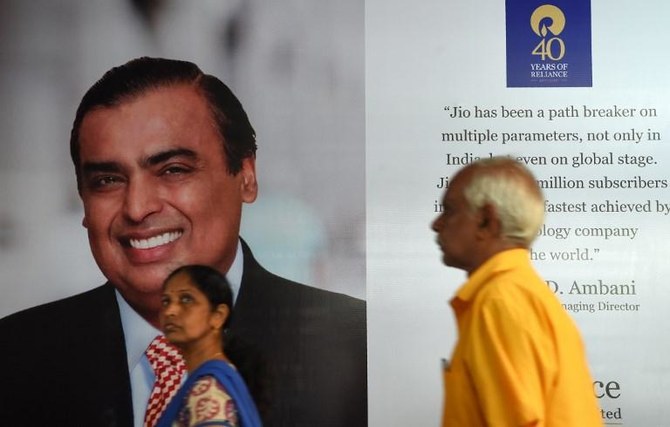

MUMBAI: The epic feud between India’s Ambani brothers has taken a new twist with the older and now vastly richer brother paying a debt owned by his struggling sibling, helping him avoid jail.

Mukesh and Anil Ambani fell out spectacularly after their rags-to-riches father died in 2002 without a will, leaving them to fight for control of his Reliance Industries conglomerate.

With their mother acting as peacemaker, they eventually agreed to split Reliance, at the time India’s most valuable listed company, and to stay out of each other’s sectors.

Mukesh’s half has thrived while Anil’s has tanked. Mukesh, 61, is now Asia’s richest man, worth $54.3 billion, dwarfing Anil’s assets of some $300 million, according to Bloomberg News.

Mukesh and his family live in a 27-story luxury Mumbai skyscraper believed to have cost more than $1 billion to build and regularly referred to as the world’s most expensive home.

Anil’s Reliance Communications is believed to have debts of around $4 billion and started insolvency proceedings in February.

That same month his woes deepened when the Supreme Court ruled he would be jailed if he failed to pay 5.5 billion rupees ($77 million) to Sweden’s Ericsson by Tuesday.

Reliance Communications dropped a bombshell late Monday by saying that the debt had been settled — implying that none other than Anil’s big brother had paid the money, prompting a humbled thank you.

“My sincere and heartfelt thanks to my respected elder brother, Mukesh, and (his wife) Nita, for standing by me during these trying times, and demonstrating the importance of staying true to our strong family values by extending this timely support,” said Anil, 59.

“I and my family are grateful we have moved beyond the past, and are deeply grateful and touched with this gesture,” he added in a statement.

Mukesh’s decision may not have been driven entirely by a desire to bury the hatchet, however.

Monday’s short statement did not say whether the payment was a gift or a loan but some Indian media reported that it may have been compensation for a deal between the two that recently collapsed.

Anil had hoped to offload his company’s telecom tower and spectrum business to his brother’s Reliance Jio for $2.4 billion.

But the deal, which hit regulatory hurdles and opposition from creditors, was confirmed dead by both companies on Tuesday.

It is also not the first time that the brothers have appeared to make up.

In 2011, they came together to dedicate a memorial to their father, and their mother Kokilaben declared the enmity over, telling reporters: “There is love between the brothers.”

But five years later the elder sibling sparked a brutal price war in the Indian telecom sector, launching his ultra-cheap Reliance Jio mobile network in 2016 — bringing Anil’s Reliance Communications to its current predicament.

‘Love between brothers’: India’s richest man Mukesh Ambani helps sibling avoid jail

‘Love between brothers’: India’s richest man Mukesh Ambani helps sibling avoid jail

- Ambani brothers Mukesh and Anil fell out spectacularly after their rags-to-riches father died in 2002 without a will

- Anil would have been jailed if he failed to pay 5.5 billion rupees ($77 million) to Sweden’s Ericsson by Tuesday

ACWA Power, IRENA join hands to accelerate global renewable energy transition

RIYADH: In a bid to add impetus to the adoption of clean energy sources worldwide, Saudi utility firm ACWA Power has signed a deal with the International Renewable Energy Agency, said a press release issued on Thursday.

The Saudi-listed firm said that the partnership aligns with its mission to provide sustainable energy solutions and seeks to accelerate the adoption and sustainable use of renewable energy across the globe.

