JEDDAH: Strong winds, rainfall and sandstorms hit Jeddah on Sunday afternoon, severely limiting visibility. It was a similar story across the Kingdom, as predicted by the General Authority of Meteorology and Environment Protection in its daily report on Sunday morning.

The authority expected Tabuk, Al-Jawf, Hail, Madinah and the northern borders to experience rain and sandstorms.

Strong winds were also expected to stir up sandstorms in Makkah, Riyadh and the Eastern Province. The southwestern and western highlands would be partly cloudy, the forecast said.

As for the seas, the forecast predicted south-to-south-westerly winds of up to 40 km/h will hit the Red Sea in the evening, with the wind direction changing to north-westerly in northern parts. Waves were expected to be between one and two meters. South-to-southeasterly winds in the Arabian Gulf were likely to reach up to 35 km/h, with waves ranging between one and 1.5 meters, according to the authority. Inclement weather is likely to continue in Makkah, Riyadh, Eastern Province, Qassim and other parts of the Kingdom on Monday.

Severe weather sweeps across Saudi Arabia

Severe weather sweeps across Saudi Arabia

- Strong winds were also expected to stir up sandstorms in Makkah, Riyadh and the Eastern Province

Saudi authorities highlight tourism commitments during UN Sustainability Week in New York

- Tourism minister says he hopes Kingdom can help lead transformation of sector into an environmentally friendly industry that supports communities and countries

NEW YORK: The Saudi tourism minister on Tuesday reiterated the Kingdom’s commitment to sustainable development of the travel sector.

Ahmed Al-Khateeb said that under the leadership of King Salman and Crown Prince Mohammed bin Salman, Saudi Arabia has become one of the most promising and attractive global travel destinations.

He was speaking at the start of an event at the UN headquarters in New York that aims to encourage a concerted approach to enhance the resilience of the sector at the highest level and maximize its contribution to sustainability.

The event, which takes place during UN Sustainability Week, was convened by the president of the 78th session of the UN General Assembly, Dennis Francis, in cooperation with UN Tourism.

Al-Khateed highlighted the efforts the Kingdom is making to address the environmental impacts of the travel and tourism sector, and noted that those efforts had contributed to the establishment, with Saudi Support, of the World Travel and Tourism Council and the World Center for Sustainable Tourism.

During the past two years, Saudi Arabia has sought, in its role as chair of the executive council of UN Tourism, to enhance the representation of the travel and tourism sector in international forums, Al-Khateeb said.

This has resulted in UN Tourism and the Kingdom cooperating on a package of initiatives to help achieve this goal, including a Best Tourism Villages award, a Tourism Opens Minds initiative, and a working group to reimagine the future of tourism, Al-Khateeb added. He also noted his country’s efforts to ensure the tourism sector was properly represented on the agenda for UN Sustainability Week.

Saudi Arabia topped the UN World Tourism list in 2023 in terms of growth among major tourism destinations in the number of international visitors. It also topped the list of G20 nations in terms of the number of international tourists, welcoming more than 27 million last year, Al-Khateeb said. He added that authorities in the Kingdom are developing plans and strategies to attract more than 70 million international tourists a year by 2030.

By then, he said, the Kingdom aims to have reduced carbon dioxide emissions by more than 278 million tonnes annually, designated 30 percent of land and marine territory as protected areas, and planted more than 600 million trees.

“The Kingdom has taken significant steps to launch the Sustainable Tourism Global Center, with the aim of accelerating the travel and tourism sector’s transition to climate neutrality, protecting nature and empowering communities around the world,” Al-Khateeb said.

He also highlighted major Saudi projects such as the NEOM smart city development and the Red Sea tourism project that aim to ensure they have positive effects on the climate, environment and local communities.

He also expressed the Kingdom’s aspiration for all countries to make concerted efforts, and be open to cooperation, to achieve the goal of sustainable development in the global travel and tourism sector.

Al-Khateeb said that through this important UN event, he hopes the Kingdom can spread a message to the world about the need to preserve the environment, and can help lead and support the transformation of tourism into an environmentally friendly industry that supports communities and countries worldwide.

UN Sustainability Week began on Monday at the UN headquarters in New York and continues until Friday.

