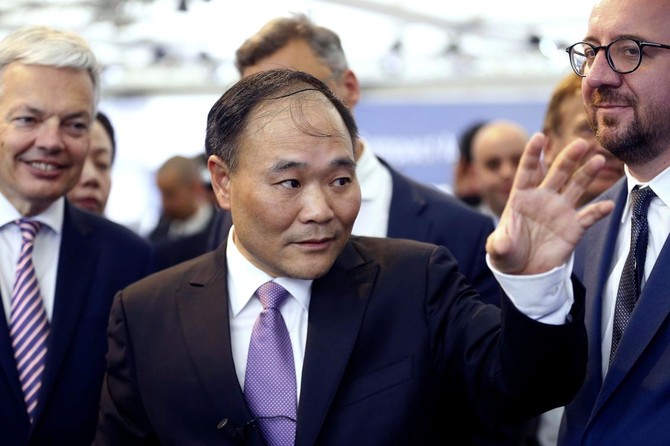

BEIJING: The chairman of Chinese carmaker Geely has built up a 9.69 percent stake in Mercedes-Benz owner Daimler, filings showed on Friday, an aggressive move designed to open the door for an industrial alliance between the two automakers.

Two sources familiar with the thinking of Li Shufu said his move to accumulate the stake, which has a market value of $9 billion, was motivated by the “dramatic transformation” under way in the automotive industry.

His strategic goal was an alliance with Daimler, which is developing electric and self-driving vehicles, to respond to the challenge from US players Tesla, Google and Uber, who are all working on their own driverless cars.

“This is what Chairman Li has envisioned. He thinks maybe one or two or three manufacturers that exist today will survive in this new competition,” one of the sources said, requesting anonymity because of the sensitivity of the matter.

“He thinks existing manufacturers should unite and invest in the future and become one of the two or three companies that will survive.”

Zhejiang Geely already owns Volvo Cars, LEVC, the maker of London’s black cabs, a 49.9 percent stake in Malaysian automaker Proton, a $3.3 billion stake in Volvo Trucks and flying car start-up Terrafugia.

Mercedes-Benz already has an industrial alliance to develop cars and trucks with Renault-Nissan, which owns a 3.1 percent stake in Daimler, and has announced plans to build electric cars with existing Chinese joint-venture partner BAIC Motor Corporation.

The stake purchase followed an initial approach last November, when Li sought to buy a Daimler stake as a way to access Mercedes-Benz technology for electric cars and trucks, including battery technology, to help Geely comply with a Chinese crackdown on pollution.

Geely sees potential in Daimler because it is developing high-speed Internet connections for autonomous cars at a time when Li believes satellite-based Internet connections could become more important for the auto industry, the source further explained.

Sources at the time told Reuters that Geely had asked Daimler to issue new shares so that it could buy a stake, but the Germans turned down the offer saying they did not want to dilute existing shareholders.

Li changed tactics and quietly accumulated shares. The 9.69 percent stake is the biggest single holding in the maker of luxury cars, trucks and vans, according to Thomson Reuters data.

“Daimler is pleased to have won a new long-term investor who is convinced of the innovation power, strategy and the potential of Daimler going forward,” the German company said on Friday.

“Daimler knows and respects Li Shufu as a Chinese entrepreneur of particular competence and forward thinking.”

Chinese investors in German technology companies have previously opted to take a consensual approach, buying incremental stakes in companies such as Kuka and Kion, typically after long consultation with management and other stakeholders.

The source said that Daimler and Geely had not held concrete talks about how to structure a potential joint venture, adding: “You know we have to become a stakeholder in order to engage.”

Geely’s move to become one of Daimler’s largest shareholders hit some speed bumps in recent weeks — an issue that has not been completely resolved, one of the sources familiar with the talks said.

Swedish truck maker AB Volvo, in which Geely took a stake late last year, has been objecting to Geely’s potential move on Daimler, one of the world’s largest commercial truck makers by sales, due to anti-trust concerns.

“We will protect interests of both companies by abiding laws in the country and the company’s governance structure. We are not seeking to have a controlling power in Daimler. We are just one of the investors in that given company,” the source said.

