LONDON: Ali Rashid Lootah has a reputation for being a tough businessman. He has certainly led Nakheel through the toughest of times.

But nine years on from a crisis that threatened to send the Palm Islands developer to oblivion, the company has quietly built up a retail empire that will soon cover 17 million square feet of leasable area across the city.

Nakheel was arguably more instrumental than any other company in awakening the world to the ambition and drive of a small trading sheikhdom called Dubai.

When the developer completed The Palm more than a decade ago, it cemented the emirate’s international reputation as a place that could make the impossible possible.

The Palm made people believe in Dubai’s ability to deliver on the big talk. Without it, there may not have been a Burj Khalifa, a Ski Dubai or a Dubai Mall. It was not just about making tourists gasp in admiration from the top of double-decker sightseeing buses but, rather, eliciting the same enthusiastic response from the international investment community, which bought into this vision with nothing but “Field of Dreams” belief.

That belief suffered what could have been a fatal blow in the wake of the 2009 Dubai World debt crisis when the state-controlled conglomerate was forced into restructuring $23.5 billion of debt — most of it amassed by Nakheel.

The debt crisis marked the end of the era of “name lending,” not only in Dubai but across the Gulf — where banks had lent billions on the strength of a reputation — and with little care for credit ratings or due diligence.

That all changed on March 25, 2009. On the eve of the Eid Al-Adha holiday weekend, the Dubai World conglomerate, one of the big three “Dubai Inc” companies, asked its creditors to “stand still” on billions of dollars of debt.

Taking the helm of the developer in 2010, in the wake of a financial crisis that should have wiped it out, Lootah’s first job was to instil some discipline into a company that had lost the run of itself.

That demanded regaining investor confidence and formulating a business model that was not literally built on sand.

A civil engineer by profession, his tenure as chairman has been characterized by a sober and superlative-free approach to property development.

“I’m a pragmatic guy,” he said. “Why does everything have to be big? You have to launch what the market wants.”

Under Lootah, Nakheel has dialled back on the mega-projects for which it became known during the boom years. The Dubai World crisis, in which Nakheel was the principal protagonist, represented a radical change of direction for a developer that for much of the previous decade had kept the dredging fleets of the Netherlands busy building ever-bigger artificial islands.

Each day the fleets would sail out to the shallow waters of the Gulf before lowering giant suction machines to suck up the sand from the seabed. Then they would sail back to blast it from their hulls along the Dubai coastline in formations that became so large they would eventually be visible from space. It was construction on an epic scale.

Before the crisis, each new project had to outdo the one that went before.

Palm Island was followed with plans for another development down the coast in Jebel Ali and then another up the coast in Deira, and then a collection of islands formed in the shape of the globe that was called “The World.”

That, in turn, was followed with another islands development called “The Universe” which was never built, coinciding as it did with the global financial crisis.

In a few years, the hype had become the business model, and there could be only one outcome.

Since the Dubai World crisis, Nakheel has reinvented itself as one of Dubai’s biggest mall operators with ambitions to become a major hospitality player as well. By reducing its exposure to the boom and bust of residential development, the Palm builder is gradually morphing from developer to landlord.

The company now has about 15 malls across the city either under development or already opened — including the vast Ibn Battuta Mall and the soon-to-be-delivered Nakheel Mall on the trunk of The Palm. Hotel building is also a core focus of the new Nakheel, which is investing more than

€1 billion ($1.19 billion) in the hospitality sector and has 17 hotel properties under development.

But in the quest for recurring revenue, does Nakheel risk replacing a residential bubble with a retail one?

Lootah doesn’t think so, despite a glut of new shop space that has forced commercial rents down across the city.

He acknowledges that “landlords are adjusting” their rent expectations, but stresses that Nakheel malls are built to serve the developer’s existing communities.

“All our projects are carefully studied. We have retailers coming forward to rent space in our developments, so I think they will know their business and where to spend their money.”

Lootah estimates that the Nakheel Mall now under construction is already 70 percent pre-let, a figure that is likely to rise to about 80 percent by the end of the year. About 75 percent of The Pointe, another Nakheel bar and restaurant development on The Palm, is also let ahead of its completion later this year.

Still, the retail sector is hurting in Dubai, with the emirate’s government recently announcing plans to investigate measures that will help support the sector, which is confronting not only a glut of new space but also the introduction of value-added tax (VAT) since the beginning of the year.