Saudi crown prince discusses military escalation in the region with UAE president, Qatar emir

RIYADH: Saudi Arabia’s Crown Prince Mohammed bin Salman received two separate calls from UAE president Mohammed bin Zayed Al Nahyan and Qatar’s emir Tamim bin Hamad Al Thani, the Saudi Press Agency said early Wednesday.

The calls discussed the recent military escalation in the region and its repercussions on safety and security, in addition to the latest developments in Gaza.

They also underscored the importance of exerting efforts to prevent the situation from worsening and to spare the region the dangers of this escalation, the SPA added.

Saudi Arabia highlights its environmental and sustainability efforts at Our Ocean Conference

- The Saudi delegation at the two-day event is led by the CEO of the National Center for Wildlife, Mohammed Qurban

- During 8 previous events since the conference was launched in 2014, participants announced 2,160 commitments worth $130 billion

RIYADH: Saudi authorities showcased their programs and plans for environmental protection and sustainability initiatives on Tuesday, during the first day of the 9th Our Ocean Conference in Athens.

Delegates at this year’s event, the theme for which is “Our Ocean: An Ocean of Potential,” include representatives of governments and businesses, as well as activists and experts on marine environments, the Saudi Press Agency reported.

They are discussing topics such as protected marine areas, sustainable blue economies, maritime security, the relationship between oceans and climate change, sustainable fishing, and ways to combat marine pollution. Other issues to be addressed during the conference include sustainable tourism in coastal areas and on islands, ways to reduce plastic and microplastic pollution in marine environments, green shipping, and the green transition in the Mediterranean.

The Saudi delegation at the two-day event is led by the CEO of the National Center for Wildlife, Mohammed Qurban. The initiatives in the Kingdom highlighted at the conference revolve around ways to protect oceans and other water resources, and the sustainable utilization of marine resources.

“Our participation in the work of this global conference reflects the Kingdom’s keenness to support the efforts and endeavors aimed at achieving Sustainable Development Goals, protecting the seas, oceans and water resources, and the sustainable use of marine resources in a way that reflects the trends of the Kingdom and (its) Vision 2030 (development plan) to support environmental protection efforts,” said Qurban.

He highlighted several key national projects that are underway, including the Saudi Green Initiative, which aims to expand protected areas of the Kingdom to encompass 30 percent of its total land and sea territory, and plant 100 million mangrove trees by 2030.

“The Kingdom remains resolute in its mission to safeguard nature and its invaluable ecological treasures, with a special emphasis on the Red Sea region,” Qurban said. “We stand ready to deploy all necessary resources and efforts toward sustainable conservation endeavors.”

Participation in forums such as the Our Ocean Conference encourages the invaluable sharing of knowledge, a cross-pollination of ideas, and collaborations in the creation of innovative ways to tackle environmental challenges and promote sustainable practices, he added.

During the previous eight events since the conference was launched in 2014 by the US to fill a gap in global ocean governance at the time, participants have announced 2,160 commitments worth $130 billion, organizers said.

Other items on the agenda this year include ways in which oceans will meet the needs of future generations, ways to encourage governments, businesses and other organizations to adopt long-term commitments that have positive effects on oceans, and efforts to achieve the UN’s Sustainable Development Goals relating to oceans, seas and marine resources.

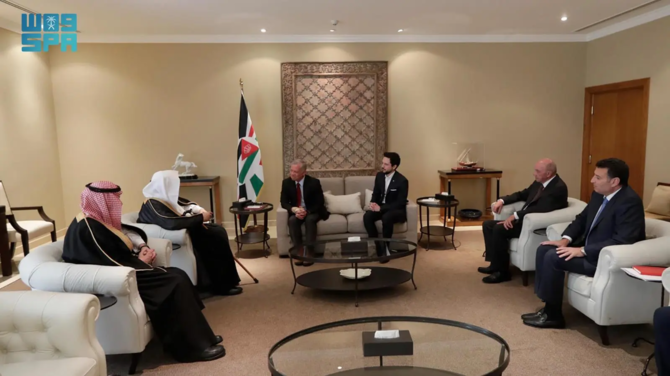

Saudi Shoura Council speaker meets king of Jordan in Amman

- Abdullah bin Mohammed Al-Asheikh also meets speaker of Jordan’s House of Representatives

- Sides discuss greater cooperation in parliamentary affairs

RIYADH: The Speaker of Saudi Arabia’s Shoura Council, Dr. Abdullah bin Mohammed Al-Asheikh, met Jordan’s King Abdullah II on Tuesday during an official visit to the country.

