OSLO: He built his fortune on dizzying forecasts but rain washed it all away: Einar Aas, one of Norway’s richest men, is now teetering on the verge of bankruptcy after betting the wrong way on the energy market.

A media-shy private trader, Aas made headlines on Friday in Norway and beyond, his misfortunes uncannily coinciding with the 10th anniversary of the collapse of US investment bank Lehman Brothers.

The 47-year-old power trader said in a statement late Thursday he was now risking “personal bankruptcy.”

Taking aggressive positions, Aas bet that the spread between energy prices on the Nordic and German electricity markets would narrow.

But, after an unusually dry summer, heavy rains earlier this week filled the reservoirs of hydroelectric dams that provide much of northern Europe’s electricity, sending prices tumbling.

At the same time, a rise in carbon prices pushed up the German cost of electricity, which is largely fossil fuel-based.

As a result, the spread between the two markets grew bigger than ever — up to 17 times the normal spread, according to the Financial Times.

Aas used his last remaining liquidity — 350 million kroner (36 million euros, $42.5 million) — to cover his positions, but still found himself in default of payment.

“I had positions that were too high compared to the liquidity on the market,” he said on Thursday.

It was a brutal fall from grace for the man born on a farm in the southern town of Grimstad and who has several times topped the list of Norway’s highest earners.

The former Agder Energi trader, who left the company to go private in 2005, made a mind-boggling 833 million kroner in taxable income in 2016, according to tax figures, which are public in the Scandinavian country.

This amounted to an hourly income of 95,000 kroner, taking his personal fortune to an estimated 2.17 billion kroner.

Described in the Norwegian media as a brilliant student who developed a passion for poker and race horse betting at secondary school, he now risks having to sell his luxury real estate digs, including a spectacular 350-square-meter (3,750-square-foot) rooftop apartment in central Oslo.

The exact scope of the damage remains to be determined, but the Norwegian media are already calling it “the biggest loss” ever recorded by a private person in Norway.

The Nasdaq stock exchange is also licking its wounds.

The market operator, which closed and liquidated Aas’ portfolio on Wednesday, said it had “fully contained” the risks.

But Nasdaq was nonetheless left 114 million euros in the hole.

Of that, 107 million came from the mutual default fund clearing house members must contribute to — reportedly two-thirds of the entire fund — and seven million from Nasdaq’s own default fund.

“For an experienced trader, who knows the market like the back of his own hand, to accumulate such an enormous position that he is unable to pull out unscathed is shocking,” Norwegian business daily Dagens Naeringsliv wrote in a comment.

“It is also shocking that Nasdaq allows a single actor to take on a risk that de facto wipes out the default fund as well as its own market capital,” it added.

Rain ruins one of Norway’s richest men

Rain ruins one of Norway’s richest men

- Taking aggressive positions, Aas bet that the spread between energy prices on the Nordic and German electricity markets would narrow

- However, the spread between the two markets grew bigger than ever — up to 17 times the normal position

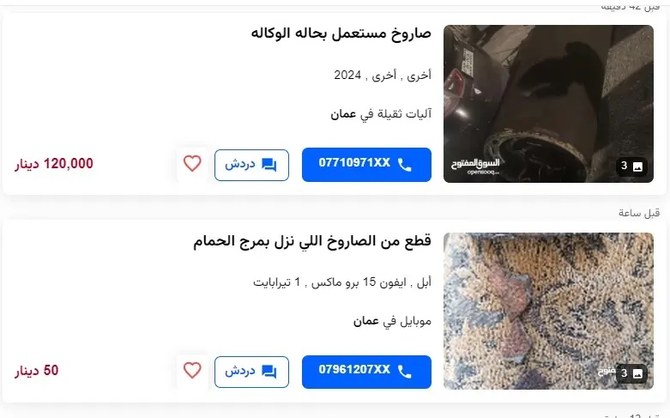

Used missiles for sale: Iranian weapons used against Israel are up for grabs on Jordan-based website

Used missiles for sale: Iranian weapons used against Israel are up for grabs on Jordan-based website

- Debris used in attack listed on OpenSooq online marketplace

LONDON: Fragments of missiles launched by Iran during the recent attack on Israel have been discovered for sale on Jordan’s prominent OpenSooq website, which is known for trading goods, including vehicles and real estate.

Al Arabiya reported on Sunday that the shrapnel was being advertised, with pieces described as “Used Iranian ballistic missile in good condition for sale,” and “One-time use ballistic missile for sale at an attractive price.”

The sellers had provided specifications and images of the missiles, describing them as “excellent type,” and mentioned their involvement in an “accident” resulting in “severe damage to the body.”

Some listings even included installment payment options.

Iran launched drones and missiles toward Israel late on Saturday as it retaliated following a suspected Israeli strike on the consulate annex building adjacent to the Iranian Embassy in Damascus, Syria, earlier this month.

While most projectiles were intercepted by a joint response from Israel, the US, UK, France, and Jordan, the attack marked Iran’s first direct military assault on Israeli territory, escalating tension and uncertainty in the region.

