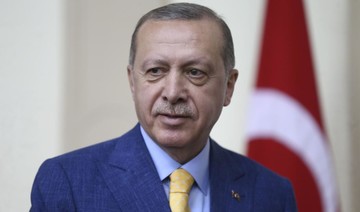

ANKARA: Turkish President Recep Tayyip Erdogan is facing a potentially severe crisis just a month ahead of elections over the sharp depreciation of the lira which risks buffeting his campaign and even influencing voters.

In an indication of the severity of the situation, the central bank hiked one of its key interest rates 300 basis points (bps) after an emergency meeting on Wednesday, after inaction for days amid Erdogan’s opposition to rate rises.

Erdogan has always painted himself as a champion of the Turkish economy, pointing to how growth and investment have expanded under his rule after the misery of Turkey’s 2000-2001 financial crisis.

But the lira’s depreciation by nearly 19 percent against the US dollar since the snap polls were called on April 18 may signal the economy could be a burden, rather than a boost, for Erdogan.

The Turkish strongman, a doughty campaigner and so far undefeated at the ballot box in any poll, has been strangely reticent in this campaign although his team emphasises his rallies will get fully under way on Saturday.

And when he speaks to the crowds in town squares nationwide, Erdogan will have to now confront people’s fears that the external value of the money in their pocket is crumbling.

“For Turks, a weak currency translates into a weak economy, so it’s difficult to see how this will not hurt Erdogan and the AKP (ruling party) even though their voter base is fairly loyal,” said Atilla Yesilada, country adviser at Global Source Partners in Istanbul, said.

Although the country was the fastest growing in the G20 in 2017, recording 7.4 percent growth, concerns remain over the economy overheating, the widening current account deficit and double-digit inflation. Inflation is currently at 10.85 percent.

Erdogan himself has spooked the markets by saying he plans a greater say in monetary policy — despite the nominal independence of the central bank — after the polls.

The central bank move to raise the late liquidity window (LLW) lending rate from 13.5 percent to 16.5 percent prompted a sharp rally in the value of the lira.

Even though the June 24 polls come at a time of strains with the West and the Turkish army is fresh from a successful operation inside Syria, pollsters’ surveys show the economy is the issue of most concern to Turks.

In polling done earlier this month by Ankara-based MAK Consultancy, 45 percent of 5,400 respondents told researchers the country’s most significant issue was the economy.

Another survey last month by Gezici pollster found 48.6 percent said economic woes were Turkey’s biggest issue.

And Turks’ faith in their economy is falling: the consumer confidence index dropped by 2.8 percentage points in May to 69.9 from 71.9 in April, according to the Turkish statistics office on Wednesday.

“Globally, it is shown that the economic performance has an immediate impact on voting behavior. Hence, the sizeable economic costs may have an impact on voting behavior,” Selva Demiralp, associate professor of economics at Koc University in Istanbul, told AFP.

She warned it was “hard to predict how the economy will evolve in the near future.”

Yesilada added: “If this exchange rate shock translates into weaker economic performance they will lose some more votes and the spectre of AKP losing power could become a reality in a fair election.”

Analysts have long said Erdogan’s administration has been split between pro-market pragmatists like Deputy Prime Minister Mehmet Simsek, a former Merrill Lynch strategist, and advisers known for outlandish statements such as Yigit Bulut.

The central bank’s decision ended days of suspense on the markets over whether it would raise rates after Erdogan called for lower rates to boost growth.

“It’s high time to restore monetary policy credibility and regain investor confidence,” Simsek said on Twitter after the bank’s move.

“The Central Bank governor and members of the monetary policy committee have my full backing in doing what’s necessary to stem the slide in lira and achieve price stability,” he added.

Erdogan has often blamed outsiders for economic problems in Turkey, railing against unnamed actors trying to wage “economic terror” against the country.

Deputy Prime Minister Bekir Bozdag on Wednesday said voters were aware of the games being played.

“They are deluded if they think they can change the outcome of the election by playing with the dollar,” Bozdag said.

Turkish central bank raises rates sharply to prop up lira

Turkish central bank raises rates sharply to prop up lira

- Turkey's central bank announces a sharp hike in interest rates to boost the embattled lira

- The bank said after an emergency meeting of its monetary policy committee it was raising the late liquidity window (LLW) lending rate from 13.5 percent to 16.5 percent

Saudia unveils beta version of new Travel Companion platform

RIYADH: The Kingdom’s flagship airline Saudia has launched a beta version of its digital platform, the Travel Companion, powered by advanced artificial intelligence, aiming to transform the industry.

The new initiative, unveiled during a special event, is part of a two-year plan developed in partnership with global professional services firm Accenture.

“This platform, resulting from our ongoing collaboration with Accenture, signifies our forward-looking approach to providing guests with unparalleled convenience and flexibility,” the Director General of Saudia Group, Ibrahim Al-Omar, said.

The main objective of this launch is to transform how travelers engage with the airline and establish new benchmarks for digital travel.