The meeting, held in the presence of Crown Prince Hussein, discussed “the historical fraternal relations between the two countries, their people and their leaders,” the Saudi Press Agency reported.

The sides also discussed ways to expand cooperation in various fields, especially parliamentary affairs, and the importance of maintaining their collaboration on issues of common interest.

Al-Asheikh led a delegation to Jordan following an invitation from Ahmed Safadi, speaker of the Jordanian House of Representatives.

In a separate meeting, the two speakers discussed ways to strengthen parliamentary cooperation and enhancing ties in other areas.

Al-Asheikh thanked his hosts for the warm reception and hospitality extended to his delegation.

“This visit comes within the framework of strengthening parliamentary cooperation between the two councils and keeping pace with the aspirations of the leadership of the two countries to strengthen bilateral relations and open new horizons for cooperation in a way that serves the interests of the two countries and their peoples,” he said.

Safadi noted the strong relations between the two countries and the high level of coordination between the Shoura Council and the Jordanian House of Representatives.

He also expressed his appreciation for the support Saudi Arabia had shown Jordan on various regional and international issues.

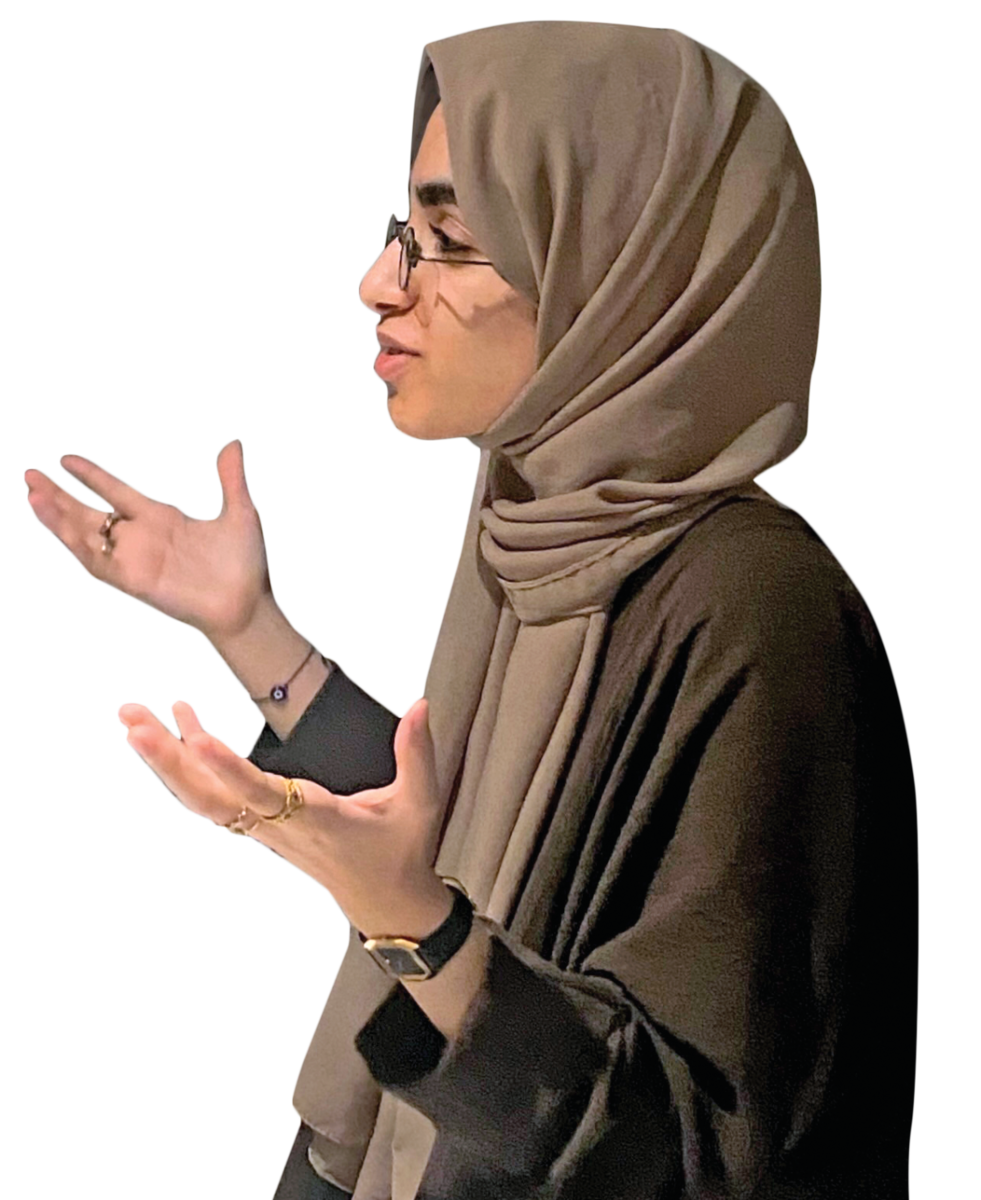

Young Saudi artist finds beauty in the ordinary

- Dana Almasoud’s works are inspired by historical Middle Eastern and European art aesthetics

RIYADH: When picking up a pencil or paintbrush to create an artwork, self-taught Saudi artist Dana Almasoud channels her inner child.

“As soon as a child picks up a pencil, they attempt to draw or capture a sense of what they see through their eyes on paper. The majority of them stop at some point in their childhood, for whatever reason,” Almasoud told Arab News.

“Fortunately, I was one of the few who never did. I had the luxury of a supportive mother who always looked forward to my next scribble.”

While pursuing her undergraduate studies in finance, as a freelance artist Almasoud explores a variety of styles, from fine art to surrealism and fantasy inspired by everyday scenes.

HIGHLIGHTS

• Much of Dana Almasoud’s work is inspired by Islamic historical art, characterized by its symbolism and emphasis on the beauty of spirituality.

• One of her first works inspired by Saudi culture was a commission from a man who wanted a portrait in the orientalist style.

• The artist says her work is an attempt to fill the void that excess simplicity and minimalism has created in recent years.

“The warm morning sun, the singing of the birds, the stoplights and the people. I am surrounded by life and I do my best to pour what I see into my work. What makes us human is how we make things from nothing,” she said.