The size of the holding accumulated by Li raises questions about how he was able to buy the stake without first alerting the German markets regulator that he had surpassed the 3 percent and 5 percent ownership thresholds.

In early February, Geely began courting Germany’s automotive establishment with a carefully timed public relations campaign. Li gave a video statement to Germany’s Car Symposium, an annual automotive congress held in Bochum which is attended by senior automotive leaders.

Li underlined that Geely’s stewardship of the Swedish carmaker Volvo brand had contributed toward “growth and prosperity” in Europe.

His statement was followed by a keynote speech held by Geely board member Carl-Peter Forster, a former BMW board member and the former head of German carmaker Opel.

Forster explained that in the areas of electromobility and autonomous driving there should be more cooperation.

“We are in competition with one another, but should cooperate in areas where it makes sense,” Forster told the audience.

Geely chairman builds $9bn stake in Germany’s Daimler

Geely chairman builds $9bn stake in Germany’s Daimler

Ministry tenders contract for expansion of Prince Faisal bin Fahd Stadium

RIYADH: Saudi Arabia’s Sports Ministry has tendered a contract to boost the capacity of Riyadh’s Prince Faisal bin Fahd Stadium to 45,000 seats up from its current 22,188.

The expansion project comes as the Kingdom prepares to host the Asian Football Confederation Asian Cup in 2027, reported MEED.

This initiative aligns with Saudi Arabia’s plan to build sports stadiums under its SR10.1 billion ($2.7 billion) capital projects program.

The ministry requested proposals on April 8 and expects to receive bids on June 14.

In April, the ministry also tendered an early works contract for the expansion and development of the Prince Mohammed bin Fahd Stadium in Dammam.

At the time, the scope of the contract included the stadium’s decommissioning, demolition, and bulk excavation, as well as the relocation and setting up of related facilities.

In July 2023, the ministry invited firms to submit pre-qualification documents for the main construction contracts for the schemes in the capital projects program.

The undertakings, which are set for completion before the 2027 AFC Asian Cup, entail increasing the capacity of King Fahd Stadium in Riyadh to 92,000 seats and boosting the seating capacity of Prince Mohammed Bin Fahd Stadium to 30,000 seats.

It also includes increasing the seating capacity of the Prince Saud bin Jalawi Stadium in Al-Kahir to 45,000 and building a sustainable New Riyadh Stadium north of the city with 45,000 seats.

Another main element of the ministry’s projects program is the construction of as many as 30 new training grounds and facilities in proximity to the stadiums that will be used for the 2027 competition.

Construction on the projects is expected to start in July 2024 and scheduled to be completed by December 2025.

A total of 18 facilities will be ready in time for the 2026 AFC Women’s Cup.

PIF-owned ROSHN expands in Eastern Province with new residential project

RIYADH: Saudi developer ROSHN Group has launched its first integrated community, ALDANAH, in the economic hub of Greater Dammam, featuring over 2,500 homes spread across 1.7 million sq. m.

The development, the second in the Eastern Province by the Public Investment Fund-owned giga-project, will cater to nearly 10,000 inhabitants who will benefit from exemplary energy conservation, including modern insulation, according to a press release.

ROSHN highlighted that the project is strategically located in the heart of Greater Dammam, at the meeting point of Dammam, Dhahran, and Al Khobar. It’s conveniently situated next to King Abdulaziz Road and is just a 20-minute drive from King Fahd International Airport.

The project will feature several amenities for residents, including a city experience center, a district mall, and three neighborhood retail centers. It will also include a primary healthcare center, mosques, and six schools, all reflecting the region’s rich cultural heritage, the release added.

The company also mentioned that the range of residences will offer a diverse selection of homes suitable for every family, including duplexes and villas tailored specifically for ROSHN’s latest community.

Industrial private sector investments in Saudi Arabia more than double to reach $1.8bn

RIYADH: Private sector investments in Saudi Arabia’s industrial field more than doubled in the first quarter of 2024, surpassing SR7 billion ($1.8 billion), according to official data.