TC, initially named, offers personalized and tailored solutions to meet individual preferences and needs, providing search results from trusted and authenticated sources and incorporating visual aids in its responses.

The interface is designed as a comprehensive, one-stop solution that enables users to book concierge services, including hotels, transportation, and restaurants, as well as activities and attractions, without the need to switch between multiple platforms.

“This is a beta version. This is not the product. We will keep enhancing and developing it,” Al-Omar stressed.

Moreover, it establishes seamless connections with transportation platforms and various train companies, ensuring a smooth and uninterrupted journey.

Commenting on the new announcement, Chief Data and Technology Officer at Saudia, Abdulgader Attiah, told Arab News: “It’s like having the VVVIP concierge service at your hand. For public, it’s not any anymore VIP service. It’s not a paid service. You have it for free, and it will give you all what all kind of services that VVIP service would provide to you, so it’s your private concierge.”

He added: “We will be the anchor for the travel industry. We are not anymore, an operator for an airline, but with this app, you will be an anchor for all tourism ecosystem in a single app, so everyone can collaborate in this app, and having the links, so you don’t need to communicate with any other party, so through this app, you can communicate to all travel ecosystem.”

In future phases, Saudia plans to add more features, including voice command and digital payment solutions.

“Once we add the complete solution we will add the more services, which is we call it the concierge services; booking for hotels and transportation and the restaurants, all of these ones is done during the, next two years, and this is the complete life cycle of the, vision we have today,” Attiah told Arab News.

He added: “If you want to develop this app, five years back, it would take three, four years. Today, we have developed only in seven, eight months. To that from the inspirational part to having an actual booking, we started back in June and now we are live.”

Attiah also underlined that Saudia is the first airline in the world to implement a GenAI-based chatbot that can perform end-to-end actions, meaning it can not only engage in conversation but also execute tasks or actions based on user requests.

With an always-on Travel Companion available through a telecom e-SIM card provided by Saudia, users can stay connected globally without relying on additional internet providers.

Furthermore, users can purchase data packages for extended use, guaranteeing continuous access to the platform’s services.

Saudi economy witnessing a fundamental shift, says minister

RIYADH: Since the launch of Vision 2030, Saudi Arabia has witnessed a fundamental shift in its economy and the business environment is transforming with the creation of new sectors, said the Kingdom’s economy minister.

Faisal Al-Ibrahim was speaking at a conference in Riyadh on Wednesday during which he highlighted the fast-evolving business landscape of the Kingdom focused on diversifying its income sources away from oil.

Speaking at the event titled “Industrial policies to promote economic diversification,” the top official said there have been fundamental changes in the legislative and economic regulations to promote sustainable development since the launching of the Vision 2030 plan.

He said the Kingdom’s efforts to diversify its economy have led to the creation of new sectors due to the initiation of several megaprojects such as NEOM, the Red Sea, and others.

“We stand at a crossroads to change the global economy,” Al-Ibrahim said.

He stressed the need for strategies to ensure a flexible and sustainable economy.

“The presence of foreign investments will develop competitiveness in the long term,” the minister affirmed.

The minister also highlighted how the Kingdom was working in the medium term to focus on transforming sectors that represent a technological shift.

Saudi Arabia is keen on achieving development in the medium term by balancing short-term profits and promoting long-term success, Al-Ibrahim highlighted.

Since the launch of the vision, the Ministry of Economy and Planning has conducted several economic studies aimed at diversifying the economy by developing objectives for all sectors, raising complexity levels, and studying emerging economies to enhance the Kingdom’s capabilities.

Saudi Arabia closes April sukuk issuance at $1.97bn

RIYADH: Saudi Arabia has completed its riyal-denominated sukuk issuance for April at SR7.39 billion ($1.97 billion), representing a rise of 66.44 percent compared to the previous month.

The National Debt Management Center revealed that the Shariah-compliant debt product was divided into three tranches.

The first tranche, valued at SR2.35 billion, is set to mature in 2029, while the second one amounting to SR1.64 billion is due in 2031.

The third tranche totaled SR3.51 billion and will mature in 2036.

“The Kingdom also plans to expand funding activities during the year 2024, reaching up to a total of SR138 billion from what has been stated previously in the Annual Borrowing Plan, with a portion of this amount already covered up to date,” said NDMC in a press statement.

It added: “This step comes with the aim of capitalizing on market opportunities to achieve proactive financing for the coming year and utilizing it to bolster the state’s general reserves or seize additional opportunities to enhance transformative spending during this year, thereby accelerating strategic projects and programs of Saudi Vision 2030.”

In March, NDMC concluded its second government sukuk savings round for March, with a total volume of requests reaching SR959 million, allocated to 37,000 applicants.

The center added that the financial product, also known as Sah, offers a return of 5.64 percent, with a maturity date in March 2025.

Earlier this month, Fitch Ratings, in a report, said that global sukuk issuance is expected to continue growing in the coming months of this year, driven by funding and refinancing demands.