“The government is trying to help retailers and see what it can do,” he said. “Dubai depends on tourism and retail is one of the attractions of Dubai.”

Eight years after Lootah took the helm at Nakheel, the developer has repaid the bonds it sold as part of its financial restructuring and is ready to take on new debt to fund its expansion. The chairman has worked hard to regain the confidence of contractors and investors in that time.

Lootah sees that as a big part of his job and, typically, does not like to launch projects before contracts for their construction have been tendered. “We want the buyer to be confident,” he said.

He travels overseas frequently, often to finalize deals with retail or hospitality partners, such as the $160 million tie-up last month with Vienna House, Austria’s biggest hotel operator.

At such events you will be more likely to find him in the hotel gym than the reception ballroom.

“Everywhere I go, I take my gym bag,” he said.

We meet at one such event in Madrid where the movers and shakers of the global retail industry have congregated, many in survival mode amid the decimation of the High Street.

Lootah has just sat in on one of the conference sessions titled “Keep it simple, stupid.”

He chuckles at the title, which could also describe Nakheel’s approach to building small community malls.

That may explain why digital disruption in the retail industry does not, for the time being, seem to be causing Lootah too much lost sleep.

He is a believer in Dubai’s ability to reinvent itself and adapt to changing economic realities. “Retail will stay,” he said. “It will adjust. It will not die.”

A look behind Dubai’s Nakheel Chairman Ali Rashid Lootah’s ‘instrumental’ vision

A look behind Dubai’s Nakheel Chairman Ali Rashid Lootah’s ‘instrumental’ vision

- Chairman Ali Rashid Lootah has led Dubai's Palm Islands through the toughest of times

- Nakheel has dialled back on the mega-projects for which it became known during the boom years

Pakistan pushes to forge strategic, economic partnership as Saudi FM visits Islamabad

ISLAMABAD: Pakistani top leaders, including the prime minister, president and foreign minister, said on Tuesday the ongoing visit of Saudi Foreign Minister Prince Faisal bin Farhan to Islamabad would help transform a longstanding friendship between the two nations into a strategic and commercial partnership.

Prince Faisal arrived in Pakistan on Monday on a two-day visit aimed at enhancing bilateral economic cooperation and pushing forward previously agreed investment deals. His trip comes a little over a week after Crown Prince Mohammed bin Salman met Prime Minister Shehbaz Sharif in Makkah and reaffirmed the Kingdom’s commitment to expedite investments worth $5 billion.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and the top source of remittances to the cash-strapped South Asian country.

“We aim to transform our traditionally fraternal ties into a strategic and economic partnership,” Foreign Minister Ishaq Dar said as he addressed a Pakistan-Saudi Arabia Investment Conference in Islamabad, held under the umbrella of Pakistan’s Special Investment Facilitation Council, set up last year to oversee all foreign investments.

“Your investments are not just financial commitments but are crucial in nurturing a deeply valued partnership,” Dar told the visiting dignitary.

“It is through the SIFC platform that we intend to streamline investment processes while ensuring rapid decision making and efficient handling of investments … The SIFC has a central role in augmenting our infrastructure and streamlining our regulatory frameworks to set the stage for a flourishing investment friendly economic environment.”

Dar said SIFC would ensure that investments were “swift and mutually beneficial, embodying our commitment to facilitating foreign direct investment in Pakistan.”

Pakistan was blessed with fertile agricultural lands, minerals and a large and dynamic population, complemented by a flourishing IT sector and abundant prospects for renewable energy creation, the foreign minister added.

He said Pakistan’s fertile lands and a vast network of water resources presented numerous investment opportunities in agri-tech and food processing, with the South Asian nation having the potential to become the region’s food basket.

“Our mining sector is marked by untapped potential especially in the expansive Tethyan belt known for its abundant deposits of copper, gold and other valuable minerals,” Dar said. “The strategic advancements in these areas are highlighted by projects such as Riko Diq copper [and gold] project which exemplifies our commitment to leveraging our natural resources for mutual benefit.”

On Sunday, Pakistani state media reported Saudi Arabia was likely to invest $1 billion in the mine project in Pakistan’s southwestern Balochistan province, one of the world’s largest underdeveloped copper-gold areas.

