean a deficit of up to Rs. 750 billion will need to be curtailed.

“The problem is that what we pay in debt servicing will have to continue as there is no space for reduction. The fiscal space is available in your defense and development budgets and the choice is yours,” Pasha said.

Some experts do believe that the agreement will boost the confidence of investors and end the long prevailing uncertainty from nine months of IMF negotiations. Others say the bearish rule at the PSX is here to stay.

“The movement of currency will now be based on demand and supply bases. At the month end when debt payment nears, we will see shocks in the currency market,” Muzzamil Aslam, a senior economist told Arab News and called for the strong role of regulator.

“As per the real effective exchange rate, the Pakistani Rupee is close to its equilibrium, and there is only 2-3 percent room for further devaluation,” he said.

The IMF forecasts Pakistan’s economic growth slowing to 2.9% this fiscal year from 5.2% in 2018, while the central bank has cut its estimate to between 3.5-4%.

“If there arises any demand and supply issue and the central bank is not allowed to intervene, then the market can do anything,” Aslam said. “We could see Rs.10 appreciation or depreciation in a single day.”

Tough IMF conditions push Pakistan stocks down 816 points

Tough IMF conditions push Pakistan stocks down 816 points

- The Pakistan Stock Exchange plunged on Monday to lose 2.3% during intra-day trading

- Defense and development are only two areas where there is fiscal space for budget cuts, economists say

US ambassador optimistic about Pakistan-IMF talks ahead of key funding meeting on April 29

- The IMF has confirmed its executive board’s meeting to discuss the approval of $1.1 billion for Pakistan next week

- Ambassador Blome says the IMF’s positive feedback will further encourage investors and help Pakistan’s ailing economy

ISLAMABAD: US Ambassador Donald Blome expressed optimism over the ongoing negotiations between Pakistan and the International Monetary Fund (IMF) on Wednesday, as the global lending agency confirmed its executive board meeting for April 29 to discuss the approval of $1.1 billion funding for the South Asian state.

The funding is the second and last tranche of a $3 billion standby arrangement with the IMF, which it secured last summer to avert a sovereign default and which runs out this month. Pakistan is now seeking a new long-term and larger IMF loan, with finance minister Muhammad Aurangzeb saying Islamabad could secure a staff-level agreement on the fresh program by early July.

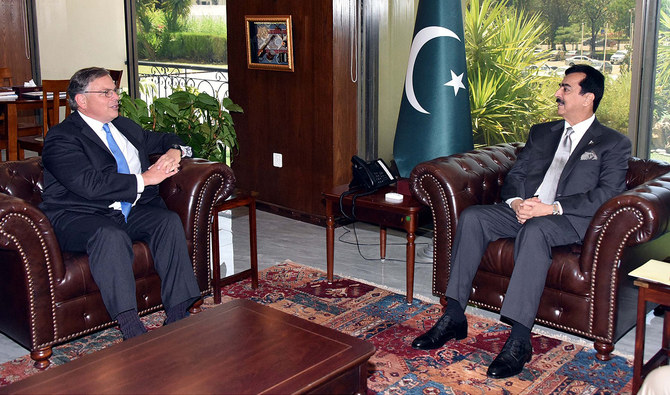

Ambassador Blome praised the performance of the country’s economic team in a meeting with the newly elected Senate chairman, Yousaf Raza Gillani, at the Parliament House wherein he also discussed strengthening of US-Pakistan bilateral relations.

“Acknowledging the positive economic indicators of Pakistan, Ambassador Blome noted the downward trend in inflation and high dollar reserves, stating that the IMF’s positive feedback would encourage investors,” said an official statement issued after the meeting. “He highlighted the flourishing gaming industry in Pakistan and called for enhanced [US-Pakistan] cooperation in the digital sector.”

The American envoy also noted the potential for further economic cooperation between the two countries in his conversation.

Pakistan’s $350 billion economy faces a chronic balance of payment crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year — three-time more than its central bank’s foreign currency reserves.

Pakistan’s finance ministry expects the economy to grow by 2.6 percent in the current fiscal year ending June, while average inflation is projected to stand at 24 percent, down from 29.2 percent in fiscal year 2023/2024. Inflation soared to a record high of 38 percent last May.

With input from Reuters

In Rawalpindi, 77-year-old tea shop named after India’s Ludhiana is still a hit with customers

- Ludhiana Tea Shop owners migrated from India’s northwestern city at the time of Partition in 1947

- Customers say they come from far-off places to relish the taste of tea at the shop which they find unique

RAWALPINDI: At a small tea shop in Pakistan’s garrison city of Rawalpindi, Nazir Hussain pours piping hot tea from a kettle into small cups and hands them away to eager customers, many of them regulars who have been frequenting the shop for decades.