Following the attack, individuals shared photographs online showing debris that had fallen on Jordanian territory in areas such as Al-Hasa, Marj Al-Hamam, and Karak Governorate.

The Jordanian government confirmed that it had intercepted some flying objects in its airspace, with no reported damage or injuries.

Debris from such incidents often holds economic value. Metal debris from the Iraq War has been used by Iran-backed groups to finance their activities.

Similar items are sold online as military memorabilia, and there has been a surge in demand for such artifacts, as seen in Australia last year, preceding the country’s ban on the sale of hate symbols.

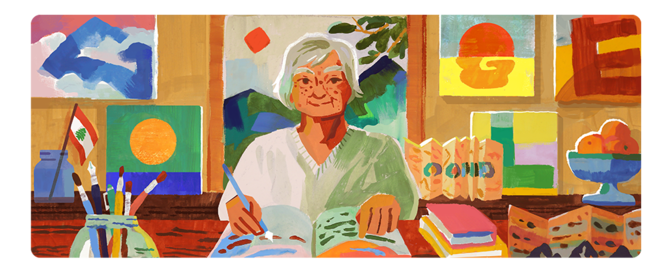

Google Doodle celebrates Lebanese-American poet and artist Etel Adnan

- Etel Adnan rose to fame for her 1977 novel Sitt Marie Rose about the Lebanese civil war

DUBAI: Google released its latest Doodle on Monday honoring Etel Adnan, a Lebanese-American poet, essayist and visual artist, considered one of the most accomplished Arab-American authors of her era.

The poet, who rose to fame for her 1977 novel Sitt Marie Rose about the Lebanese civil war, was born in Lebanon in 1925 to a Greek mother and a Syrian father, and grew up in multiple cultures, languages, nationalities and religions. Sitt Marie Rose won the France-Pays Arabes award and become a classic of war literature, so much so that it is taught in American classrooms.

In 1949, Adnan went to Paris to study philosophy at the Sorbonne before going to America to study at Harvard and Berkeley.

From 1958 to 1972, she taught philosophy in California, during which time she also started painting and writing poetry. She developed her literary voice in English and said abstract painting was the entry point into her native Arabic.

Adnan returned to Beirut, where from 1972 to 1976 she worked as the arts editor for two newspapers. She returned to California in 1979, then spent her later years living between Paris and Beirut.

In 2003, Adnan was named “arguably the most celebrated and accomplished Arab American author writing today” by the academic journal MELUS: Multi-Ethnic Literature of the United States.

Adnan’s most recent honor was in 2020. Her poetry collection “Time,” which is a selection of her work — translated from French by Sarah Riggs — won the Griffin Poetry Prize.

The King Abdulaziz Center for World Culture, or Ithra, earlier this year opened an eponymous exhibition in her honor – “Etel Adnan: Between East and West” – showcasing 41 of her works. The space at Ithra’s gallery is the first solo exhibition of Adnan’s work in Saudi Arabia, running until June 30.

The works on display span from the beginning of Adnan’s artistic career in the late 1950s through to her final creations in 2021, shortly before her death that year aged 96.

Some of the works are on loan from significant international institutions such as the Sharjah Art Foundation, Sfier-Semler Gallery and Sursock Museum. Some are part of private collections.

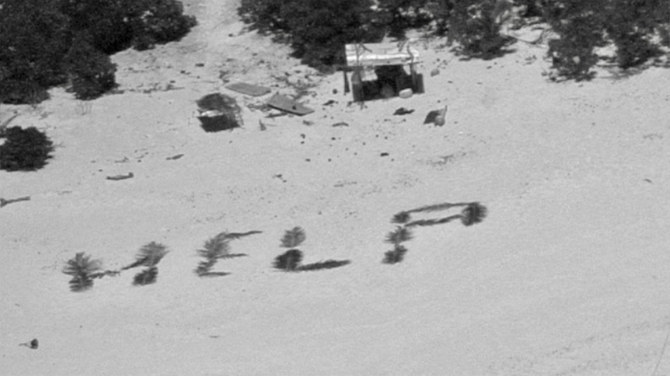

‘HELP’ written in palm fronds lands rescue for Pacific castaways

- The trio became stranded on Pikelot Atoll, a tiny island in the remote Western Pacific, after their motor-powered skiff malfunctioned

- A US Navy aircraft saw the "help" sign and a ship came later to rescue the stranded trio, all experienced mariners in their 40s

LOS ANGELES: Sometimes all you have to do is ask for “HELP“: That’s what three men stranded on a deserted Pacific island learned earlier this week, writing the message in palm fronds which were spotted by US rescuers.

The trio, all experienced mariners in their 40s, became stranded on a lonely island after setting off from Micronesia’s Polowat Atoll on March 31 in their motor-powered skiff which subsequently experienced damage.

They were reported missing last Saturday by a woman who told the US Coast Guard her three uncles never returned from Pikelot Atoll, a tiny island in the remote Western Pacific.