The foreign minister said Pakistan’s goal was to transform the country into a hub of economic activity, and innovation and create an attractive environment for global investors like Saudi Arabia.

“Investing in Pakistan is not merely a placement of capital. It would actually be instrumental toward forging a partnership that promises mutual prosperity and progress,” he concluded.

“Your engagement and investment in Pakistan will be handled with utmost respect and institutionalized commitment from our side, ensuring that together we achieve remarkable success.”

MEETINGS WITH PM AND PRESIDENT

Prince Faisal also met Pakistani PM Sharif on Tuesday who said the Saudi official’s visit would herald a new era of strategic and commercial partnerships between the two long-time allies.

“The visit is the beginning of a new era of strategic and commercial partnership between Pakistan and Saudi Arabia,” Sharif was quoted as saying in a statement from his office after he met Prince Faisal. “Pakistan wants to further promote cooperation in the fields of trade and investment between the two countries.”

The PM said Pakistan was taking steps to promote foreign investment and make partnerships “mutually beneficial” for allies, adding that Islamabad was grateful to the Saudi leadership for increasing investment.

Informing the Saudi delegation about the wide potential of investment in Pakistan, Sharif briefed them about the Special Investment Facilitation Council and measures the body was taking to promote investment.

Sharif also invited the Saudi crown prince to Islamabad.

“The people of Pakistan are looking forward to the visit of His Highness the Crown Prince Muhammad Bin Salman to Pakistan,” the PM’s office said.

President Asif Ali Zardari and Prince Faisal also met on Tuesday and reiterated the two nations’ resolve to build a strong partnership and promote mutually beneficial economic cooperation.

Zardari said Pakistan was working to transform its long-standing and decades-old relationship with Riyadh into a “long-term strategic and economic partnership.”

The two sides also discussed regional dynamics and recent developments in the Middle East and called for an immediate and unconditional ceasefire in Gaza and an end to Israeli air and ground offensives there.

INVESTMENT PUSH

In a statement shared with media on Monday, the Pakistan information ministry said the Saudi delegation would consult with Pakistani officials “on the next stages of investment and implementation issues.”

Saudi Arabia’s planned investment in the Reko Diq gold and copper mining project would be discussed during the visit, the ministry said, adding that Riyadh was also interested in investing in agriculture, trade, energy, minerals, IT, transport and other sectors in Pakistan:

“As a result of this visit, Pakistan’s export capacity will increase, joint ventures will be launched and new opportunities will be paved.”

Cash-strapped Pakistan desperately needs to shore up its foreign reserves and signal to the International Monetary Fund (IMF) that it can continue to meet requirements for foreign financing that has been a key demand in previous bailout packages. Pakistan’s finance minister, Muhammad Aurangzeb, is currently in Washington to participate in spring meetings of the International Monetary Fund and World Bank and discuss a new bailout program. The last loan deal expires this month.

Saudi Arabia has often come to cash-strapped Pakistan’s aid in the past, regularly providing it oil on deferred payments and offering direct financial support to help stabilize its economy and shore up its forex reserves.

Last year, however, Saudi Arabia’s finance minister said the Kingdom was changing the way it provides assistance to allies, shifting from previously giving direct grants and deposits unconditionally and moving toward mutually beneficial investment deals backed by internal economic reforms.

The PM said Pakistan was taking steps to promote foreign investment and make partnerships “mutually beneficial” for allies, adding that Islamabad was grateful to the Saudi leadership for increasing investment.

Informing the Saudi delegation about the wide potential of investment in Pakistan, Sharif briefed them about the Special Investment Facilitation Council and measures the body was taking to promote investment. The body was set up last year to oversee all foreign funding.

Sharif also invited the Saudi crown prince to Islamabad.

“The people of Pakistan are looking forward to the visit of His Highness the Crown Prince Muhammad Bin Salman to Pakistan,” the PM’s office said.