The credit rating agency noted that various other factors like economic diversification efforts by countries in the Gulf Cooperation Council region and development of the debt capital market will also propel the growth of the market in the future.

In January, another report released by S&P Global revealed that sukuk issuance worldwide is expected to total between $160 billion and $170 billion in 2024, driven by higher financing needs in Islamic nations.

The report noted that higher financing needs in some core Islamic finance countries and easing liquidity conditions across the world are two crucial factors which will drive the growth of the market this year.

Closing Bell: TASI edges down to close at 12,355 points

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Wednesday, losing 128.72 points, or 1.03 percent, to close at 12,355.69.

The total trading turnover of the benchmark index was SR8.45 billion ($2.25 billion) as 41 of the listed stocks advanced, while 187 retreated.

Similarly, the MSCI Tadawul Index decreased by 14.78 points, or 0.95 percent, to close at 1,548.62.

Also, the Kingdom’s parallel market Nomu dipped, losing 365.84 points, or 1.37 percent, to close at 26,326.12. This comes as 17 of the listed stocks advanced, while 45 retreated.

The best-performing stock of the day was Al-Rajhi Co. for Cooperative Insurance as its share price surged by 9.87 percent to SR138.

Other top performers include Al Sagr Cooperative Insurance Co. and First Milling Co., whose share prices soared by 6.38 percent and 5.63 percent, to stand at SR35.85 and SR78.80, respectively.

In addition to this, other top performers included Batic Investments and Logistics Co. and Saudi Research and Media Group.

The worst performer was Al-Baha Investment and Development Co., whose share price dropped by 7.14 percent to SR0.13.

Other weak performers were National Co. for Learning and Education as well as Arriyadh Development Co., whose share prices dropped by 5.95 percent and 5.91 percent to stand at SR148.60 and SR22.60, respectively.

Moreover, other subdued performers also include Red Sea International Co. and AYYAN Investment Co.

On the Kingdom’s parallel market Nomu, the best-performing stock of the day was Osool and Bakheet Investment Co., as its share price surged by 12.05 percent to SR40.90.

Other top performers on Nomu include Arabian Plastic Industrial Co. and Lana Medical Co., with their share prices soaring by 7.42 percent and 3.59 percent, respectively, reaching SR37.65 and SR41.85.

The worst performer was Jahez International Co. for Information System Technology, whose share price dropped by 5.88 percent to SR32.

Other weak performers were Alhasoob Co. as well as Aqaseem Factory for Chemicals and Plastics Co., whose share prices dropped by 3.61 percent and 3.38 percent to stand at SR64.10 and SR62.80, respectively.

On the announcements front, HSBC Saudi Arabia, serving as sole financial advisor, joint bookrunner, underwriter, and lead manager, has announced the intention of Dr. Soliman Abdel Kader Fakeeh Hospital Co., known as Fakeeh Care Group, to proceed with its initial public offering on the main market of Saudi Exchange.

According to a statement, the offering will include 49.8 million ordinary shares, with 19.8 million existing shares and 30 million new shares upon completion.

This offering is set to represent 21.47 percent of the company's share capital post-capital increase.

Saudi Exchange and the Capital Market Authority approved the listing and IPO, respectively, with the pricing of shares to be determined after the book-building period.

Ministry tenders contract for expansion of Prince Faisal bin Fahd Stadium

RIYADH: Saudi Arabia’s Sports Ministry has tendered a contract to boost the capacity of Riyadh’s Prince Faisal bin Fahd Stadium to 45,000 seats up from its current 22,188.

The expansion project comes as the Kingdom prepares to host the Asian Football Confederation Asian Cup in 2027, reported MEED.

This initiative aligns with Saudi Arabia’s plan to build sports stadiums under its SR10.1 billion ($2.7 billion) capital projects program.

The ministry requested proposals on April 8 and expects to receive bids on June 14.

In April, the ministry also tendered an early works contract for the expansion and development of the Prince Mohammed bin Fahd Stadium in Dammam.

At the time, the scope of the contract included the stadium’s decommissioning, demolition, and bulk excavation, as well as the relocation and setting up of related facilities.

In July 2023, the ministry invited firms to submit pre-qualification documents for the main construction contracts for the schemes in the capital projects program.

The undertakings, which are set for completion before the 2027 AFC Asian Cup, entail increasing the capacity of King Fahd Stadium in Riyadh to 92,000 seats and boosting the seating capacity of Prince Mohammed Bin Fahd Stadium to 30,000 seats.

It also includes increasing the seating capacity of the Prince Saud bin Jalawi Stadium in Al-Kahir to 45,000 and building a sustainable New Riyadh Stadium north of the city with 45,000 seats.

Another main element of the ministry’s projects program is the construction of as many as 30 new training grounds and facilities in proximity to the stadiums that will be used for the 2027 competition.

Construction on the projects is expected to start in July 2024 and scheduled to be completed by December 2025.

A total of 18 facilities will be ready in time for the 2026 AFC Women’s Cup.