“In a remarkable testament to their will to be found, the mariners spelled out ‘HELP’ on the beach using palm leaves, a crucial factor in their discovery,” said search and rescue mission coordinator Lt. Chelsea Garcia.

She reported that the trio was discovered Sunday on Pikelot Atoll by a US Navy aircraft.

“This act of ingenuity was pivotal in guiding rescue efforts directly to their location,” she said.

The aircraft crew dropped survival packages, and rescuers one day later dropped a radio which the mariners used to communicate that they were in good health, had access to food and water, and that the motor on their 20-foot (six-meter) skiff was no longer working.

On Tuesday morning a ship rescued the trio and their equipment, returning them to Polowat Atoll, the Coast Guard said.

In August 2020, three Micronesian sailors also stranded on Pikelot were rescued after Australian and US warplanes spotted a giant “SOS” they had scrawled on the beach.

Dining hall with Trojan War decorations uncovered in ancient Roman city of Pompeii

- One fresco depicts Paris and Helen, whose love affair caused the Trojan War, according to classical accounts

- Pompeii and the surrounding countryside was submerged by volcanic ash when Mount Vesuvius exploded in AD 79

ROME: A black-walled dining hall with 2,000-year-old paintings inspired by the Trojan War has been discovered during excavations at the Roman city of Pompeii, authorities said on Thursday.

The size of the room — about 15 meters long and 6 meters wide — the quality of the frescoes and mosaics from the time of Emperor Augustus, and the choice of characters suggest it was used for banquets, Pompeii Archaeological Park said.

“The walls were painted black to prevent the smoke from the oil lamps being seen on the walls,” Gabriel Zuchtriegel, head of the park, said.

“People would meet to dine after sunset, and the flickering light of the lamps had the effect of making the images appear animated, especially after a few glasses of good Campanian wine.”

Pompeii and the surrounding countryside was submerged by volcanic ash when Mount Vesuvius exploded in AD 79, killing thousands of Romans who had no idea they were living beneath one of Europe’s biggest volcanoes.

The site has seen a burst of archaeological activity aimed at halting years of decay and neglect, largely thanks to a 105-million-euro ($112 million) European Union-funded project.

The dominant theme of the newly discovered paintings is heroism and fate.

One fresco depicts Paris and Helen, whose love affair caused the Trojan War, according to classical accounts. Another one shows doomed prophetess Cassandra and the Greco-Roman god Apollo.

According to Greek mythology, Cassandra predicted the Trojan War after receiving the gift of foresight from Apollo, but no-one believed her. This was because of a curse Apollo put upon her for refusing to give herself to him.

Bosnian Formula One fan brings speed dreams to the mountains

- The 36-year-old mechanic bought the car from another racing superfan in the capital Sarajevo last year

- Since purchasing the vehicle, he has been methodically making tweaks to its exterior, while nursing hopes of one day replacing its engine

KLJUC, Bosnia and Herzegovina: Far from the glitzy racetracks where legendary drivers made their mark in the world of Formula One, Himzo Beganovic has turned his dreams of speed into reality along the dirt roads of northwestern Bosnia.

“I always wanted to own a Formula One car, to have it in front of the house, to be able to go for a spin,” Beganovic told AFP, as he tuned up a replica “Ferrari red” race car outside his home near the Bosnian town of Kljuc.

The 36-year-old mechanic bought the car from another racing superfan in the capital Sarajevo last year.

The replica, which took two years to build, remains a ramshackle mock-up, crafted with sheet metal — a far cry from the advanced carbon fiber used in the multimillion-dollar cars of Formula One teams.

Despite Beganovic’s limited means, he still hopes to make his car more efficient, bit by bit.

Since purchasing the vehicle, he has been methodically making tweaks to its exterior, while nursing hopes of one day replacing its engine.

Along with a more powerful motor, Beganovic hopes to install an automatic gearbox and better tires.

“When you drive Formula One, you feel like you are flying. It is not like a car,” he said.

“It is the only one in Bosnia-Herzegovina. There are no others.”

A self-professed lover of “fast driving” and taking “dangerous turns,” Beganovic has been turning heads along Bosnia’s mountain roads where he reaches speeds of up to 200 kilometers per hour (124 miles per hour).

Other times he simply parks the car in a popular area and lets people check it out.

“I sometimes put it on a trailer to take it to other places in the country. People come, photograph it, and ask questions,” he said.

“The feeling is indescribable.”

For Beganovic, there was no question of what color the car would be.

As a longtime fan of seven-time world champion Michael Schumacher, the Ferrari-red paint pays tribute to the driver who won five titles with the famous Italian team.

Since the legendary German champion’s skiing accident in 2013 in the French Alps, Beganovic said he has yet to find another driver that interests him as much.

With Schumacher in mind, he hopes to put an Audi V-8 engine into his car soon.

“When a German engine and Bosnian ingenuity combine, you get an Italian car,” laughed one of Beganovic’s neighbors.