This marks a significant increase from the SR3.34 billion recorded during the first quarter of 2023, according to a report released by the Saudi Authority for Industrial Cities and Technology Zones, also known as MODON.

The report revealed a substantial rise in the number of constructed factories, reaching 6,683 in the first three months of 2024 compared to 5,894 in the same period last year.

Moreover, the total number of logistics contracts surged to 367, up from 223 in the first quarter of 2023.

The report also highlighted a significant growth in industrial contracts, with 276 agreements issued by end of March, nearly doubling the figures from the first three months of 2023.

Jeddah Third Industrial City led in contract issuance with 76 agreements, followed by Al Kharj Industrial City with 47. Sudair Industrial and Business City recorded 20 contracts, while Dammam Third Industrial City and Dammam Second Industrial City had 18 and 16 agreements, respectively.

Furthermore, the total regulatory visits conducted in industrial cities during the first quarter amounted to 1,867, underscoring MODON's rigorous oversight.

In terms of sectoral distribution, food industries secured the highest number of contracts in the first quarter of 2024, constituting 24 percent of the total. They were followed by mining at 12 percent, rubber products industries at 12 percent, chemicals at 8 percent, and electrical equipment at 7 percent.

Additionally, the number of food factories operating in the Kingdom reached 1,300, indicating the country’s expanded capacity in the sector. This underscores its commitment to the “Food Industry Localization” initiative, aimed at enhancing productivity, local production, and quality.

These figures come as MODON prepares to engage as a strategic partner in the inaugural Saudi Food Manufacturing Show.

Scheduled from April 30 to May 2, at Riyadh Front, the event will be under the patronage of the Minister of Industry and Mineral Resources Bandar Al-Khorayef.

MODON plans to showcase its products, services, and comprehensive solutions for the food industry at the show, targeting investors, small and medium enterprises, and entrepreneurs.

This effort is aligned with MODON’s role in the National Industrial Development and Logistics Program, aimed at fostering sustainable growth and enhancing value chains.

The show is expected to host 500 participants from around the globe, including ministers, officials, and industry leaders, as well as CEOs, investors, and experts.

It will feature discussion panels, workshops, and exhibitions, providing a vital platform for displaying the latest in services, products, and solutions for the food industry and its supportive sectors.

Saudi entrepreneurs among beneficiaries of $493m Social Development Bank funding in Q1 2024

RIYADH: Almost 12,000 Saudi entrepreneurs received support and training from the Kingdom’s Social Development Bank in the first quarter of 2024, it was revealed.

Minister of Human Resources and Social Development Ahmed Al-Rajhi announced in a post on X that SDB provided financing worth SR1.85 billion ($493 million) in the first three months of this year.

The financing aims to “support individuals and enterprises to contribute to economic development and sustain efforts toward national sustainable growth.”

During the same period, assistance for small and startup businesses amounted to SR606 million for over 1,700 establishments.

Furthermore, empowerment support for vibrant and productive communities reached SR640 million, benefiting 12,000 citizens through various social developmental products, including marriage, family support, and restoration.

Assistance for freelancers and productive families also surged to SR600 million, benefiting 13,000 individuals.

Additionally, the number of savings accounts increased by 13,000, reaching a total of 245,000, with a balance exceeding SR525 million.

According to the Small and Medium Enterprises General Authority, Saudi Arabia witnessed a 3.1 percent uptick in its small and medium enterprises during the fourth quarter of 2023, totaling 1.3 million establishments.

Recognized for their pivotal role in diversifying income streams and stimulating economic progress, SMEs are a cornerstone of Saudi Arabia’s economic landscape.

Credit facilities extended to micro, small, and medium-sized enterprises experienced an 18 percent year-on-year surge in the third quarter of 2023.

Figures from the Saudi Central Bank underscored a notable increase in borrowing lines allocation to this sector, totaling SR268.57 billion in the three-month period ending October 2023, up from SR228.03 billion in the corresponding period of the preceding year.

This increase is credited to governmental endeavors aimed at bolstering support for SMEs.

In January, SDB signed 24 deals worth SR1 billion to support entrepreneurs across various sectors in the Kingdom.