This is the scene from a typical evening at Ludhiana Tea Shop, located in the narrow streets of Rawalpindi’s old Lal Kurti area. The tea shop takes its name after the northwestern Indian city of Ludhiana, from where its owners migrated to Rawalpindi in 1947.

“My grandfather named this business in the memory of his hometown in India,” Hussain, who took charge of the shop in 1976, told Arab News, adding that he also sold dairy products and ghee.

“We are a family of milk sellers,” he said. “In India, we used to do the same. We were milk sellers and we used to own buffaloes.”

The shop has been serving tea to customers for the past 77 years. Agha Asghar Saeed, 72, is one of them and has been coming here since he was young.

“I was born here. I spent my childhood here, my youth and now my old age as well,” he told Arab News. “I’ve been having this tea since then.”

During the Muslim holy month of Ramadan, Saeed would break his fast at home but have tea at Ludhiana Tea Shop.

“I am addicted to this tea,” he explained.

But what inspires such loyalty in customers?

“You have to buy good quality milk,” Hussain said, adding that he purchased pure and organic milk for his shop that was a bit expensive. “Not everyone knows how to buy good milk.”

He maintained that most milk sellers in Pakistan did not sell pure milk, making him take several sips while buying to check the fat content.

Just like the milk, he continued, the quality of the tea leaves was also important.

The price of one cup of tea used to be around five paisas several years ago.

“Now, we sell it for Rs60 (22 cents),” he added.

The rich taste of Ludhiana Tea Shop means Muhammad Hasnain and his friends visit it every day rather than go to other tea shops in the neighborhood.

“Obviously, everybody wants a good bang for their buck,” Hasnain told Arab News. “The most important thing for anyone is that the quality should be good, and both quality and quantity are good here.”

Ludhiana Tea Shop offers customers deep-fried sweet and savory snacks, such as pakoras, samosas, jalebis and spring rolls, delectable items popularly consumed in Pakistan with tea.

Muhammad Shoaib Khan, a man in his 30s, informed he visited the shop with his friends at least a couple of times every day.

“We come on our bikes and travel for at least 1.5 kilometer on every trip,” Khan told Arab News. “It roughly adds up to 6 kilometers.”

Despite the cost of petrol, which has surged in recent times, Khan said he visited the shop for tea because it was worth it.

Hussain said he understood why customers came from far-off places just to have a cup of tea at his 77-year-old shop.

“Everyone cannot make good tea,” he said. “They don’t pour their heart in it. They lack passion. Making good tea is something that can only be done from the heart.”

Malala Yousafzai vows support for Gaza after backlash over Broadway musical

- Yousafzai was criticized in Pakistan for co-producing a play with Hillary Clinton who supports Israel’s Gaza campaign

- The Nobel laureate says ‘we do not need to see more dead bodies’ to understand the urgency of a ceasefire in Gaza

LAHORE: Nobel laureate Malala Yousafzai on Thursday condemned Israel and reaffirmed her support for Palestinians in Gaza, after a backlash in her native Pakistan over a Broadway musical she co-produced with former US Secretary of State Hillary Clinton.

Yousafzai, who was awarded the Nobel Peace Prize in 2014, has been condemned by some for partnering with Clinton, an outspoken supporter of Israel’s war against Hamas.

The musical, titled “Suffs,” depicts the American women’s suffrage campaign for the right to vote in the 20th century and has been playing in New York since last week.

“I want there to be no confusion about my support for the people of Gaza,” Yousafzai wrote on X, the former Twitter. “We do not need to see more dead bodies, bombed schools and starving children to understand that a ceasefire is urgent and necessary.”

She added: “I have and will continue to condemn the Israeli government for its violations of international law and war crimes.”

Pakistan has seen many fiercely emotional pro-Palestinian protests since the war in Gaza began last October.

Yousafzai’s “theatre collaboration with Hillary Clinton – who stands for America’s unequivocal support for genocide of Palestinians – is a huge blow to her credibility as a human rights activist,” popular Pakistani columnist Mehr Tarar wrote on social media platform X on Wednesday.

“I consider it utterly tragic.”

Whilst Clinton has backed a military campaign to remove Hamas and rejected demands for a ceasefire, she has also explicitly called for protections for Palestinian civilians.

Yousafzai has publicly condemned the civilian casualties and called for a ceasefire in Gaza.

The New York Times reported the 26-year-old wore a red-and-black pin to the “Suffs” premier last Thursday, signifying her support for a ceasefire.

But author and academic Nida Kirmani said on X that Yousafzai’s decision to partner with Clinton was “maddening and heartbreaking at the same time. What an utter disappointment.”

The war began with an unprecedented Hamas attack on Israel on October 7 that resulted in the deaths of around 1,170 people, according to an AFP tally of Israeli official figures. Hamas militants also abducted 250 people and Israel estimates 129 of them remain in Gaza, including 34 who the military says are dead.

Clinton served as America’s top diplomat during former president Barack Obama’s administration, which oversaw a campaign of drone strikes targeting Taliban militants in Pakistan and Afghanistan’s borderlands.

