SINGAPORE: US oil prices rose above $70 a barrel on Monday for the first time since November 2014, as a deepening economic crisis in Venezuela threatened the country’s already tumbling oil supplies.

The concerns added to worries over a looming decision on whether the United States will walk away from a deal with Iran and instead re-imposes sanctions on Tehran, keeping international oil markets on edge.

US West Texas Intermediate (WTI) crude futures rose 0.7 percent to trade at $70.18 per barrel at 0242 GMT, up 46 cents from their last settlement.

Brent crude oil futures were at $75.22 per barrel, up 35 cents, or 0.5 percent from their last close.

Analysts warned that the deepening economic crisis in major oil exporter Venezuela threatened to further crimp its production and exports.

Shannon Rivkin, investment director of Australia’s Rivkin Securities, said that oil prices had been driven up due to “growing concerns over the economic collapse of Venezuela and its oil industry, plus possible new sanctions against Iran from the Trump administration.”

US oil firm ConocoPhillips has moved to take key Caribbean assets of Venezuela’s state-run PDVSA to enforce a $2 billion arbitration award, actions that could further impair PDVSA’s declining oil production and exports.

Venezuela’s oil output has halved since the early 2000s to just 1.5 million barrels per day (bpd), as the South American country has failed to invest enough to maintain its petroleum industry.

Beyond Venezuela’s woes Greg McKenna, chief market strategist at futures brokerage AxiTrader, said “the big story this week is going to be about oil and the Iran Nuclear deal.” Most market participants expect Trump to withdraw from the pact, he said.

Iran re-emerged as a major oil exporter in 2016 after international sanctions against it were lifted in return for curbs on Iran’s nuclear program.

Expressing doubts over Iran’s sincerity, Trump has threatened to walk away from the 2015 agreement by not extending sanctions waivers when they expire on May 12, which would likely result in a reduction of Iran’s oil exports.

Some traders, however, are becoming cautious about ever higher oil prices.

Hedge funds cut their net long US crude futures and options positions in the week to May 1 by 11,825 contracts to 444,060, according to the US Commodity Futures Trading Commission.

Looming over markets is surging US output, which has soared by more than a quarter in the last two years, to 10.62 million bpd.

US output will likely rise further this year, toward or past Russia’s 11 million bpd, as its energy firms keep drilling for more.

US energy companies added nine oil rigs looking for new production in the week to May 4, bringing the total count to 834, the highest level since March 2015, energy services firm Baker Hughes said last Friday.

US oil rises above $70 for first time since November 2014 on Venezuela, Iran worries

US oil rises above $70 for first time since November 2014 on Venezuela, Iran worries

- Worries over a looming decision on whether the US will walk away from a deal with Iran and instead re-imposes sanctions on Tehran keep market on edge

- Some traders, however, are becoming cautious about ever higher oil prices

stc Group top workplace in Saudi Arabia, LinkedIn study finds

RIYADH: Telecommunications major stc Group has been named the best workplace in Saudi Arabia by the professional networking platform LinkedIn.

According to a press statement, the firm was followed in second place by hospitality giga-project Red Sea Global, with energy giant Saudi Arabian Oil Co., also known as Aramco, ranked third.

Motor vehicle manufacturing company Ceer took fourth place on the list, while ROSHN, backed by the Kingdom’s Public Investment Fund, and Riyad Bank, secured fifth and sixth spots, respectively.

“LinkedIn top companies is an annual list created by data on its platform, which will help professionals identify the top workplaces to grow their careers. The list uncovers the organizations leading the way in growth and learning opportunities for their employees, equity in the workplace, and strong company culture,” according to the report.

Business consulting firm Bain & Co. was named the top organization in the UAE, followed by Mastercard and Procter & Gamble.

“This year’s lists show how companies in the UAE and Saudi Arabia are continuing to grow and expand, which further cements the region’s reputation as a leading business hub,” said Salma Altantawy, senior news editor at LinkedIn.

She added: “Our research has previously indicated professionals’ appetite for new career moves in 2024, and this list recognizes those employers that can be a top choice for professionals looking to make those moves.”

Saudi Entertainment Ventures, also known as SEVEN, was named the tenth-top company in Saudi Arabia, an indication of the sector’s growth in the Kingdom.

“Entertainment companies Miral and Saudi Entertainment Ventures have joined the top 15 companies in the UAE and Saudi Arabia in 2024. Both companies took 10th place in their respective countries, which shows the rise of the entertainment industry across the region,” said LinkedIn in the report.

According to the survey, a majority of regional professionals are considering switching jobs this year and the UAE has seen a growth in hiring over the last 12 months.

In February, stc Group revealed that its net profit in 2023 rose 9 percent to SR13.3 billion ($3.55 billion) compared to the previous year.

In a Tadawul statement, the company revealed that the rise in profit was driven by an SR4.90 billion year-on-year rise in revenues.