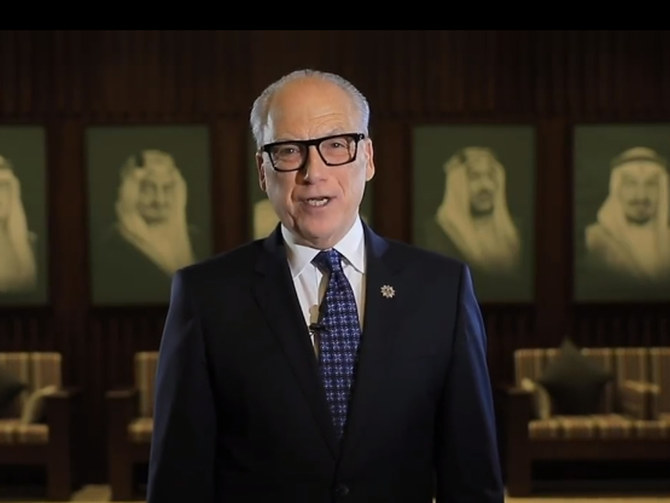

Diriyah Co. CEO appointed UN Tourism ambassador

RIYADH: Saudi historical destination developer Diriyah Co.’s CEO, Jerry Inzerillo, has been appointed as a UN Tourism ambassador, joining an elite group including Lionel Messi, Georgio Armani, and Placido Domingo.

The appointment was made during the global body’s first-ever sustainability week, being held in New York from April 15 to 19, according to a press statement.

Inzerillo has been honored for his “lifelong commitment” to employing “innovative design and development strategies” that bolster local communities and cultivate new and undiscovered tourism destinations, it added.

“The UN Tourism is enormously proud to welcome Inzerillo as our newest tourism ambassador. In this new role, he will help to amplify the UN Tourism’s key messages of the ability of tourism to drive change and achieve sustainable growth,” said Secretary-General Zurab Pololikashvili.

Diriyah is located on the outskirts of the Kingdom’s capital city, Riyadh. At its core is the UNESCO World Heritage Site of At-Turaif, the historic capital of the First Saudi State.

Upon completion, the Diriyah project will host 100,000 residents, workers, students, and visitors, offering a diverse range of cultural, entertainment, retail, hospitality, educational, and residential spaces.

Developing tourist destinations like Diriyah is crucial for Saudi Arabia, as the Kingdom pursues economic diversification, in line with the goals outlined in Vision 2030.

“In the area of tourism, we have the privilege to work in one of the world’s fastest growing sectors that employ 320 million people today and will add a further 100 million within the next decade. But with that privilege comes enormous responsibility to ensure that our developments are innovative, actionable and have real and enduring impact,” said Inzerillo.

Spearheaded by Inzerillo, Diriyah Co.’s development strategies adhere to the highest international sustainability, preservation, and conservation standards. They aim to support the mobility, health, and well-being of the local community.

“A key part of our master planning strategy is that our commitment to sustainable practices must also extend beyond the day-to-day operations of Diriyah Co.,” he added.

In January, Inzerillo told Arab News that Riyadh will be undergoing consistent transformative change “every year” that will allow visitors and residents to feel a palpable difference.

He added that visitors to the Kingdom’s capital do not need to look forward to 2030 to begin to witness the changes that the tourism sector is undergoing.

Formerly known as the World Tourism Organization, UN Tourism is a global agency responsible for promoting responsible, sustainable, and universally accessible tourism.

As a leading international organization, it advocates for tourism as a catalyst for economic growth, inclusive development, and environmental sustainability.

Closing Bell: Saudi benchmark index edges down 1.64% to 12,500

RIYADH: Saudi Arabia’s Tadawul All Share Index shed 207.91 points or 1.64 percent on Tuesday to close at 12,500.43.

The total trading turnover of the benchmark index was SR10.22 billion ($2.72 billion), with 42 stocks advancing and 186 declining.

Nomu, Saudi Arabia’s parallel market, also lost 239.21 points to close at 26,309.38. The MSCI Tadawul Index shed 31.821 points to 1,578.42.

The best-performing stock was Red Sea International Co. The firm’s share price soared by 10 percent to SR33.

Other top performers were Etihad Atheeb Telecommunication Co. and Saudi Steel Pipe Co., whose share prices surged by 6.57 percent and 4.59 percent respectively.

Meanwhile, ACWA Power’s share price hit SR427 on Tuesday, an all-time high since the company’s listing on the main market. However, the company closed its trading at SR417.

The worst performer of the day was Advanced Petrochemical Co., as its share price dipped by 5.30 percent to SR42.90.

On the announcements front, United Electronics Co. revealed that its net profit for the first quarter of this year climbed 11 percent to SR93.9 million.