Yousafzai earned her Nobel Peace Prize after being shot in the head by the Pakistani Taliban as she pushed for girls’ education as a teenager in 2012.

However, the drone war killed and maimed scores of civilians in Yousafzai’s home region, spurring more online criticism of the youngest Nobel Laureate, who earned the prize at 17.

Yousafzai is often viewed with suspicion in Pakistan, where critics accuse her of pushing a Western feminist and liberal political agenda on the conservative country.

Pakistan commends UAE leadership for ‘swift’ response to record-breaking rains

- Pakistan’s foreign minister telephones UAE counterpart, expresses sympathy over devastation caused by torrential rains

- Heavy rains lashed UAE last week, turning streets into rivers and hobbling Dubai airport, world’s busiest for global passengers

ISLAMABAD: Pakistan’s Foreign Minister Ishaq Dar on Wednesday commended the United Arab Emirates (UAE) leadership for its swift and efficient response to the devastation caused by record-breaking rains in the desert country.

Heavy rains lashed the desert country last week, turning streets into rivers and hobbling Dubai airport, the world’s busiest for international passengers.

The rainfall was the UAE’s heaviest since records began 75 years ago, dumping two years’ worth of rain on the desert country.

“Foreign Minister Ishaq Dar held telephone conversation with Foreign Minister His Highness Sheikh Abdullah Bin Zayed of United Arab Emirates to express deepest sympathy on the devastation caused by recent torrential rains,” Pakistan’s Ministry of Foreign Affairs (MoFA) said.

“He commended the leadership of the UAE for the swift, efficient and timely administrative response to this natural calamity,” it added.

The foreign ministry said both representatives also exchanged views on matters of bilateral and global importance.

Pakistan’s PM Sharif last Friday telephoned UAE President Sheikh Mohamed bin Zayed Al-Nahyan, urging both countries to collaborate to tackle the impacts of climate change.

Sharif had lauded the UAE president for his “outstanding leadership qualities” and strong commitment to ensure the welfare of the Emirati people.

Pakistan has been prone to natural disasters and consistently ranks among one of the most adversely affected countries due to the effects of climate change. Torrential rains have killed more than 90 people in the South Asian country this month, according to authorities.

Malala Yousafzai faces backlash for Clinton musical co-credit

- Malala Yousafzai co-produced “Suffs” musical with Hillary Clinton, which depicts American women’s struggle for right to vote

- Yousafzai has been condemned by some for partnering with Clinton, an ardent supporter of Israel’s war on Palestine

LAHORE: Nobel laureate Malala Yousafzai faced a backlash in her native Pakistan on Wednesday, after the premier of a Broadway musical she co-produced with former US Secretary of State Hillary Clinton.

The musical, titled “Suffs” and playing in New York since last week, depicts the American women’s suffrage campaign for the right to vote in the 20th century.

However Yousafzai, who was awarded the Nobel Peace Prize in 2014, has been condemned by some for partnering with Clinton, an outspoken supporter of Israel’s war against Hamas.

Pakistan has seen many fiercely emotional pro-Palestinian protests since the war in Gaza began last October.

“Her theater collaboration with Hillary Clinton — who stands for America’s unequivocal support for genocide of Palestinians — is a huge blow to her credibility as a human rights activist,” popular Pakistani columnist Mehr Tarar wrote on social media platform X.

“I consider it utterly tragic.”

Whilst Clinton has backed a military campaign to remove Hamas and rejected demands for a ceasefire, she has also explicitly called for protections for Palestinian civilians.

Yousafzai has publically condemned the civilian casualties and called for a ceasefire in Gaza.

The New York Times reported the 26-year-old wore a red-and-black pin to the “Suffs” premier last Thursday, signifying her support for a ceasefire.

But author and academic Nida Kirmani said on X that Yousafzai’s decision to partner with Clinton was “maddening and heartbreaking at the same time. What an utter disappointment.”

Israel’s military offensive has killed at least 34,262 people in Gaza, mostly women and children, according to the Hamas-run territory’s health ministry.

The war began with an unprecedented Hamas attack on October 7 that resulted in the deaths of around 1,170 people, according to an AFP tally of Israeli official figures.

Clinton served as America’s top diplomat during former president Barack Obama’s administration, which oversaw a campaign of drone strikes targeting Taliban militants in Pakistan and Afghanistan’s borderlands.

Yousafzai earned her Nobel Peace Prize after being shot in the head by the Pakistani Taliban as she pushed for girl’s education as a teenager in 2012.

However the drone war killed and maimed scores of civilians in Yousafzai’s home region, spurring more online criticism of the youngest Nobel Laureate, who earned the prize at 17.

Yousafzai is often viewed with suspicion in Pakistan, where critics accuse her of pushing a Western feminist and liberal political agenda on the conservative country.