Inked during the Entrepreneurship and Modern Work Patterns Forum, the memorandums of cooperation encompassed a broad spectrum of sectors, including health, transportation, and logistics.

This aligns with the objectives of Vision 2030, aiming to reduce the unemployment rate, enhance women’s participation in the workforce, and expand the contribution of small and medium-sized enterprises to 35 percent of the gross domestic product by the end of the decade.

Speaking at the time, CEO of SDB Ibrahim Al-Rashid said those deals would “open new horizons for entrepreneurship and small and emerging enterprises" by developing new systems for financing, training and qualification.

Last year, the bank introduced a range of training programs to assist small businesses across the Kingdom.

The courses covered key areas such as marketing and administration, allowing business owners to meet and discuss their development plans with local and international experts.

Saudi biotechnology sector poised for double-digit growth: report

RIYADH: Saudi Arabia’s biotechnology and genomics sector is likely to record double-digit growth as it plans to invest 2.5 percent of its gross domestic product in research and development by 2040, aiming to add $16 billion to its economy.

This was highlighted in a recent report by US-based consulting firm Arthur D. Little, emphasizing the Kingdom’s substantial growth potential in the sector.

The study highlighted that the global biotech market, valued at $1.5 trillion in 2023, is projected to reach $4 trillion by 2030. This growth is driven by rising demand for improved healthcare and increased investment from both government and private sectors.

“Within this context, Saudi Arabia’s directed R&D investments, amounting to $3.9 billion in 2021 and aims to become a global leader in innovation and R&D, with annual investment equivalent to 2.5 percent of GDP by 2040 which are set to catalyze the expansion of the sector,” the report said.

It added: “This is expected to add $16 billion to the economy and create high-value jobs in science and technology, are set to catalyze the expansion of the sector, reinforcing its commitment to a knowledge-based economy.”

In 2022, Saudi Arabia’s investment in research and development soared to $5.1 billion, marking a 32.7 percent increase from the previous year, according to the General Authority for Statistics.

GASTAT’s report revealed that the government sector infused SR11.1 billion into R&D, constituting 58 percent of the nation’s total R&D budget.

Patrick Linnenbank, a partner in the healthcare and life sciences practice for Middle East & South East Asia at Arthur D. Little, emphasized the synchrony between strategic investments and the burgeoning demand for enhanced healthcare services.

“Our analysis indicates that strategic investments and initiatives are aligning with a growing demand for enhanced healthcare services and personalized medical treatment, which Saudi Arabia is well-positioned to fulfill,” Linnenbank said.

The report underscored the pivotal role of the Kingdom’s biotech and genomics initiatives, exemplified by the Saudi Genome Project 2.0 and collaborative endeavors. These initiatives are instrumental in propelling precision medicine forward, leveraging AI and genomics for personalized healthcare solutions.

Launched in 2018, the Saudi Genome Program utilizes cutting-edge genomic technologies to combat genetic diseases, advancing healthcare through improved diagnosis, treatment, and prevention.

Ankita Gulati highlighted the transformative potential of AI and genomics in healthcare, stating: “The confluence of genomic data and AI in healthcare is at the core of next-generation medical treatment and may revolutionize healthcare. Saudi Arabia’s current trajectory in genomics research and development is a robust indicator of its potential to lead in this domain.”

Integral to Saudi Arabia’s advancement in the biotech sphere are strategic collaborations with global pharmaceutical firms and the integration of research initiatives from key entities such as King Abdullah International Medical Research Center, King Abdullah University of Science and Technology, and King Abdulaziz City for Science and Technology.

The report also applauded the progressive establishment of a regulatory framework, with new guidelines from the Saudi Food and Drug Authority and legislative oversight from the Saudi Research Development and Innovation Authority.

While Saudi Arabia strides confidently toward leadership in the biotech landscape, the report acknowledged the necessity of further developing capabilities across the value chain.

The Kingdom’s accelerator and incubator programs, including KAIMRC’s Medical Biotechnology Park, KAUST’s Taqadam initiative, and the Biotech Startup Program in Dammam Valley, are pivotal in nurturing a thriving biotech and genomics ecosystem.