ACWA Power secures landmark $80m bridge loan from Bank of China for Uzbekistan projects

RIYADH: Saudi energy giant ACWA Power has secured an $80 million equity bridge loan from the Bank of China for its Uzbekistan initiatives.

According to an official press release, the payment is split equally between Chinese yuan and US dollars, marking the first loan cooperation deal by a bank from the Asian country using its native currency involving a company from the Kingdom.

ACWA Power said the fund will boost its Tashkent 200 megawatts solar photovoltaic power plant and 500 MW per hour battery energy storage system project in Uzbekistan.

“This transaction culminated the initial agreement reached during the 3rd BRF (Belt and Road Forum) summit in October 2023, where ACWA Power was represented by its chairman as a keynote speaker,” the company said in a statement.

ACWA Power’s Chief Financial Officer, Abdulhameed Al-Muhaidib, highlighted the significance of this milestone, citing its alignment with Saudi Arabia’s Vision 2030 and China’s Belt and Road initiative.

He said: “We are delighted to deepen our cooperation with Bank of China to bring renewable energy at competitive tariffs to our key markets, including Uzbekistan.”

ACWA Power has a longstanding relationship with Chinese entities, dating back over 15 years, with investments from the Asian country in the company’s projects exceeding $10 billion.

The General Manager of the Bank of China, Pan Xinyuan, said: “I believe that the Belt and Road Initiative is in harmony with Saudi Arabia’s Vision 2030. Bank of China will further leverage its strengths to support the cooperation between Saudi enterprises like ACWA Power and their Chinese partners for win-win objectives.”

He added: “Looking ahead, Bank of China will continue to improve financial connectivity to push the Belt and Road economies on a track of sustainable and high-quality development.”

ACWA Power has been collaborating with multiple countries to develop its plants.

Earlier this month, the company signed a $800 million agreement with Senegal’s Ministry of Water to develop a desalination facility.

It announced the inking of a water purchase agreement for the construction of the facility in Dakar, Senegal in a statement on the Saudi stock exchange, Tadawul.

ACWA Power will be responsible for the infrastructure, design and financing as well as construction, operation and maintenance of the Grande Cote seawater desalination plant in the West African country.

Microsoft to invest $1.5bn in UAE-based AI firm G42

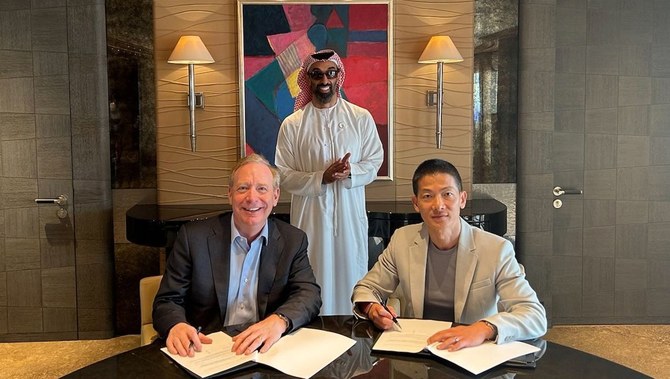

RIYADH: Global tech giant Microsoft will invest $1.5 billion in the UAE-based artificial intelligence technology company G42, aiming to offer the latest AI solutions and skilling initiatives.

As part of the deal, G42 will grant the US firm a minority stake and Brad Smith, Microsoft’s vice chair and president, will join the Emirati firm’s board of directors, according to a press release.

G42 will utilize Microsoft Azure to run its AI applications and services, partnering to deliver advanced solutions to global public sector clients and large enterprises.

Smith said: “Our two companies will work together not only in the UAE, but to bring AI and digital infrastructure and services to underserved nations.”

He added: “We will combine world-class technology with world-leading standards for safe, trusted, and responsible AI, in close coordination with the governments of both the UAE and the United States.”

The companies will collaborate to bring advanced AI and digital infrastructure to nations in the Middle East, Central Asia, and Africa, ensuring equitable access to services to address critical governmental and business concerns, while upholding high levels of security and privacy, the release added.

“Microsoft’s investment in G42 marks a pivotal moment in our company’s journey of growth and innovation, signifying a strategic alignment of vision and execution between the two organizations,” said Tahnoon bin Zayed Al-Nahyan, chairman of G42.

“This partnership is a testament to the shared values and aspirations for progress, fostering greater cooperation and synergy globally,” he added.

The agreement also encompasses a $1 billion investment in a fund for developers, which aims to bolster the creation of a skilled and diverse AI workforce, as well as foster innovation and competitiveness for the UAE and the broader region.

“This partnership significantly enhances our international market presence, combining G42’s unique AI capabilities with Microsoft’s robust global infrastructure. Together, we are not only expanding our operational horizons but also setting new industry standards for innovation,” said Peng Xiao, group CEO of G42.