In a Tadawul statement, the company, also known as eXtra said that the rise in net profit was driven by a 10 percent year on year rise in total revenues.

Meanwhile, Al-Moammar Information Systems announced that its board of directors has recommended the payment of a cash dividend at 8 percent of capital, or SR0.8 a share for the first quarter of 2024.

Moreover, the company’s board also recommended a three-year dividend policy until 2026.

“The policy will be submitted for approval at the upcoming general assembly meeting, the date of which will be announced later. The policy aims to maintain a minimum dividend per share of 50 percent of net profits annually,” said Al-Moammar Information Systems in a statement.

Saudi companies to attend energy conference in Dubai

RIYADH: Comprehensive knowledge sharing is set to unravel at Dubai’s Middle East Energy conference, with over 17 Saudi companies participating in the event.

The gathering, hosted at the Dubai World Trade Centre starting April 17, highlights the Middle East and Africa’s most extensive energy event, now in its 49th edition.

A rescheduling to include an additional day on April 19 follows unexpected adverse weather conditions that led to pushing the event’s opening day from April 16 to April 17.

This year, the Middle East Energy conference will expand across 14 halls, covering 28,500 sq. meters and will welcome more than 1,500 exhibitors and feature 14 national pavilions, showcasing the breadth of the global energy sector.

Saudi Arabia is well-represented, with companies like Bahra Advanced Cable Manufacture Co. Ltd., Jeddah Cables Co., and Riyadh Cables Group Co. leading the contingent.

Other participants include MEMF Electrical Industries Co., Electrical Industries Co., and International Tube & Conduit Co. Ltd.

The conference will also feature Middle East Specialized Cables Co., Red Sea Cable Co., and United Transformers Electric Co., alongside Al-Haitam for Industries & Economic Development and Asharqiyah Cables Co. for Industry.

With more than 250 speakers and three high-level strategic conferences, including the leadership summit, technical seminars, and the Intersolar and Electrical Energy Storage Middle East conference, the event promises crucial insights into energy transition, real-world solutions, and emerging challenges in sustainability and cybersecurity.

These dialogues are key as the sector seeks to transform rapidly to meet global energy demands responsibly.

Industry experts believe the region plays a significant role in the road to net-zero.

stc Group top workplace in Saudi Arabia, LinkedIn study finds

RIYADH: Telecommunications major stc Group has been named the best workplace in Saudi Arabia by the professional networking platform LinkedIn.

According to a press statement, the firm was followed in second place by hospitality giga-project Red Sea Global, with energy giant Saudi Arabian Oil Co., also known as Aramco, ranked third.

Motor vehicle manufacturing company Ceer took fourth place on the list, while ROSHN, backed by the Kingdom’s Public Investment Fund, and Riyad Bank, secured fifth and sixth spots, respectively.

“LinkedIn top companies is an annual list created by data on its platform, which will help professionals identify the top workplaces to grow their careers. The list uncovers the organizations leading the way in growth and learning opportunities for their employees, equity in the workplace, and strong company culture,” according to the report.

Business consulting firm Bain & Co. was named the top organization in the UAE, followed by Mastercard and Procter & Gamble.

“This year’s lists show how companies in the UAE and Saudi Arabia are continuing to grow and expand, which further cements the region’s reputation as a leading business hub,” said Salma Altantawy, senior news editor at LinkedIn.

She added: “Our research has previously indicated professionals’ appetite for new career moves in 2024, and this list recognizes those employers that can be a top choice for professionals looking to make those moves.”

Saudi Entertainment Ventures, also known as SEVEN, was named the tenth-top company in Saudi Arabia, an indication of the sector’s growth in the Kingdom.

“Entertainment companies Miral and Saudi Entertainment Ventures have joined the top 15 companies in the UAE and Saudi Arabia in 2024. Both companies took 10th place in their respective countries, which shows the rise of the entertainment industry across the region,” said LinkedIn in the report.

According to the survey, a majority of regional professionals are considering switching jobs this year and the UAE has seen a growth in hiring over the last 12 months.

In February, stc Group revealed that its net profit in 2023 rose 9 percent to SR13.3 billion ($3.55 billion) compared to the previous year.

In a Tadawul statement, the company revealed that the rise in profit was driven by an SR4.90 billion year-on-year rise in revenues.