Speaking about the “sanctuary” she has created in her room, she said: “It took me years of collecting, arranging and a lot of dedication to get it to how it is now.”

Much of Almasoud’s work is inspired by Islamic historical art, characterized by its symbolism and emphasis on the beauty of spirituality.

“In order for me to create things that resemble life, it only makes sense to use colors that already exist in nature,” she said.

“I take a lot of inspiration from historical art, both from Europe and the Middle East, since the pigments they used were extracted from natural sources and were perfectly saturated.”

She enjoys experimenting with new mediums, but drawing with a pencil is her preferred choice.

“I also do enjoy the occasional challenge of an ink brush, because once it sets its bristles on paper, you cannot go back. When it comes to painting with color (watercolors, acrylics, oils), I still consider myself in the process of learning,” she said.

The warm morning sun, the singing of the birds, the stoplights and the people. I am surrounded by life and I do my best to pour what I see into my work.

Dana Almasoud, Saudi artist

“I also experiment with pyrography, doll making, embroidery, linoleum block printing and, soon, murals.”

Almasoud said one of her first works inspired by Saudi culture was a commission from a man who wanted to look like an orientalist.

Her most recent painting is of a man selling ramsi tomatoes, the seasonal heirloom fruits with green “shoulders” that are prevalent in Qatif.

“These tomatoes are known for a special flavor and a lot of farmers from various lands tried to grow it themselves, but to no avail. For some reason, these tomatoes only taste special when they grow on that specific piece of land,” Almasoud said.

She said she had been told her work had “a layer of fog, where the edges are never harsh,” which reflects the high levels of humidity in the Eastern Province where she lives.

“I can see the Arabian Gulf from the window of my room. You can imagine the high rates of humidity, which is where I think that layer came from,” she said.

“I will always wonder how this translated into what I draw, but regardless, I do love it.”

Almasoud said her art was an attempt to fill the void that excess simplicity and minimalism has created in recent years.

“My art is an attempt to inspire people back to see the beauty in complexity and the intricacy of the small things in life.”

Speaking about the importance of art in the modern world, she said: “With the increase in the pace of the world, art has become even more important. It gives people and their minds something to hang on to, for them to not lose themselves and their identities in a busy world.”

For more information about the artist visit @esotericdana on Instagram.