The release stated that this expanded collaboration will empower organizations of all sizes in new markets to harness the benefits of AI and the cloud, while ensuring they adopt AI that adheres to world-leading standards in terms of safety and security.

UAE grocery store chain Spinneys to float 25% stake on Dubai Financial Market

RIYADH: UAE-based grocery store operator Spinneys 1961 Holding PLC has announced its intention to proceed with an initial public offering on the Dubai Financial Market.

Al Seer Group, Spinney’s parent company and the selling shareholder, expects to sell 25 percent of the total issued share capital of the firm, equivalent to a total of 900 million shares.

The IPO’s subscription period will begin on April 23 and the DFM listing is set for May 9, the company said in a release.

The offering will be made available to UAE retail investors with 5 percent or 45 million shares in the first tranche, while the second tranche will provide professional stakeholders with 855 million shares.

Ali Saeed Juma Al-Bwardy, founder and chairman of Spinneys, said: “Ours is a brand with huge ambition, positioned to flourish in the GCC’s most attractive and fast-growing markets. Our IPO represents an opportunity for investors to be part of our next stage of growth and we are excited to embark on a new chapter, bringing our fresh opportunity to a wider shareholder base.”

The release stated that the price per share, or offer price, will be denominated in Emirati dirhams and will be announced before the offer period.

Rothschild & Co Middle East Limited has been selected as the independent financial advisor for the IPO, while Emirates NBD Capital PSC has been appointed as the listing advisor.

The UAE firm operates 75 premium grocery retail supermarkets under the Spinneys, Waitrose, and Al Fair brands in the UAE and Oman. Additionally, it plans to open its first store in Saudi Arabia in the first half of 2024.

The company aims to leverage the UAE’s robust economic landscape, with the economy projected to grow at an annual rate of 3.4 percent from 2022 to 2028, and high average disposable income per capita expected to increase by 2.3 percent over the same period.

While the UAE’s population is forecasted to grow by 0.7 percent from 2022 to 2028, the supermarket chain expects its target market of affluent individuals to increase at an annual rate of 4.3 percent over the same period.

This growth is anticipated to drive sustained demand for premium food in the UAE.

Similarly, the group’s expansion into the Saudi market, the Gulf Cooperation Council’s largest economy, will concentrate on opening stores in Jeddah and Riyadh, the Kingdom’s most populous cities.

“We have much to be excited about this year as we celebrate the 100th anniversary of the Spinneys brand in the region, with plans to enter the thriving Saudi market, where we see immense potential for our business,” said Sunil Kumar, CEO of Spinneys.

The company said the market for affluent shoppers in the grocery retail segment is surpassing overall grocery market growth in the Kingdom, with a projected growth rate of 6.7 percent in Riyadh and Jeddah.

This announcement marks the second DFM listing this year, following the $429 million IPO of public parking operations company Parkin last month.

Parkin’s IPO set a record-breaking debut for Dubai, being oversubscribed 165 times and attracting $71 billion in demand.

Dubai’s high-end property sales rise on overseas demand

DUBAI: Sales of homes in Dubai worth $10 million or more rose 6 percent in the first quarter versus last year, an industry report showed on Tuesday, as demand from the international ultra-rich for homes in the emirate showed little sign of abating, according to Reuters.

A total of 105 homes worth an overall $1.73 billion were sold from January to March, up from around $1.6 billion a year earlier, according to property consultancy Knight Frank.

Activity was dominated by cash buyers, with palm tree-shaped artificial island Palm Jumeirah the most sought-after area, accounting for 36.3 percent of sales by total value, followed by Jumeirah Bay Island and Dubai Hills Estate.

Home to the world’s tallest tower, the UAE’s Dubai is seeking to grow its economy through tourism, building a local financial center and by attracting foreign capital, including into property.

The recent property boom has shown signs of fizzling out, however, with developers, investors and brokers worrying whether a painful correction akin to the slump that rocked the emirate in 2008 can be avoided.

Last year, Dubai ranked first globally for number of home sales above $10 million, selling nearly 80 percent more such properties than second-placed London, according to Knight Frank.

The city also bucked the trend of falling luxury prices seen in cities like London and New York last year, posting double-digit gains, Knight Frank said in February.

“The level of deal activity in Dubai continues to strengthen, particularly at the top end of the market, where the near constant stream of international high-net-worth-individuals vying for the city’s most expensive homes persists,” said Faisal Durrani, Knight Frank’s head of research for Middle East and Africa.

Durrani told Reuters Dubai was aided by the relative affordability of its luxury homes, where well-heeled buyers can purchase about 980 sq. feet of residential space for $1 million, “about three or four times more than you would get in most major global gateway cities.”

The strong demand suggests many international investors are acquiring Dubai property for second homes rather than “constant buying to flip,” he said, referring to the past practice of buying in order to sell to others quickly for more money.