ACWA Power will work closely with IRENA to share crucial insights on infrastructure investment in renewable energy, green hydrogen advancement, solar energy, smart grids, and the intersection of energy and water, the press release said.

The Saudi-listed company also announced its participation in various IRENA initiatives, such as Green Hydrogen, Collaborative Frameworks, Project Facilitation, the Alliance for Industry Decarbonization, the Utilities for Net-Zero Alliance, and the Coalition for Action.

As per the deal, ACWA Power and IRENA will investigate avenues to mobilize finance and investment for renewable energy projects, while also supporting infrastructure for the development, storage, distribution, transmission, and consumption of renewables.

Moreover, collaborative workshops and seminars will be arranged to exchange best practices, enhance skills, and promote awareness of the energy transition among youth, professionals, and the public using IRENA’s platforms and programs.

ACWA Power CEO Marco Arcelli said the partnership with IRENA marks a significant milestone in his company’s journey toward a sustainable energy future.

“By combining our strengths and resources, we are prepared to drive meaningful change and accelerate the transition to renewable energy on a global scale,” he said.

The CEO added that through collaborative partnerships and innovative solutions, ACWA Power remains committed to advancing the widespread adoption and sustainable use of renewable energy, shaping a brighter and more sustainable future for generations to come.

IRENA Director General Francesco La Camera commented: “We have less than a decade left to secure a fighting chance for a 1.5°C world. Accelerating the renewable-based energy transition needs industry leaders and this deal between IRENA and ACWA Power stands for the growing commitment of global industry to act on decarbonization.”

He added: “We need to act together to accelerate the sustainable use of renewables and green hydrogen across the globe.”

Closing Bell: TASI ends the week in green with trading turnover at $2.18bn

RIYADH: Saudi Arabia’s Tadawul All Share Index rose on Thursday, gaining 36.37 points, or 0.29 percent, to close at 12,502.35.

The total trading turnover of the benchmark index was SR8.19 billion ($2.18 billion) as 130 stocks advanced, while 90 retreated.

The MSCI Tadawul Index also increased by 5.98 points, or 0.38 percent, to close at 1,575.11.

The Kingdom’s parallel market, Nomu, followed suit and gained 305.77 points, or 1.16 percent, to close at 26,418.75. This comes as 33 stocks advanced, while as many as 27 retreated.

The best-performing stock on the main index was Saudi Arabian Amiantit Co., as its share price rose by 7.69 percent to SR30.80.

Allianz Saudi Fransi Cooperative Insurance Co. also performed well as its share price saw a 6.79 percent increase to close at SR20.16.

This comes as Abu Dhabi National Insurance Co. completed a strategic acquisition of a 51 percent stake in Allianz, according to the Emirates News Agency, WAM.

ADNIC Chairman Mohamed Al- Nahyan told WAM: “The connection between the UAE and Saudi Arabia is deep, mutually beneficial and ever-growing. At ADNIC, we see Saudi Arabia as a high-potential market which perfectly aligns with our overall growth strategy, and we are looking forward to unlocking new possibilities for growth and success.”

Other top performers include United Cooperative Assurance Co. and Saudi Pharmaceutical Industries and Medical Appliances Corp. whose share prices soared by 5.68 percent and 5.51 percent, to stand at SR11.16 and SR14.16 respectively.

The worst performer was Alkhaleej Training and Education Co., whose share price dropped by 5.27 percent to SR33.25.

On the announcements front, Saudi mining giant and Public Investment Fund subsidiary, Saudi Arabian Mining Co., known as Ma’aden, announced the launch of single stock options in a statement on Tadawul.

SSOs will enable local and international investors to effectively hedge and manage portfolio risks as well as diversify products available for trading in the market.

Saudi minister calls for ‘decisive financial policies’ to counter global economic uncertainties

RIYADH: Saudi Arabia’s finance minister on Thursday stressed the need for “decisive financial policies” across the world to navigate through uncertain economic conditions.

Speaking during the Spring Meetings 2024 of the IMF held in Washington, D.C, Mohammed Al-Jadaan noted that such a decisive approach would bolster resilience and sustainability amid the ongoing uncertainties.

He was attending a meeting of finance ministers and governors of the Middle East, North Africa, Afghanistan and Pakistan region with IMF Managing Director Kristalina Georgieva.

“I also participated in the Global Sovereign Debt Roundtable, where I highlighted the importance of enhancing Comparability of Treatment by establishing a clear and fair framework that ensures equitable treatment among all creditors,” Al-Jadaan said in a post on X.

Additionally, the minister participated in the second G20 finance ministers and central bank governors’ meeting held under the Brazilian presidency in Sao Paulo. He emphasized that effective climate action required a holistic approach.

He said that can be achieved “by integrating diverse sectors acknowledging the diversity of solutions to address climate challenges, including using innovative technologies to manage emissions.”

Al-Jadaan also met with Jose Vinals, chairman of Standard Chartered Bank, to discuss the regional and global economic outlook.

He also met with Spanish Minister of Economy, Trade, and Business, Carlos Cuerpo to discuss ways to enhance relations between the two countries.

Moreover, Al-Jadaan held talks with Jean Lemierre, chairman of Bank BNP Paribas, the global head of Official Institutions Coverage, Laurent Leveque, and the head of Debt Capital Markets, Alexis Taffin.

They discussed progress made in Saudi Arabia, as well as issues related to attracting investment and alternative financing.

Magrabi opens new complex in Makkah

RIYADH: With a new branch in Makkah, Magrabi Hospitals and Centers are expanding to more Saudi cities to meet the growing demand for specialized ophthalmological and dentistry care.

Minister of Health Fahad Al-Jalajel inaugurated the medical complex and one-day surgery center in the holy city, accompanied by Magrabi Hospitals and Centers CEO Mutasim Alireza, the Group’s Deputy CEO and Cheif Operating Officer Abdulrahman Barzangi, and several officials and dignitaries.

Al-Jalajel underscored that the opening reflects the Kingdom’s commitment to enhancing the quality of its healthcare services and transitioning toward a more comprehensive and integrated medical system.

He further stated that this initiative is a vital component of the Health Transformation Program, a foundational aspect of Saudi Vision 2030, which has achieved significant milestones and advancements in the medical sector under the leadership of Crown Prince Mohammed bin Salman.

Following the official inauguration, the minister toured the complex’s facilities, noting its significance as a notable project and a valuable contribution to the Kingdom.

Alireza said: “This specialized medical complex underscores our commitment to being at the forefront of healthcare for ophthalmology and dental services and continuing our mission to offer specialized medical services that meet community needs with the utmost quality and safety.”

In March, Magrabi Ophthalmology and Dentistry Hospital Dammam officially opened its doors in Al-Shaala, marking an achievement for medical care in Saudi Arabia.

The Magrabi Dammam health facility is the largest specialized center in the region and provides sub-specialized services, meeting the highest quality standards and leveraging the latest global technologies.

UAE records 64% surge in trademark registrations

RIYADH: The UAE recorded an annual 64 percent surge in trademark registrations, amounting to 4,610 in the first quarter of 2024, official data showed.

The figures, released by the nation’s Ministry of Economy, reveal the notable increase from 2,813 signups in the same period of 2023.

March emerged as a particularly prolific period, with 2,018 new brands reported.

The trademarks registered during this time span a wide range of key sectors, including smart technology, transportation, food and beverage and pharmaceuticals as well as medical devices, finance, real estate, and more.

The preceding months of January and February collectively accounted for 2,592 trademarks, further highlighting sustained growth and momentum in registrations.

As the country continues to position itself as a global business hub, trademark registrations serve as a crucial indicator of economic vitality and innovation-driven growth.

In a release on X, the ministry noted on April 17 that it has: “Worked on developing the trademark registration service, using the latest technologies and innovative solutions to achieve higher efficiency and better interaction with clients.”

The UAE’s adherence to international treaties and agreements further strengthens its trademark registration regime.

By adhering to agreements like the Paris Convention for the Protection of Industrial Property and the Agreement on Trade-Related Aspects of Intellectual Property Rights or TRIPS, the UAE facilitates international trademark registration and enforcement, empowering businesses to broaden their operations across borders.

The nation has further established mechanisms for enforcing trademark rights and combating infringement.

These include civil remedies, such as damages, injunctions, and seizure of infringing goods, as well as criminal penalties for trademark counterfeiting and piracy.